Arch Coal, Inc. Reports Third Quarter Results

Arch Coal, Inc. Reports Third Quarter Results

October 15, 2004 at 1:15 AM EDT

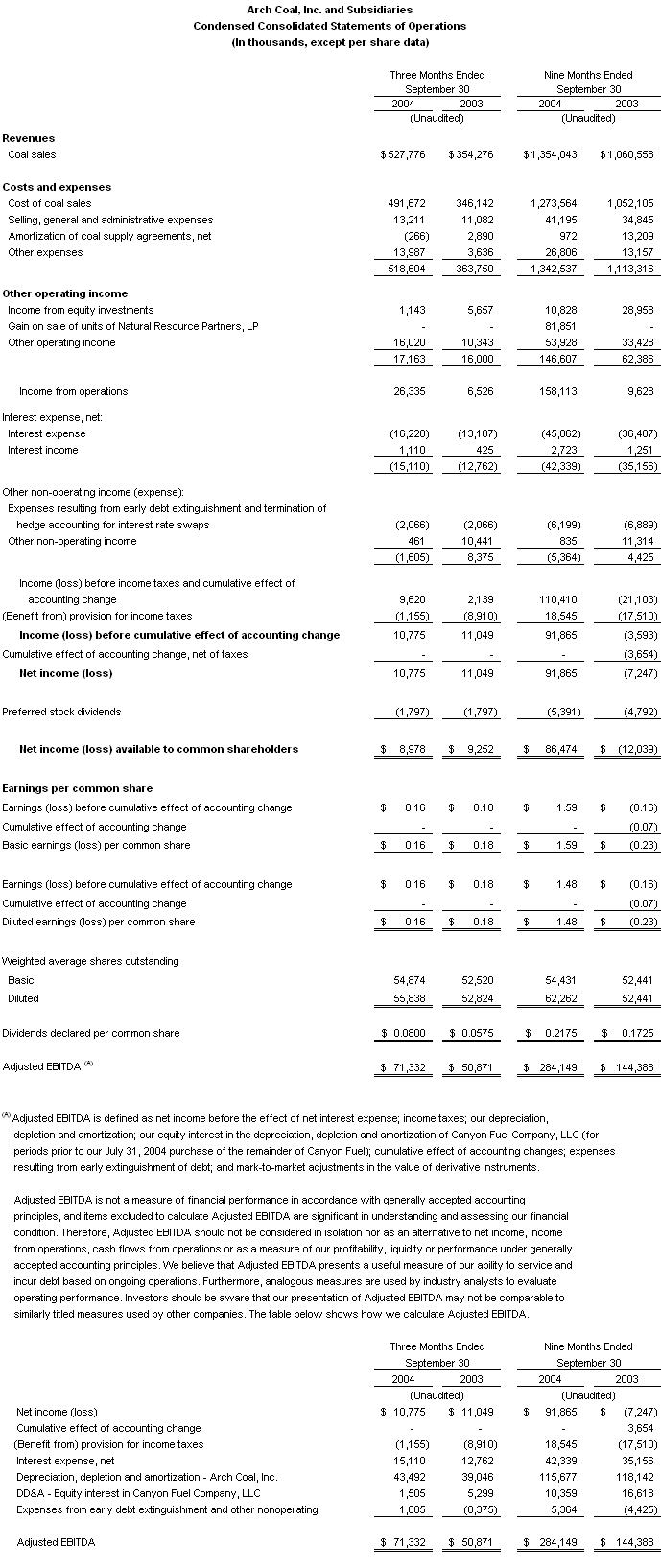

- Revenue increases to $527.8 million, up 49% vs. same period last year

- Earnings per fully diluted share total $0.16 ($0.19 excluding swap-related charges), compared to $0.18 in 3Q03

- Operating income increases to $26.3 million, compared to $6.5 million in 3Q03

- Adjusted EBITDA increases 40% to $71.3 million

- Average margin nearly doubles to $1.52 per ton vs. $0.80 in 3Q03

- Acquisitions of North Rochelle and remaining 35% of Canyon Fuel Company completed

