Arch Coal, Inc. Reports First Quarter 2008 Results

Earnings per share increase 180% from the year-ago quarter

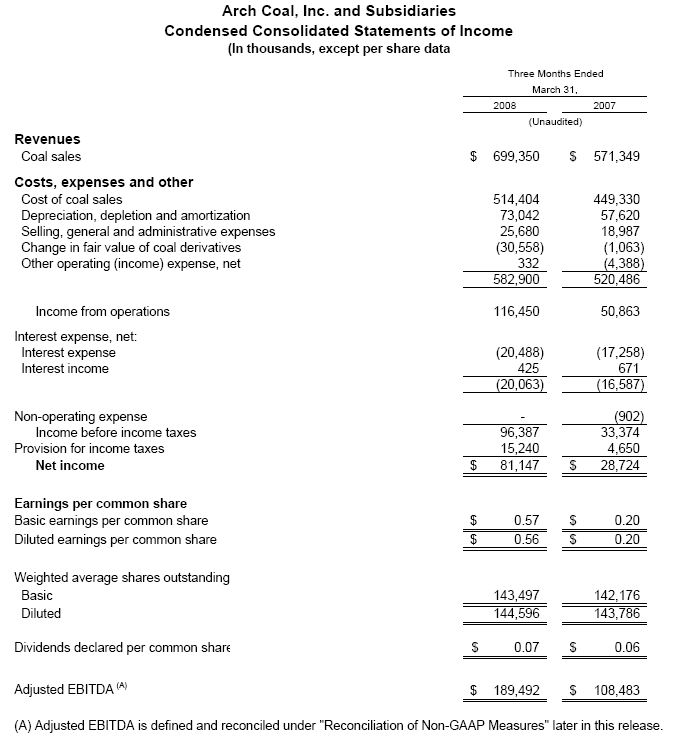

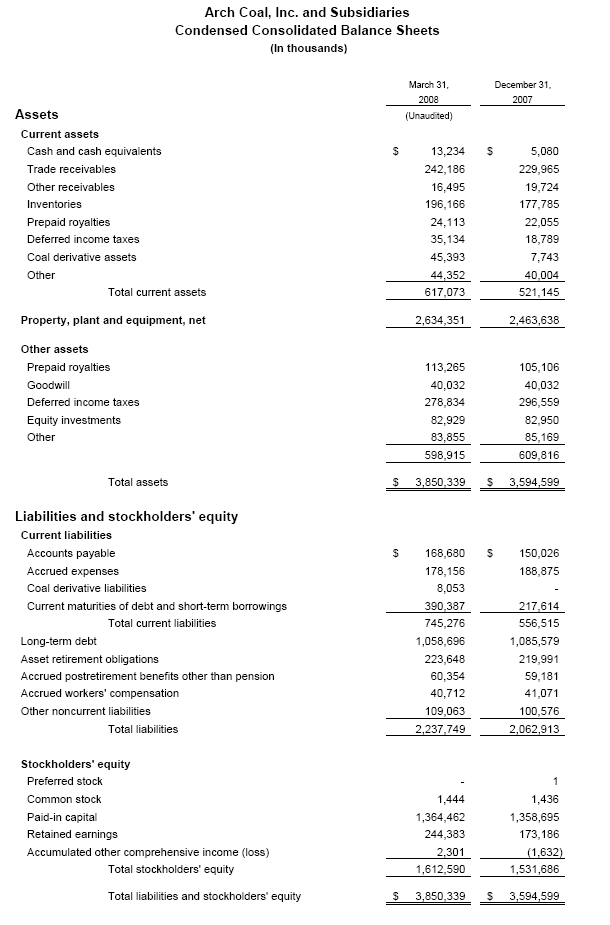

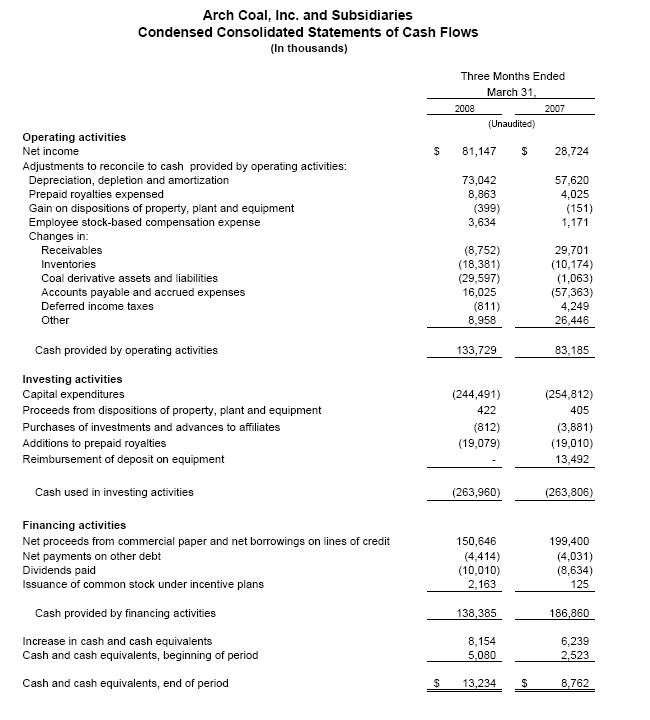

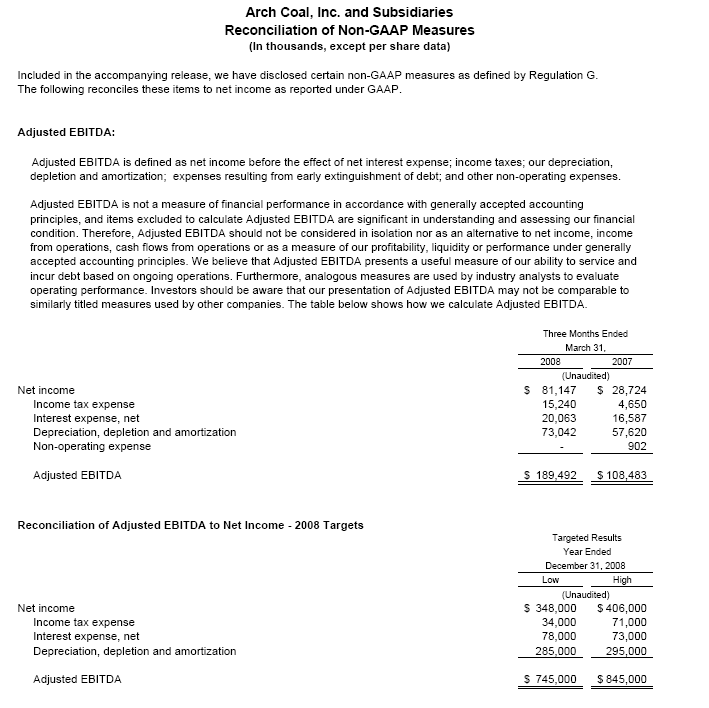

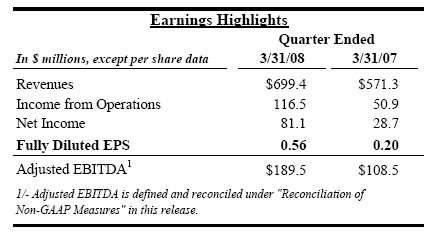

ST. LOUIS (April 21, 2008) - Arch Coal, Inc. (NYSE:ACI) today reported first quarter 2008 net income of $81.1 million, or $0.56 per fully diluted share, compared with $28.7 million, or $0.20 per fully diluted share, in the first quarter of 2007. Income from operations more than doubled to $116.5 million, and adjusted earnings before interest, taxes, depreciation and amortization ("EBITDA") increased 75 percent over the prior-year period. The company also recorded consolidated revenues of $699.4 million in the first quarter of 2008, an increase of 22 percent over the prior-year period.

"Arch Coal executed a strong financial performance during the first quarter, with meaningful expansion in revenues, earnings per share and adjusted EBITDA," said Steven F. Leer, Arch's chairman and chief executive officer. "We had substantial contributions from each of our operating regions, earning record EBITDA of $189.5 million for the company. In particular, our Central Appalachian region had a standout performance - attaining more than a fourfold increase in per-ton operating margin versus the first quarter of 2007. We also recognized incremental earnings in the quarter from our expanded strategic trading, brokerage and asset optimization function."

