Arch Coal, Inc. Reports Fourth Quarter Results

Arch Coal, Inc. Reports Fourth Quarter Results

February 8, 2005 at 12:00 AM EST

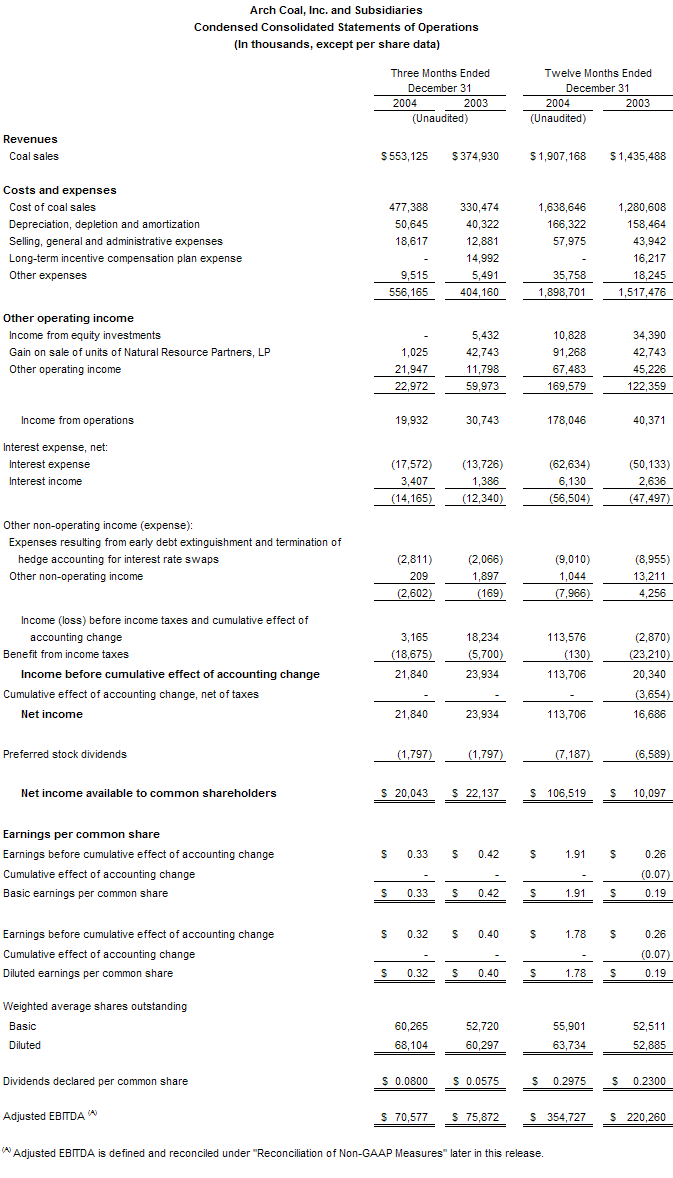

- Revenue increases to a record $553.1 million, up 48% vs. same period last year

- Earnings per fully diluted share total $0.32 ($0.34 excluding special items), compared to $0.04 in 4Q03 excluding special items

- Adjusted EBITDA increases 41% to $69.6 million, compared to $49.3 million in 4Q03, excluding special items in both periods