- Substantial progress made on integration of North Rochelle into Black Thunder mine

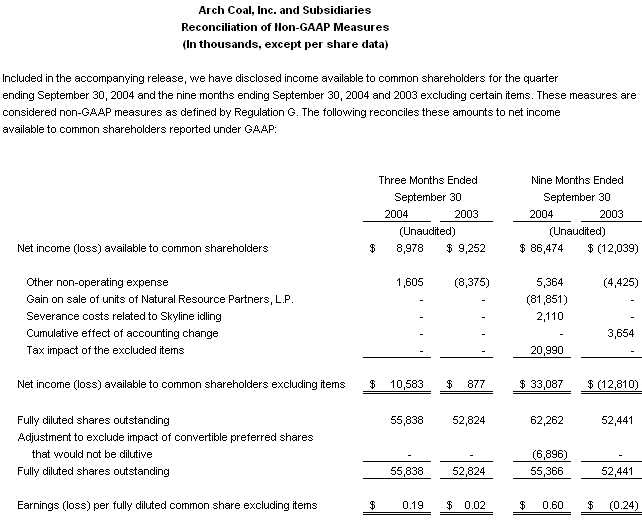

- Successful bid placed for Little Thunder federal coal lease

St. Louis - October 15, 2004 - Arch Coal, Inc. (NYSE:ACI) today reported that for its third quarter ended September 30, 2004, it had income available to common shareholders of $9.0 million, or $0.16 per fully diluted share. Excluding charges of $1.6 million related to the termination of hedge accounting for interest rate swaps, income available to common shareholders totaled $10.6 million, or $0.19 per fully diluted share. During the same period of 2003, Arch had income available to common shareholders of $9.3 million, or $.18 per fully diluted share, which included a net gain of $8.4 million, or $0.16 per share, related to mark-to-market adjustments and charges stemming from the termination of hedge accounting.

"I am pleased to report that Arch had a strong and highly productive third quarter," said Steven F. Leer, Arch's president and chief executive officer. "We recorded much-improved financial results; completed the acquisition of Triton Coal Company and the remaining 35% of Canyon Fuel Company; expanded our Powder River Basin reserve base through the addition of the Little Thunder federal lease; and made excellent headway towards fully integrating the newly acquired North Rochelle operation into our existing Black Thunder mine. In short, we continued to lay a solid foundation for further earnings momentum and value creation."

Arch's mining operations generally performed well during the quarter, Leer noted, despite continuing rail-related challenges that were exacerbated by the aftermath of the recent hurricanes. Rail disruptions resulted in missed shipments totaling approximately 200,000 tons during the quarter.

Revenues increased 49% for the quarter to $527.8 million, compared to $354.3 million during the same period last year, due principally to higher realizations and the addition of North Rochelle and Canyon Fuel Company (which was previously accounted for on the equity method) during the quarter. Sales volumes increased 34% to 33.8 million tons, compared to 25.3 million tons during the same period of 2003. Operating income for the third quarter totaled $26.3 million, compared to $6.5 million in the third quarter of 2003. Adjusted EBITDA increased 40% to $71.3 million, compared to $50.9 million in the same period last year.

For the nine months ended September 30, 2004, income available to common shareholders increased to $33.1 million, or $0.60 per fully diluted share, excluding a net gain of $81.9 million associated with the sale of nearly all of Arch's remaining interest in Natural Resource Partners, as well as other items disclosed in the attached schedule. That compares to a loss of $12.8 million, or $0.24 per fully diluted share, excluding charges related to early debt extinguishment and the cumulative effect of accounting change, during the same period of 2003. Total coal sales for the nine months increased 28% to $1,354.0 million and coal sales volumes increased 17% to 86.1 million tons, vs. $1,060.6 million and 73.6 million tons in the comparable period of 2003. Adjusted EBITDA totaled $284.1 million for the first nine months of 2004, compared to $144.4 million for the same period of 2003.