"Our first quarter 2008 results represent one of the best quarterly performances in Arch's history as a public entity," continued Leer. "We plan to build upon these exceptional results as the year progresses. We believe Arch's national footprint, competitive asset base and access to robust global and domestic coal markets have positioned the company to earn substantial returns in 2008 and beyond."

Arch Delivers Strong Operational Results

"Our mines delivered strong results during the quarter just ended, reflecting higher price realizations and a continued focus on cost control across our key basins in the face of commodity cost pressures as well as higher sales-sensitive costs," said John W. Eaves, Arch's president and chief operating officer. "The addition of the new Mountain Laurel complex to Arch's diverse asset base has been particularly significant, as evidenced by the outstanding performance in the company's Central Appalachian region during the first quarter."

"As we progress throughout the year, we will continue to diligently focus on managing our controllable costs, emphasize process improvement initiatives and maximize revenue from our strategic unpriced volume position to enhance margins at our operations," continued Eaves.

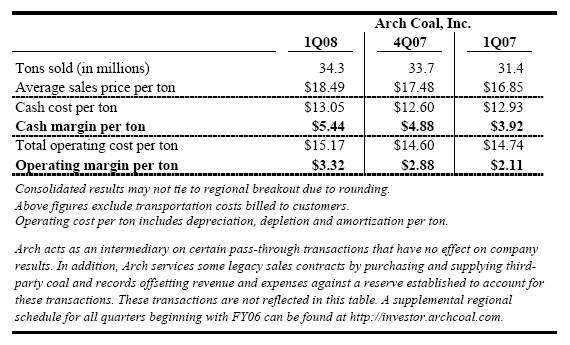

Consolidated average sales price per ton increased 6 percent in the first quarter of 2008 compared with the fourth quarter of 2007, reflecting higher average price realizations across all regions. Consolidated per-ton operating costs increased 4 percent over the same time period, with nearly half of the increase being driven by higher sales-sensitive costs. Arch's first quarter 2008 consolidated per-ton operating margin expanded by 15 percent over the prior-quarter period.

Consolidated sales volumes in the first quarter of 2008 increased 9 percent compared with the first quarter of 2007. Volumes in the first quarter of 2007 were reduced by an unplanned belt outage and weather-related shipment challenges in Arch's Powder River Basin segment. Average sales price per ton increased 10 percent in the first quarter of 2008, benefiting from stronger coal market conditions than in the year-ago quarter. Arch's first quarter 2008 consolidated per-ton operating margin increased 57 percent compared with the first quarter of 2007, driven by expanded margins in the company's Central Appalachian and Western Bituminous regions.

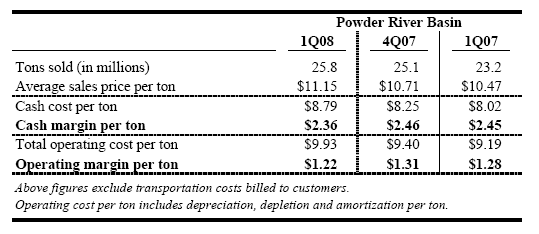

In the Powder River Basin, first quarter 2008 sales volumes increased modestly compared with the fourth quarter of 2007. Average sales price per ton increased $0.44 in the first quarter of 2008 when compared with the prior-quarter period, due to higher pricing on contract and market index-priced tons. Operating costs increased $0.53 per ton over this same time period, reflecting higher planned maintenance, commodity and sales-sensitive costs. Arch's Powder River Basin operations contributed $1.22 per ton in operating margin in the first quarter of 2008 compared with $1.31 per ton in the prior-quarter period.

