Arch Coal, Inc. Reports Full Year 2007 Results

Strong fourth quarter caps Arch Coal's second-best year on record

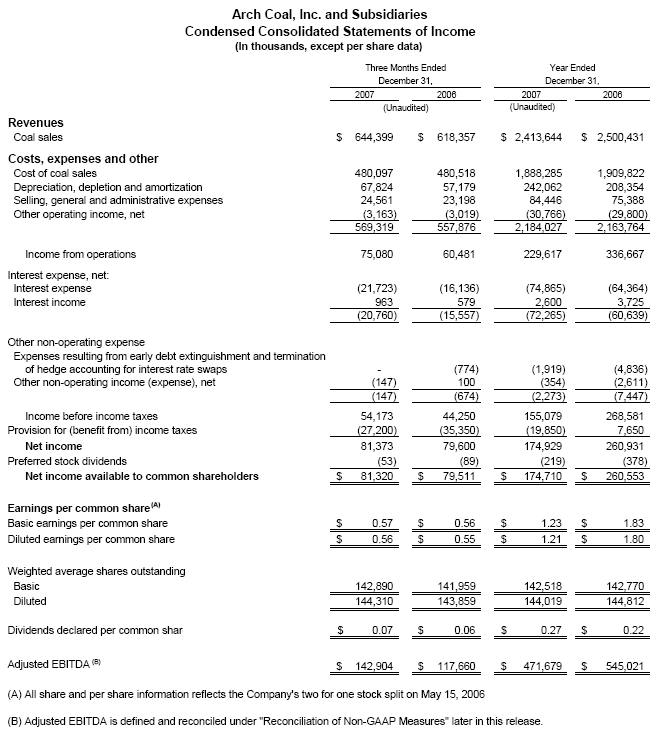

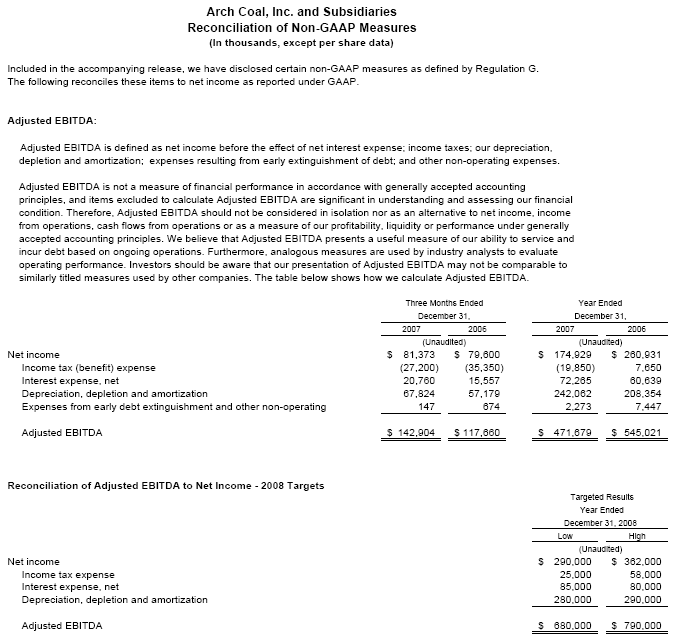

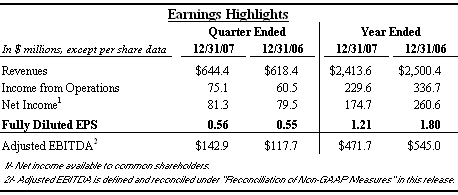

ST. LOUIS (February 1, 2008) — Arch Coal, Inc. (NYSE:ACI) today reported fourth quarter 2007 net income available to common shareholders of $81.3 million, or $0.56 per fully diluted share, on income from operations of $75.1 million and adjusted earnings before interest, taxes, depreciation and amortization ("EBITDA") of $142.9 million. In the fourth quarter of 2006, the company earned net income available to common shareholders of $79.5 million, or $0.55 per fully diluted share, on income from operations of $60.5 million and adjusted EBITDA of $117.7 million.

For the full year 2007, Arch earned net income available to common shareholders of $174.7 million, or $1.21 per fully diluted share, compared with $260.6 million, or $1.80 per fully diluted share, for full year 2006. The company also earned $471.7 million of adjusted EBITDA in 2007, compared with $545.0 million in 2006, when market conditions were more favorable.