- Average margin increases 78% to $1.19 per ton, vs. $0.67 per ton in 4Q03

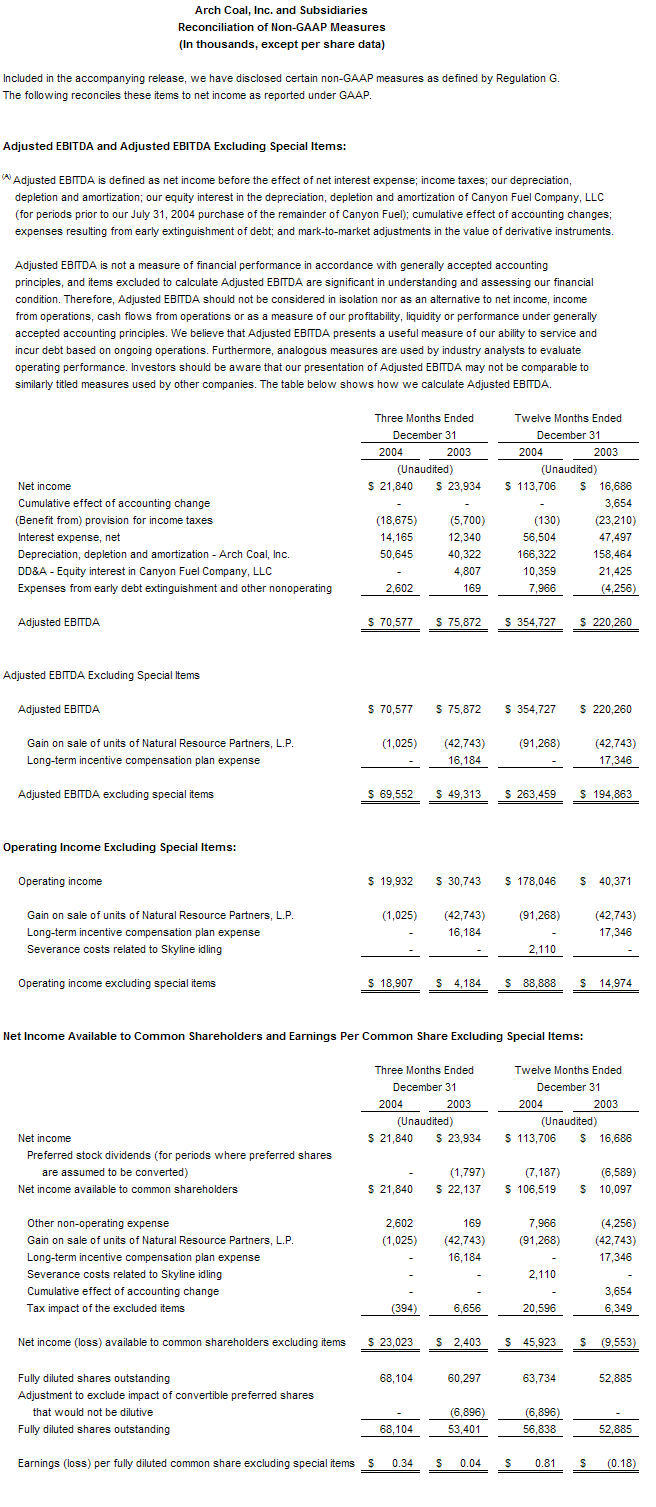

St. Louis (February 8, 2005) - Arch Coal, Inc. (NYSE:ACI) today reported that for its fourth quarter ended December 31, 2004, it had income available to common shareholders of $20.0 million, or $0.32 per fully diluted share. Excluding special items, income available to common shareholders totaled $23.0 million, or $0.34 per fully diluted share. During the same period of 2003, Arch had net income of $2.4 million, or $0.04 per fully diluted share, excluding special items. (See table that follows release for reconciliation to GAAP net income.)

"Despite continuing rail difficulties, Arch achieved solid results in the fourth quarter," said Steven F. Leer, Arch's president and chief executive officer. "Looking ahead to 2005 and beyond, we expect to build on our recent progress as an increasing percentage of our sales tonnage resets to market-based pricing."

Revenues increased 48% to $553.1 million in the fourth quarter, compared to $374.9 million during the same period last year, due principally to higher realizations and the acquisition of the North Rochelle mine and the remaining interest in Canyon Fuel, the company's Utah subsidiary. (Arch's Utah subsidiary was previously accounted for on the equity method.) Sales volumes increased 37% to 37.0 million tons, compared to 27.0 million tons during the same period of 2003. Operating income for the fourth quarter totaled $18.9 million, compared to $4.2 million in the fourth quarter of 2003, excluding special items in both periods. Adjusted EBITDA totaled $70.6 million vs. $75.9 million in last year's fourth quarter, which benefited from a large gain associated with the partial sale of the company's interest in Natural Resource Partners.