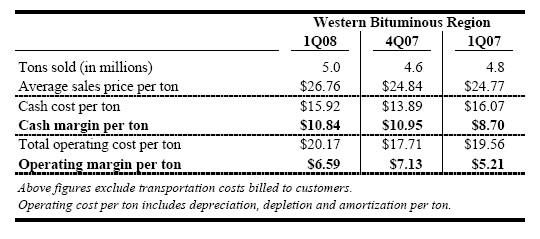

In the Western Bituminous region, first quarter 2008 sales volumes increased 9 percent compared with the fourth quarter of 2007, driven by increased shipments from Arch's Utah operations. First quarter 2008 average sales price per ton increased $1.92 when compared with the prior-quarter period, reflecting the roll-off of lower-priced sales contracts. While solid, the increase in price realization was muted to some degree by a less favorable mix of customer shipments during the quarter just ended. Operating costs increased $2.46 per ton over the same time period, due to higher sales-sensitive and commodity-related costs as well as higher depreciation, depletion and amortization expense. First quarter 2008 per-ton operating costs also reflect the impact of a longwall move at the West Elk mine in Colorado. By contrast, the region's fourth quarter 2007 results do not reflect the impact of any longwall moves, and represent an exceptionally strong performance from a cost perspective. Arch's Western Bituminous operations contributed $6.59 per ton in operating margin in the first quarter of 2008 compared with $7.13 per ton in the prior-quarter period.

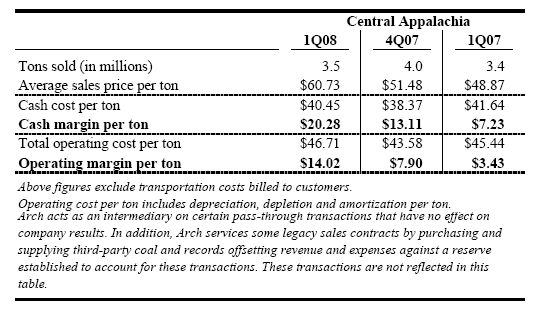

In Central Appalachia, first quarter 2008 sales volumes declined 13 percent compared with the fourth quarter of 2007 due to lower brokerage activity. First quarter 2008 average sales price per ton improved by $9.25 when compared with the prior-quarter period, reflecting more than a 50 percent increase in metallurgical coal volume as well as higher pricing on metallurgical and steam coal sales during the quarter just ended. Per-ton operating costs increased $3.13 over the same time period, driven by higher sales-sensitive and commodity-related costs as well as higher depreciation, depletion and amortization expense. Arch's Central Appalachian operations contributed $14.02 per ton in operating margin during the first quarter of 2008 compared with $7.90 per ton in the prior-quarter period.

Arch Earns Key Awards in the First Quarter

During the first quarter of 2008, two operations from Arch's Central Appalachian region received Mountaineer Guardian Awards for outstanding 2007 safety performances from the West Virginia Office of Miners' Health, Safety and Training.

Also during the first quarter, the West Elk mine in Arch's Western Bituminous region earned two Colorado state awards for its outstanding environmental achievements in 2007. West Elk was recognized for operating more than eight years without a state environmental violation, and was honored for its environmentally sound engineering practices as well as its contributions to the state's Pollution Prevention Program.

Furthermore, Arch Coal, Inc. was recently named one of the nation's most trustworthy companies by Forbes magazine based on the company's sound accounting practices and transparency in financial reporting. Arch ranked as one of the top 15 large-cap companies - and as the sole U.S. coal company - on the Trustworthy 100 List.

"We continue to enhance Arch's reputation as a responsible energy company through outstanding achievements in the company's three key pillars of performance - safety, environmental stewardship and superior financial performance," said Leer. "We believe these core values strengthen investor confidence and ultimately increase shareholder value."

Strength in Global Coal Markets Positively Influencing Domestic Coal Markets

Growing international coal demand, along with persistent challenges in augmenting global coal production, infrastructure and transportation networks, has led to a shift in worldwide seaborne coal trade flows. Constrained global coal supply has allowed the United States to become a more significant supplier of metallurgical and steam coal into the Atlantic and, in some cases, Pacific basins.

According to the 2007 B.P. Statistical Review of World Energy, coal has been the world's fastest growing fuel source during the past five years. Arch expects the growth in coal demand to continue, primarily driven by expanding economies in coal-consuming Asian nations and in the United States. In 2008, Arch estimates that global coal demand will outstrip supply by 25 million to 35 million metric tonnes, and expects this supply deficit to grow through 2010.