"During 2007, Arch Coal achieved our second-best year of earnings in the company's 10-year history as a public corporation," said Steven F. Leer, Arch's chairman and chief executive officer. "We are proud of the financial performance achieved in 2007, especially considering the weakened state of U.S. coal markets during much of the year. Also, we are particularly pleased with our fourth quarter results, which benefited from strong execution at our mines as well as positive momentum in global coal markets."

"Looking ahead, we are optimistic that domestic coal markets will continue to improve in 2008, driven by the strength of international coal markets," continued Leer. "We also expect the company to deliver a record performance in 2008, with meaningful expansion in operating margins, earnings per share and EBITDA."

Arch's Operations Deliver a Solid Performance in 2007

"Our operations ran exceptionally well during the fourth quarter, and turned in a solid performance for the full year 2007," said John W. Eaves, Arch's president and chief operating officer. "Each operating region made a substantial contribution in the quarter just ended, particularly in terms of cost containment and margin expansion. We applaud these efforts and look to build upon this performance in 2008."

"Additionally, the early start-up of our Mountain Laurel operation has exceeded our expectations and contributed meaningfully during the fourth quarter," added Eaves. "With the flexibility to sell a substantial portion of the mine's output into booming metallurgical and domestic pulverized coal injection markets, and with the mine's extremely competitive cost structure, we expect to significantly expand our operating margin in 2008."

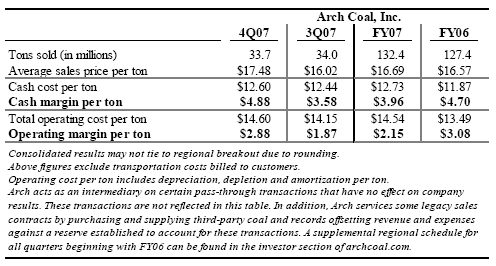

Consolidated average sales price per ton increased $1.46 during the fourth quarter of 2007 when compared with the third quarter, primarily reflecting larger volume and price realization contributions from Central Appalachia. Consolidated per-ton operating costs increased $0.45 over the same time period, driven by changes in the company's overall production mix. Arch's fourth quarter 2007 consolidated operating margin expanded by $1.01 per ton compared with the prior-quarter period, reflecting the contribution from the start-up of Mountain Laurel in Central Appalachia.

Consolidated 2007 average sales price per ton increased modestly over 2006, reflecting a slightly larger percent of Western Bituminous and Central Appalachian sales. Consolidated per-ton operating costs rose by $1.05 over the same time frame, resulting from changes in the company's overall production mix as well as increased commodity and input cost pressures in Arch's western operating regions. In 2007, Arch earned consolidated operating margin of $2.15 per ton compared with $3.08 per ton in 2006.

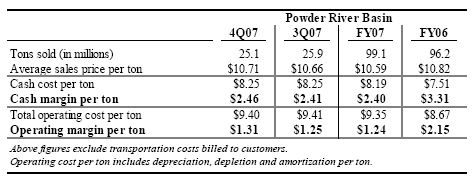

In the Powder River Basin, fourth quarter 2007 volumes declined slightly from the prior-quarter period due to the timing of customer shipments. Even with a larger percentage of lower-priced volume from Arch's Coal Creek mine, average sales price per ton increased modestly when compared with the third quarter, largely due to higher pricing on market index-priced tons. Per-ton operating costs were generally flat over this same time period, despite reduced volumes and commodity cost pressures, resulting in the expansion of the region's per-ton operating margin.

Full year 2007 volumes increased modestly over 2006 due to the restart of Coal Creek in the second quarter of 2006. Average sales price per ton declined over the same time period, reflecting a larger mix of Coal Creek volume and weaker market conditions when compared with 2006. Full year 2007 per-ton operating costs increased moderately due to reduced volumes at Arch's Black Thunder mine and commodity cost pressures in the region. Arch's Powder River Basin operations contributed $1.24 per ton in operating margin in 2007 compared with $2.15 per ton in 2006.