Recent Capital Projects

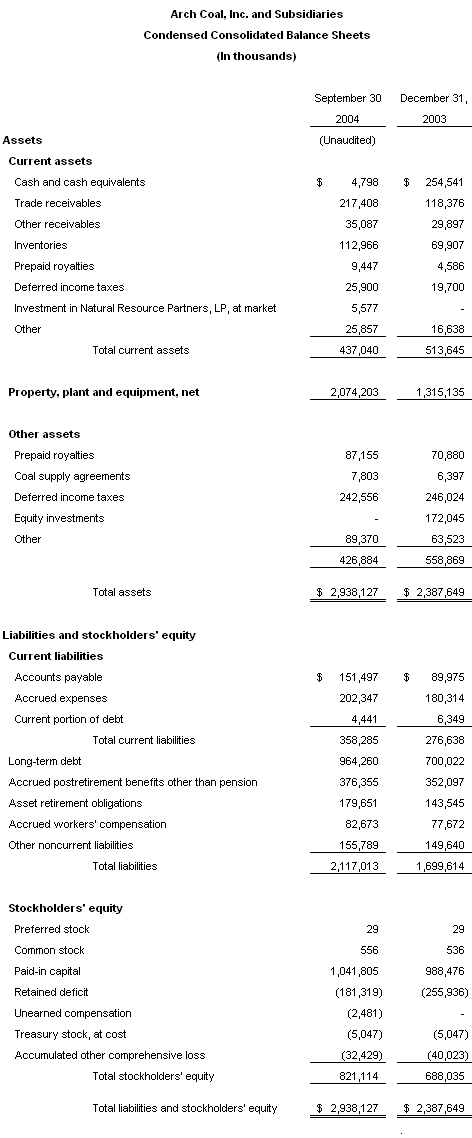

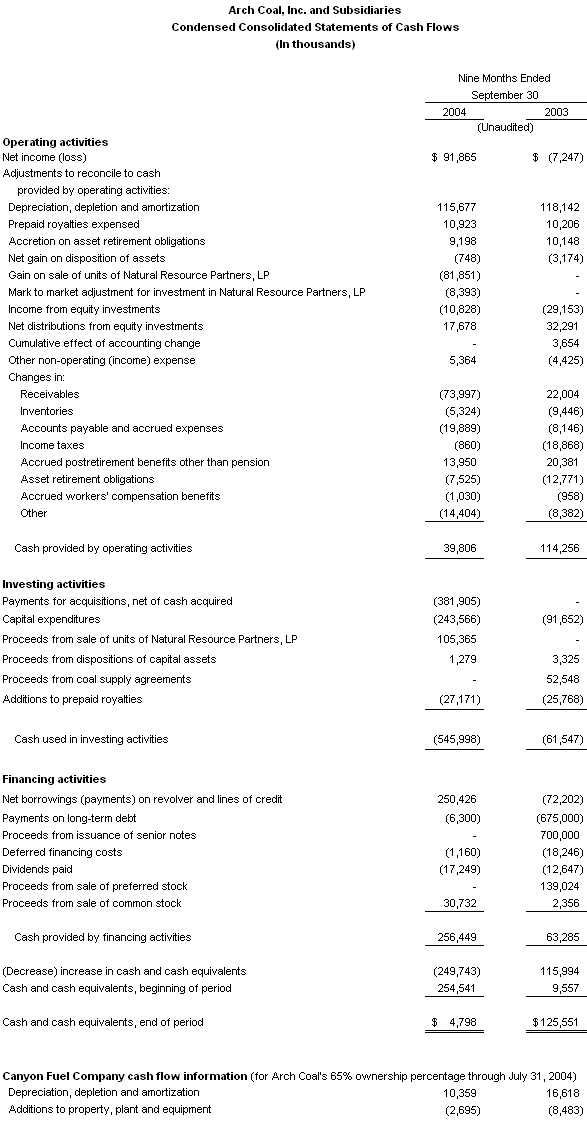

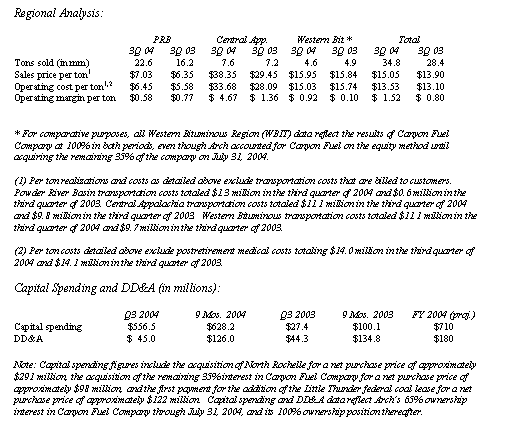

Through the first nine months of 2004, Arch's capital spending totaled $628.2 million, as the company completed a series of highly strategic acquisitions and reserve additions.