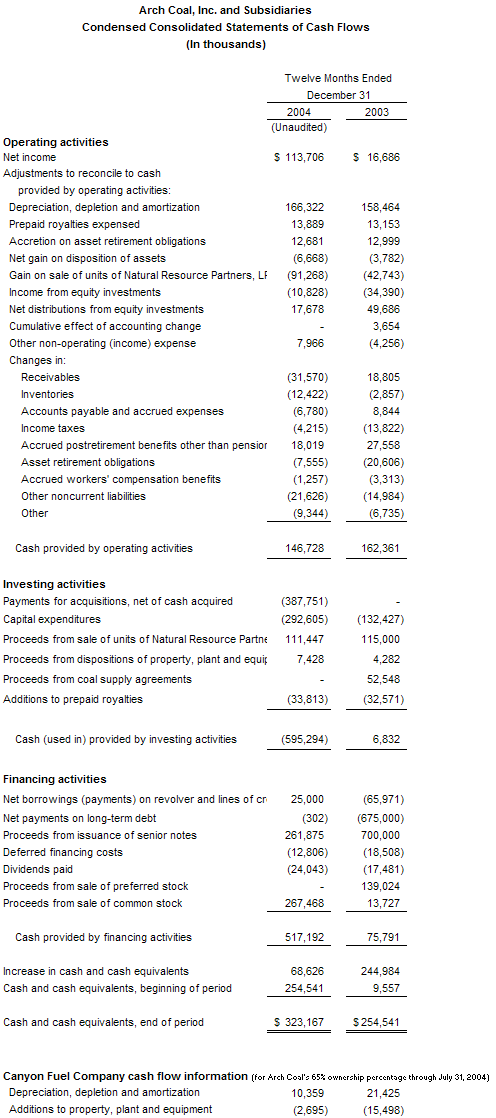

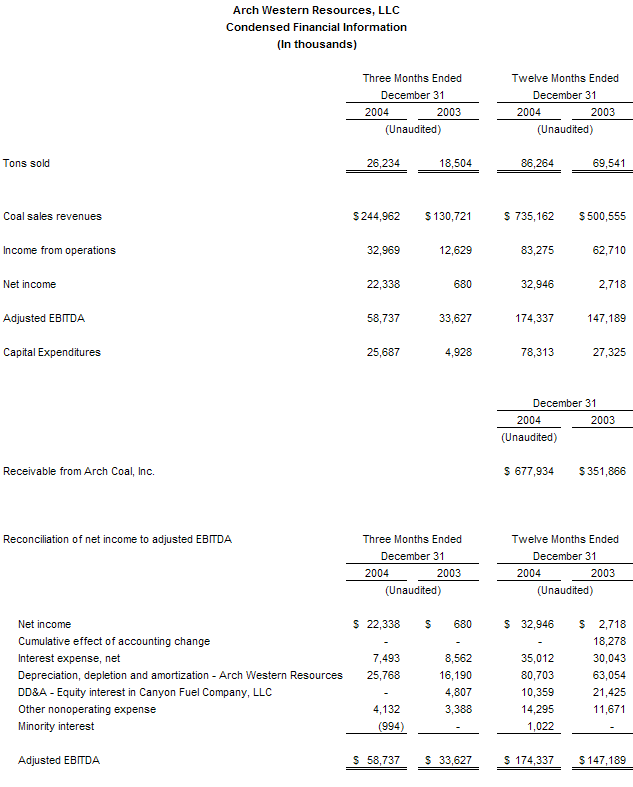

For the year ended December 31, 2004, income available to common shareholders increased to $45.9 million, or $0.81 per fully diluted share, excluding special items. That compares to a loss of $9.6 million, or $0.18 per fully diluted share, on a comparable basis during the fourth quarter of 2003. Revenues for the year increased 33% to $1,907.2 million and coal sales volumes increased 22% to 123.1 million tons, vs. $1,435.5 million and 100.6 million tons in the comparable period of 2003. Adjusted EBITDA totaled $354.7 million for 2004, compared to $220.3 million for the same period of 2003.