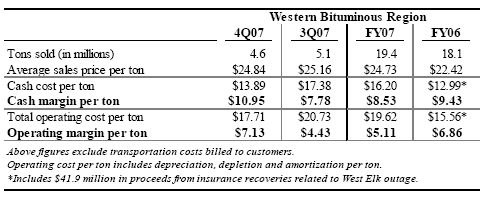

In the Western Bituminous region, average sales price per ton declined in the fourth quarter of 2007 when compared with the third quarter, reflecting a less favorable mix of customer shipments. Due to the absence of any longwall moves in the fourth quarter, operating costs declined $3.02 per ton, leading to an expansion of operating margin of $2.70 per ton.

Full year 2007 volumes increased moderately compared with 2006, benefiting from a full year of production at Arch's West Elk mine, as well as the start-up of the company's Skyline mine during the second quarter of 2006. In the first quarter of 2006, West Elk experienced an outage related to a thermal event that occurred in late 2005. Average 2007 per-ton sales price realization increased $2.31 over the prior year, reflecting the roll-off of lower-priced sales contracts. Full year 2007 per-ton operating costs rose by $4.06, due to increased volumes from the higher-cost Skyline mine, higher input costs, and higher depreciation, depletion and amortization expense. Full year 2006 operating costs also benefited from $41.9 million in insurance recoveries, partially offset by costs related to the outage at West Elk in early 2006. Arch's Western Bituminous operations contributed $5.11 per ton in operating margin in 2007 compared with $6.86 per ton in 2006.

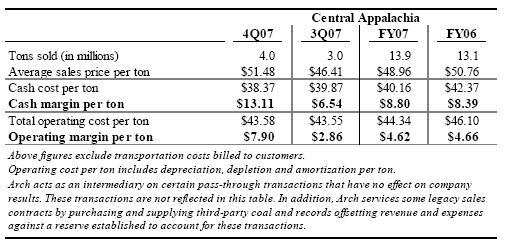

In Central Appalachia, Arch's fourth quarter 2007 volumes increased 1.0 million tons when compared with the prior-quarter period due to the start-up of the Mountain Laurel longwall mine on October 1. Average sales price per ton improved by $5.07 over the same time period as metallurgical coal sales doubled during the quarter just ended. Per-ton operating costs were generally flat when compared with the third quarter, while per-ton cash costs declined, benefiting from the strong start-up of the Mountain Laurel longwall operation. This strong cost performance was achieved in spite of higher sales-sensitive costs related to higher sales price realization. Arch's Central Appalachian per-ton operating margin nearly tripled in the fourth quarter of 2007 compared with the prior-quarter period.

Volumes in Central Appalachia increased in 2007 when compared with 2006 as a result of increased brokerage activity associated with Arch's margin optimization efforts. Average sales price per ton declined $1.80 over the same time period, reflecting generally weaker market conditions than in 2006. Per-ton operating costs declined $1.76 over this same time period, primarily due to the replacement of higher-cost Mingo Logan volume with lower-cost Mountain Laurel volume in the region's production mix. For the full year 2007, Arch's Central Appalachian operations contributed $4.62 per ton in operating margin compared with $4.66 per ton in 2006.

Arch Sees Dynamic Coal Markets in 2008 and Beyond

U.S. coal markets are dynamically responding to the scarcity of coal in the global landscape. With severe supply constraints in traditional coal export nations, including flooding in Australia, power outages in South Africa and coal shortages in China and India, Arch believes that U.S. coal increasingly will be valued for purposes of supply diversification.

Arch estimates that coal imports into the U.S. were essentially flat in 2007, as supply - primarily from South America - was diverted into higher-priced seaborne trade. Over the same time frame, U.S. coal became the swing supply for the global market. In fact, Arch estimates that U.S. coal exports grew by close to 10 million tons in 2007, and conservatively expects another 20-million-ton increase in 2008.

Pricing for international metallurgical and thermal coal has been robust, and has positively influenced pricing in key domestic coal markets. Central Appalachian coal index prices increased an average of 34 percent in 2007, and have reached the $70-per-ton mark for second quarter 2008 delivery. Likewise, Powder River Basin coal index prices increased more than 50 percent in 2007, and have approached the $15-per-ton mark for second quarter 2008 delivery.

These domestic price increases have been supported by positive supply and demand trends in U.S. coal markets. On the supply side, Arch estimates that domestic coal production declined more than 16 million tons in 2007, with more than half of this decline occurring in Central Appalachia. Looking ahead, Arch continues to expect significant geologic and regulatory challenges in Central Appalachia to constrain production in this region.