Continued strength in the international coal marketplace is positively influencing domestic coal markets as well. Arch estimates that U.S. coal imports could decline as much as 10 million tons this year due to supply disruptions and increased competition for those tons. The company also expects U.S. coal exports in 2008 to increase by another 20 million tons over last year's strong market levels.

"In 2008, we expect supply tightness in the eastern United States to trigger a meaningful reduction in generator stockpiles by year-end," said Leer. "This tightness already has begun to manifest itself in terms of rising eastern coal index prices and declining eastern stockpile levels. We believe these trends will translate into increased demand for western coal, particularly during the second half of the year."

U.S. coal market trends are favorable to date in 2008. According to statistics compiled by the Edison Electric Institute, U.S. electric generation increased nearly 1.0 percent year-to-date through the second week of April, driven by seasonal weather trends and better-than-expected industrial demand. Based on internal estimates, Arch also believes that year-to-date coal consumption for electric generation has grown at an even faster rate than overall electric power demand.

On the supply side, the Energy Information Administration estimates that domestic coal production increased 3.1 percent through the second week of April 2008, with Powder River Basin production, which is lower in heat content, offsetting declines in Central Appalachia. Looking ahead, Arch continues to expect significant geologic and regulatory challenges in Central Appalachia to constrain production in this region, despite higher coal index price trends.

As of March 31, 2008, Arch estimates that U.S. generators held approximately a 52-day supply in coal stockpiles. Arch expects total stockpile levels to decline as the year progresses. Additionally, the company believes that increased stockpiles partially reflect an effort by generators to increase inventories as a hedge against future supply disruptions.

Arch also estimates that 16.5 gigawatts of new coal-fueled capacity are now under construction in the United States, and will be phased in during the next four years. This build-out will require nearly 59 million tons of new annual coal supply, with 75 percent of the forecasted supply needed before the end of 2010. Another 8 gigawatts of new coal-fueled plants are estimated to be in advanced stages of development, equating to roughly 25 million tons of additional incremental annual coal demand. Arch expects the majority of these plants to be built within the next five years.

"We believe that the U.S. coal market is transitioning from a national market to an integrated global coal supply network," said Leer. "With our highly competitive mine portfolio, we expect to capitalize on these positive secular global trends."

Arch Selectively Adds to Sales Contract Portfolio, Expands Terminal Capacity

Pricing for international metallurgical and steam coal has been robust in 2008, and has positively influenced pricing in domestic coal markets. Coal index pricing across Arch's key operating basins has risen dramatically, with prices for 2009 delivery up more than 35 percent for Central Appalachian steam coal, nearly 50 percent for Western Bituminous coal and roughly 15 percent for Powder River Basin coal since the beginning of the year.

In Central Appalachia, Arch committed significant volumes into international and domestic metallurgical coal markets for 2008 and 2009 delivery, at average netback mine prices in the triple digits. Recent metallurgical coal sales have approached the benchmark prices set in the Asian market, on a quality adjusted basis. In addition, Arch committed substantial steam coal volumes for 2008 and 2009 delivery, at pricing that averaged more than a 40-percent premium to the company's average realized price in the region during the first quarter of 2008.

In the Western Bituminous region, Arch signed selective sales commitments for 2008 and 2009 delivery, at prices that significantly exceeded average 2009 coal index price levels of $38 per ton in the region. Arch anticipates coal demand to exceed supply from this basin during the next several years, and has chosen to date to maintain an open position on a portion of the company's production in this region through 2010.

In the Powder River Basin, Arch signed sales commitments for several million tons of coal for 2008 and 2009 delivery at average prices that are more than 50 percent above Arch's average realized price in the region during the first quarter of 2008.

Currently, Arch has unpriced coal volumes of between 8 million and 13 million tons in 2008, more than one-third of which is already committed but not yet priced. Arch also has unpriced volumes of between 75 million and 85 million tons for 2009 delivery, and between 95 million and 105 million tons for 2010 delivery.