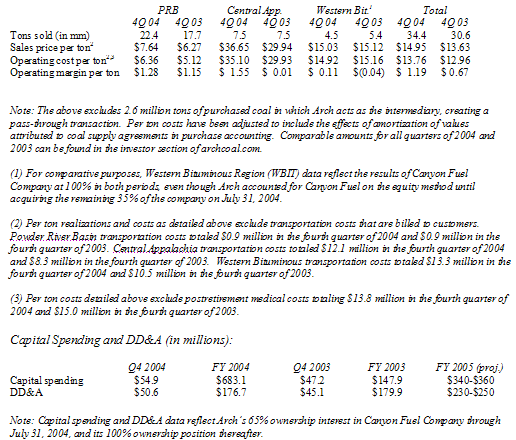

Regional analysis and other data

Powder River Basin

Arch's Powder River Basin mine, Black Thunder, operated exceptionally well during the quarter. Total production increased to 26.3 million tons and the mine's average operating margin more than doubled compared to the previous quarter, climbing to $1.28 per ton despite a relatively weak market environment for PRB coal. Arch has now completed the integration of the newly acquired North Rochelle mine into Black Thunder and has begun to capture the very substantial operating synergies created by the combination.

"The integration process has solidified Black Thunder's position as a truly world-class mining operation," said John W. Eaves, Arch's executive vice president and chief operating officer. "Not only have we increased the mine's output, but we have also driven down the average cost structure for the combined mines, increased average coal quality, and boosted operational flexibility. In short, we are better prepared than ever to meet the needs of the growing list of power generators that are turning to PRB coal for their fuel requirements."

Central Appalachia

In Central Appalachia, rail difficulties and a section of challenging geology at Mingo Logan contributed to compressed operating margins during the quarter. These factors reduced shipments of higher-priced spot and metallurgical coal, causing average per-ton realizations to slip modestly after three successive quarters of higher average pricing. Meanwhile, lower production volumes at Mingo Logan resulted in an average increase in per-ton operating costs in Central Appalachia of roughly $1.25 as compared to expectations.

At the end of January, Mingo Logan relocated the longwall into a new district at the mine where the seam is thicker, and where productivity rates are expected to improve and remain stable for the rest of the longwall mine's life. "While we anticipated challenging geology at Mingo Logan during the fourth quarter, conditions proved to be even tougher than expected," Eaves said. "We are pleased to have advanced into the new district where the geology is much more favorable. We expect Mingo Logan to quickly regain its form as one of the region's most productive mines," Eaves said.

Even without significant improvements in rail service, Arch expects average per-ton realizations in Central Appalachia to continue their upward climb during 2005. Average realizations in the region during the first quarter of 2005 are expected to be stronger than in any quarter of 2004.

Western Bituminous

In the Western Bituminous Region, Arch shipped more lower-priced contract and less spot tonnage, resulting in lower realizations in the region compared to the previous quarter. "The current spot market environment for Western Bituminous coal is exceptionally strong," Leer said. "As our existing contracts roll off, we expect operating margins in the region to strengthen substantially."

Arch is also moving forward with plans to develop a new longwall mine on the North Lease reserve at the idle Skyline complex in Utah. Demand for Western Bituminous coal has strengthened markedly in recent quarters, as Eastern power generators have attempted to secure Utah and Colorado coal as a substitute for supply-constrained high-Btu, low-sulfur Eastern coal. The North Lease is one of the best remaining undeveloped reserves in the region. Arch expects to invest approximately $40 million over the next 18 months to develop the new mine, which will ramp up to its targeted annual run rate of three million tons as early as the third quarter of 2006 if market conditions warrant. Initial continuous miner production is expected by the end of the first quarter of 2005.