"The past few months have been a period of tremendous growth and change for Arch Coal," Leer said. "We believe these developments greatly enhance our already strong competitive position in each of the nation's principal, low-sulfur coal basins." In each instance, the acquired assets support and complement the company's existing operations, Leer noted.

Acquisition of Remaining 35% of Canyon Fuel Company

On July 31, Arch completed the acquisition of the remaining 35% of Canyon Fuel Company for a net purchase price of approximately $98 million. The acquisition solidified Arch's position as the leading producer in the Western Bituminous Region of Utah and Colorado.

"We are enthusiastic about the potential of our Western Bituminous operations," Leer said. "With high-Btu, low-sulfur eastern coal in short supply, eastern power producers are turning to high-Btu western coals as a ready substitute. We believe our longwall mines in Utah and Colorado are poised to capitalize on this trend as existing contracts expire, and we have a strategic reserve position in the region that should support increased production as market conditions warrant."

The acquisition is expected to be accretive to EBITDA immediately and accretive to earnings within 12 months. As a wholly owned subsidiary of Arch Coal, Canyon Fuel's results are now being consolidated in Arch's financial statements, effective August 1, 2004.

Acquisition of North Rochelle Mine

On August 20, Arch completed the acquisition of Triton Coal Company's former North Rochelle mine for a net purchase price of $291.1 million. Arch immediately began integrating the former North Rochelle operation into the company's existing and adjacent Black Thunder mine. The integration of the two mines is expected to create operating synergies of between $15 million and $20 million per year beginning in 2005, with that number increasing in subsequent years.

"The integration effort has gone exceptionally well," Leer said. "While we do not expect to realize all of the anticipated operating synergies until 2005, we have effectively combined the two mines into one seamless and highly productive operation. Since taking possession of the new property, we are more enthusiastic than ever about the future potential of this world-class asset and its talented workforce."

Leer pointed to a number of integration initiatives already completed or well under way at the expanded Black Thunder mine. These initiatives include reducing overhead through the elimination of 30 salaried positions; redesign of the mine plan to enhance equipment utilization on the expanded property; and optimization of the mine's multiple rail loading facilities to increase fluidity, alleviate rail congestion and reduce truck hauls. In addition, the enhanced blending capabilities of the expanded mine has facilitated a 3%-5% increase in coal recovery at the former North Rochelle property.

"The integration process should be substantially completed during the fourth quarter, and we expect the acquisition to be accretive to earnings by the first quarter of 2005," Leer said. "Given the progress made thus far, we are confident that we will meet or exceed our previously announced targets for operating synergies," Leer said.

Addition of Little Thunder Federal Lease

On September 22, Arch was the successful bidder for a 5,084-acre federal coal lease known as Little Thunder adjacent to the Black Thunder mine. Arch bid $611 million for the lease, which contains approximately 719 million mineable tons of coal with an average Btu content per pound of nearly 8,900 and an extremely low sulfur content of approximately 0.5 pounds of SO2 per million Btu's, according to the U.S. Bureau of Land Management (BLM).

"The addition of these reserves directly west of our existing operations will support continued low-cost production at Black Thunder for many years to come, while at the same time serving as a strategic platform for future growth," Leer said.

Improving Profit Margins

For the quarter, Arch's average per-ton operating margin rose to $1.52 per ton, compared to $0.80 per ton during the same period last year. Average realization for all tons sold increased 8% to $15.05 per ton, while the average cost for all tons sold increased approximately 3% to $13.53.