On the domestic demand side, U.S. electric generation grew by close to 3 percent in 2007, according to statistics compiled by the Edison Electric Institute. Arch estimates that coal consumption for power demand in the electric power sector increased nearly 20 million tons last year - compared with a nearly 11 million ton decline in 2006 - driven by relatively average economic growth and more favorable weather. During the first half of 2008, Arch expects slower growth in electric generation demand driven by a weaker U. S. economy, but forecasts U.S. coal consumption for the full year to exceed that of 2007.

Arch estimates that U.S. generators held approximately a 51-days supply in stockpiles at the end of 2007, compared with a 50-days supply at the end of 2006. Arch continues to believe that increased stockpiles, nearly all in the West, stem in part from an effort by U.S. generators to increase inventories as a hedge against future supply disruptions.

"2007 was a transitional year for U.S. coal markets," said Leer. "With increased coal consumption and reduced production levels, the market was able to essentially rebalance itself. Looking ahead, we foresee a dynamic coal market in 2008, with robust international coal demand providing the catalyst for further strengthening in domestic coal markets. While expectations for a U.S. economic slowdown remain a concern, normal weather trends and strong global markets are driving price levels to new highs."

Furthermore, Arch estimates that 14 gigawatts of new coal-fueled capacity are now under construction in the U.S., representing the addition of roughly 50 million tons of new annual coal demand. These identified plants will be phased in over the next four years, with roughly one-half expected to start-up by the end of 2009. Another 8 gigawatts - representing more than 30 million tons of additional incremental annual coal demand - are in advanced stages of development. Arch expects the majority of these plants to be built during the next five years.

"We believe that building new coal-fueled generation capacity is the right answer for America, as it provides us with affordable, reliable and secure domestic energy for decades to come," continued Leer. "At the same time, we believe it is essential to increase investment in technology that can make coal use in this country and around the world cleaner, more efficient and more climate-friendly."

Arch Contracts a Portion of 2008 Portfolio; Maintains Upside Potential Heading Into 2009

During the fourth quarter of 2007, Arch committed significant volumes from Central Appalachia into international and domestic metallurgical markets for 2008 and 2009 delivery at prices up to 70 percent above current domestic steam coal index prices in the region. Select 2008 business also has been placed in export steam markets at prices that meaningfully exceed comparable domestic steam coal market price indications.

In the Western Bituminous region, Arch signed sales commitments for export via rail and vessel, through the Gulf of Mexico, at substantial price premiums to prevailing fourth quarter 2007 domestic steam coal index prices in the region. The company also committed additional volumes to eastern domestic utilities at prices exceeding Arch's regional average realized pricing earned in the fourth quarter of 2007.

In the Powder River Basin, Arch signed selective sales commitments for delivery over the next two years - and set previously committed but unpriced coal for 2008 delivery - at pricing that exceeded the prevailing fourth quarter 2007 domestic steam coal index prices in the region.

"During the fourth quarter, Arch committed a substantial volume of coal - principally for 2008 delivery - into the strengthening marketplace," said Eaves. "Given significant gains in domestic pricing levels since the beginning of 2007, our market-driven sales strategy has proved profitable."

At the same time, Arch has maintained its exposure to the upside potential of coal markets through its unpriced position of between 15 million and 25 million tons in 2008, a meaningful portion of which is already committed but not yet priced. Additionally, Arch has unpriced volumes of between 85 million and 95 million tons for 2009 delivery; and between 95 million and 105 million tons for 2010 delivery.

"As previously indicated, our objective to date has been to focus on near-term agreements, preserving our very substantial upside in 2009 and 2010," continued Eaves. "Looking ahead, Arch will continue to pursue a market-driven strategy, which allows us to layer in new sales contracts as market demand dictates. We will continue to be selective in contracting, with long-term agreements predicated on securing prices that allow superior returns. We believe that this approach creates substantial value for our shareholders, and ensures that we achieve a sufficient return for all of our valuable coal reserves."