"We've been successful in locking up a substantial portion of our metallurgical and steam coal sales opportunities in Central Appalachia given the strong pricing environment," said Eaves. "We've also strategically chosen to leave a small portion unhedged in 2008 - and substantially more unpriced in 2009 including most of our metallurgical-quality coal - to capitalize on continued pricing strength."

"Arch will continue to pursue a market-driven strategy, which allows us to layer in new sales contracts across all basins once a sufficient return on our valuable coal reserves is achieved," continued Eaves. "However, we will remain selective in contracting, and will leave our low-cost reserves in place for future development if expected returns prove insufficient. We believe this strategy provides the best long-term value for our shareholders."

Additionally, affirming the company's ongoing favorable international coal market expectations, Arch has signed an agreement to increase its ownership interest in Dominion Terminal Associates, a coal export terminal with annual throughput capacity of 20 million tons, located in Newport News, Va. The transaction will increase Arch's percentage interest in the storage-to-vessel coal transloading facility from 17.5 percent to roughly 22 percent.

"Given anticipated global coal supply shortfalls over the next several years, we believe the additional throughput capacity provided by the transaction will prove advantageous for the company," said Eaves.

Arch Raises 2008 Guidance

Based on the company's current expectations regarding the future direction of coal markets, Arch has raised its 2008 guidance for the full year as follows:

- Earnings per fully diluted share are expected to be in the $2.40 to $2.80 range.

- Adjusted EBITDA is expected to be in the $745 million to $845 million range.

- Sales volumes from company controlled operations are expected to remain in the 135 million to 140 million ton range, excluding purchased coal from third parties.

- Capital spending is projected to remain in the $310 million to $340 million range, excluding reserve additions.

- Depreciation, depletion and amortization expense is expected to be in the $285 million to $295 million range.

- Arch's full year 2008 effective income tax rate is projected to be between 9 percent and 15 percent.

"We expect our company to deliver a record earnings performance in 2008," stated Leer. "Our raised guidance range reflects pricing gains in the international and domestic metallurgical coal marketplace, anticipated strong operating performances in our Central Appalachian and Western Bituminous regions as well as continued solid execution in our Powder River Basin operations."

"Arch is strategically prepared to respond to evolving coal market dynamics," said Leer. "We believe our size, strategic asset base, low-cost operational profile and strong balance sheet will provide ample opportunities for the company to enhance shareholder value over the next several years."

"With crude oil and natural gas prices trading at record levels," added Leer, "it is imperative that America's vast coal reserves remain an essential part - and play an increasingly important role - in the nation's domestic energy mix. Over the longer-term, Arch is well-positioned to supply affordable, reliable and vital energy to America for decades to come."

A conference call regarding Arch Coal's first quarter 2008 financial results will be webcast live today at 11 a.m. E.D.T. The conference call can be accessed via the "investor" section of the Arch Coal Web site (www.archcoal.com ).

St. Louis-based Arch Coal is one of the nation's largest coal producers, with revenues of $2.4 billion in 2007. The company's core business is providing U.S. power generators with cleaner-burning, low-sulfur coal for electric generation. Through its national network of mines, Arch supplies the fuel for roughly 6 percent of the electricity generated in the United States.

Forward-Looking Statements.: This press release contains "forward-looking statements" - that is, statements related to future, not past, events. In this context, forward-looking statements often address our expected future business and financial performance, and often contain words such as "expects," "anticipates," "intends," "plans," "believes," "seeks," or "will." Forward-looking statements by their nature address matters that are, to different degrees, uncertain. For us, particular uncertainties arise from changes in the demand for our coal by the domestic electric generation industry; from legislation and regulations relating to the Clean Air Act and other environmental initiatives; from operational, geological, permit, labor and weather-related factors; from fluctuations in the amount of cash we generate from operations; from future integration of acquired businesses; and from numerous other matters of national, regional and global scale, including those of a political, economic, business, competitive or regulatory nature. These uncertainties may cause our actual future results to be materially different than those expressed in our forward-looking statements. We do not undertake to update our forward-looking statements, whether as a result of new information, future events or otherwise, except as may be required by law. For a description of some of the risks and uncertainties that may affect our future results, you should see the risk factors described from time to time in the reports we file with the Securities and Exchange Commission