U.S. Coal Markets

Despite a very mild summer across much of the United States, spot prices for many U.S. coal products remained at or near their highest levels in decades. Pricing was particularly strong in Central Appalachia, where coal producers are struggling to maintain production levels in the face of reserve degradation, an increasingly challenging permitting and regulatory environment, and a continuing labor shortage.

Meanwhile, coal stockpiles at U.S. power producers remain under significant pressure. Arch estimates that consumption will outstrip production by approximately 35 million tons in 2004, following a supply deficit of an estimated 40 million tons in 2003. "We expect power plant stockpiles to fall to record low levels by the end of 2004, which should support continued strength in U.S. coal markets," Leer said.

The tight supply picture in the East should benefit the Powder River Basin over time, he added. "We are in discussion with a number of eastern power producers who have indicated an intent to use an increasing percentage of Powder River Basin coal in their fuel mixes," Leer said. "With leading positions in both the Powder River Basin and Central Appalachia, Arch is particularly well equipped to supply the changing needs of these customers."

While demand for coal has strengthened across all regions, the outlook for low-sulfur coal is particularly bright, Leer noted. At present, sulfur dioxide emissions allowances are trading at levels well above $500, which translates into a significant premium for the lowest sulfur coal products. "Our focus on the cleanest burning coals has proved to be the ideal strategy in today's market environment," Leer said.

Contract Activity

During the quarter, Arch continued to build an attractive portfolio of contracts for its expected 2005 and 2006 production. The percentage of Arch's planned production already priced for delivery currently stands at 80% for 2005 and 50% for 2006.

"We are taking a patient and balanced approach to our contract portfolio," Leer said. "Our strategy is to seek term sales commitments in the current strong market environment, while still maintaining a sizable open position that will enable us to capitalize on further market gains if and when they materialize. We remain very confident in the future direction of the U.S. coal market."

Looking Ahead

Arch expects to record earnings of between $0.20 and $0.35 per share for the fourth quarter, excluding charges related to the termination of hedge accounting for interest rate swaps, with actual results dependent in part on rail performance. Rail service improved somewhat during the third quarter, but suffered a setback following hurricane-related disruptions late in the quarter.

"We believe the railroads are working with an appropriate degree of urgency to restore rail service to acceptable levels," Leer said. "Unfortunately, these problems cannot be rectified overnight. While we expect some improvement as the year progresses, we anticipate continued challenges in the fourth quarter."

Leer indicated that he expected continued improvement in the company's results in 2005. "We have made solid progress on many different fronts this year, and we are confident that even better days lie ahead," Leer added. "As we move into 2005 and 2006, an increasing percentage of our expected production will reflect current market conditions. We are confident that we have the right mix of assets, management talent and operating personnel to make the most of this strong and exciting market environment."

A conference call concerning third quarter earnings will be webcast live today at 11 a.m. Eastern. The conference call can be accessed via the "investor" section of the Arch Coal Web site (www.archcoal.com).

St. Louis-based Arch Coal is the nation's second largest coal producer, with subsidiary operations in West Virginia, Kentucky, Virginia, Wyoming, Colorado and Utah. Through these operations, Arch Coal provides the fuel for approximately 7% of the electricity generated in the United States.

Forward-Looking Statements: Statements in this press release which are not statements of historical fact are forward-looking statements within the "safe harbor" provision of the Private Securities Litigation Reform Act of 1995. These forward-looking statements are based on information currently available to, and expectations and assumptions deemed reasonable by, the company. Because these forward-looking statements are subject to various risks and uncertainties, actual results may differ materially from those projected in the statements. These expectations, assumptions and uncertainties include: the company's expectation of continued growth in the demand for electricity; belief that legislation and regulations relating to the Clean Air Act and the relatively higher costs of competing fuels will increase demand for its compliance and low-sulfur coal; expectation of continued improved market conditions for the price of coal; expectation that the company will continue to have adequate liquidity from its cash flow from operations, together with available borrowings under its credit facilities, to finance the company's working capital needs; a variety of operational, geologic, permitting, labor and weather related factors; and the other risks and uncertainties which are described from time to time in the company's reports filed with the Securities and Exchange Commission.