Arch Achieves Milestones in Key Performance Metrics

Arch attained an overall safety record in 2007 that was 2.5 times better than the national coal industry average, representing the company's second-best year on record as measured by its total incident rate. Several of Arch's operations were recipients of various state and national safety awards last year, including the company's Band Mill No. 2 mine, part of the Cumberland River mining complex in Central Appalachia, which was honored in September 2007 with the U.S. Department of Labor's prestigious Sentinels of Safety award as the nation's safest underground mine in 2006. This recognition marks the second year in a row that an Arch subsidiary has earned the highest national safety award in the large underground mining category. Arch's Skyline mine in Utah earned the 2005 Sentinels of Safety award in 2006.

In 2007, Arch delivered the company's best environmental compliance record in the company's 10-year history thanks to continuous improvements in environmental stewardship. Two of Arch's subsidiaries in Central Appalachia, Coal-Mac and Mountain Laurel, were honored last year with U.S. Department of the Interior awards for exemplary reclamation and good corporate citizenship practices. Arch also received three other national or state distinctions for excellence in land reclamation, wildlife habitat enhancement and community service in 2007.

Additionally, the company achieved key productivity milestones in 2007. According to the most recent industry data, Arch's surface operations were 2.7 times more productive, and its underground operations were 1.5 times more productive, than national coal industry averages for each production type. In 2007, Arch estimates that three of its underground mines were among the top eight most productive longwall mines in the U.S., including the nation's most productive longwall mine, Sufco in Utah.

"We are pleased with our achievements in each of Arch's three pillars of performance - safety, environmental stewardship and financial performance," said Leer. "We believe these core values provide the foundation for establishing the legacy of a responsible energy company."

Arch Announces 2008 Guidance

Based on current expectations, Arch has set its guidance for 2008 as follows:

- Fully diluted earnings per share is expected to be between $2.00 and $2.50.

- Adjusted EBITDA is expected to be in the $680 million to $790 million range.

- Sales volume from company controlled operations is expected to be between 135 million to 140 million tons, excluding all purchased coal from third parties.

- Capital spending is projected to be between $310 million and $340 million, excluding reserve additions.

- Depreciation, depletion and amortization expense is expected to be in the $280 million to $290 million range.

- Arch's full year 2008 effective income tax rate is projected to be between 8 percent and 14 percent.

"Our operations executed a solid performance in 2007," said Leer. "Over the past few years, we have worked diligently to reorient our mines to become flexible in response to market demand, while still running efficiently. Looking ahead, we expect Arch's diverse portfolio of mines to deliver a record earnings performance in 2008."

"Over the longer-term, Arch is particularly well-positioned to create substantial value for our shareholders given our size, low-cost operations, extensive low-sulfur reserve base, and leverage to the upside potential of coal markets," added Leer. "Continued elevated crude oil and natural gas prices create a compelling reference point for coal-based energy in America. We believe that domestic coal is the most affordable and abundant resource available to help meet America's growing energy needs and, with investment in clean-coal technologies, can help provide a secure and clean energy future."

A conference call regarding Arch Coal's fourth quarter 2007 financial results will be webcast live today at 11 a.m. E.S.T. The conference call can be accessed via the "investor" section of the Arch Coal Web site (www.archcoal.com ).

St. Louis-based Arch Coal is one of the nation's largest coal producers. The company's core business is providing U.S. power generators with clean-burning, low-sulfur coal for electric generation. Through its national network of mines, Arch supplies the fuel for approximately 6 percent of the electricity generated in the United States.

Forward-Looking Statements: This press release contains "forward-looking statements" - that is, statements related to future, not past, events. In this context, forward-looking statements often address our expected future business and financial performance, and often contain words such as "expects," "anticipates," "intends," "plans," "believes," "seeks," or "will." Forward-looking statements by their nature address matters that are, to different degrees, uncertain. For us, particular uncertainties arise from changes in the demand for our coal by the domestic electric generation industry; from legislation and regulations relating to the Clean Air Act and other environmental initiatives; from operational, geological, permit, labor and weather-related factors; from fluctuations in the amount of cash we generate from operations; from future integration of acquired businesses; and from numerous other matters of national, regional and global scale, including those of a political, economic, business, competitive or regulatory nature. These uncertainties may cause our actual future results to be materially different than those expressed in our forward-looking statements. We do not undertake to update our forward-looking statements, whether as a result of new information, future events or otherwise, except as may be required by law. For a description of some of the risks and uncertainties that may affect our future results, you should see the risk factors described from time to time in the reports we file with the Securities and Exchange Commission.