Contract position

Arch began 2005 with an unpriced position estimated at roughly 14-16 million tons for the current year; 60-70 million tons for 2006; and 110-120 million tons for 2007.

"We have taken a patient approach to the current market environment, and we are pleased with our current balance between priced and unpriced tons," Leer said. "We believe the market outlook remains excellent, and we expect to have ample opportunity to layer in attractive new commitments as the year progresses."

Arch has also made good progress in shifting additional tons into metallurgical markets. In 2004, Arch sold approximately 2.8 million tons of metallurgical coal - nearly double the company's sales volume for 2003. In 2005, the company expects still further increases, with a target of up to five million tons. If demand remains strong, that number could climb to seven million tons in 2006. Still further increases are possible as the company's Mountain Laurel longwall mine ramps up to full production in mid-2007.

"We believe we are in an enviable position," Leer said. "Nearly one quarter of our current eastern production can be sold as either a metallurgical coal or a high-quality steam coal, depending on market conditions at the time. Moreover, we are producing this coal at low-cost mines that don't require today's very attractive met prices to be economic. We will continue to work to shift as many tons of high-quality steam coal into metallurgical markets as possible in 2005 and thereafter, assuming met markets continue to provide a strong premium."

Financial developments

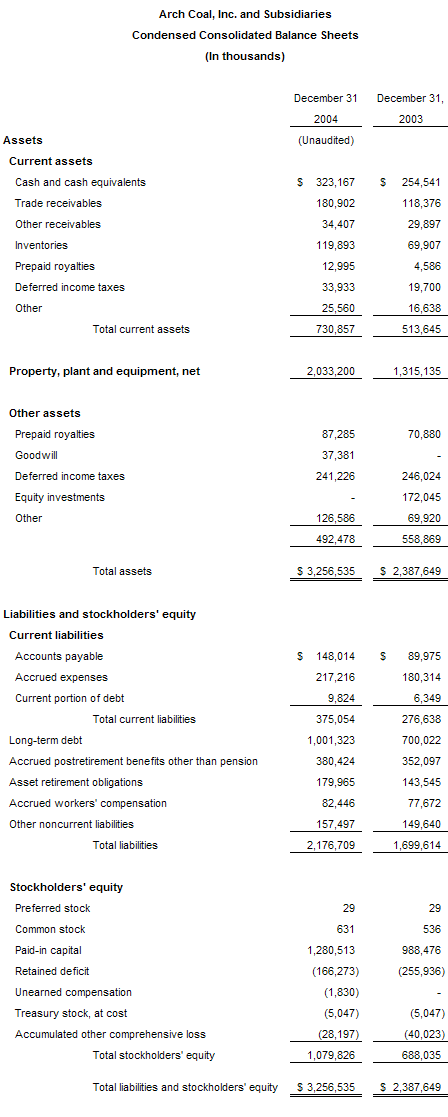

During 2004, Arch completed acquisitions and reserve additions that boosted its reserve base by approximately 30% to 3.8 billion tons, and its total sales volume by nearly 40% to 137.8 million tons on a pro forma basis. Arch financed these acquisitions in part with cash raised through the sale of non-strategic assets in late 2003 and early 2004 and via a debt and equity offering completed in October.

"Even after a period of dramatic growth, Arch ended 2004 with a very strong balance sheet," said Robert J. Messey, Arch's senior vice president and chief financial officer. "At year-end, debt to capitalization totaled 48%, compared to nearly 51% at the end of 2003 and nearly 84% just four years ago."

Liquidity also remained strong. Arch ended the fourth quarter with cash and cash equivalents of $323.2 million. In addition, the company secured a new revolving credit facility during the quarter and ended the year with approximately $600 million of borrowing capacity under this new facility. Arch expects its capital requirements to remain high over the course of the next two years as the company develops its new Mountain Laurel longwall mine in southern West Virginia and makes additional payments on the Little Thunder reserve lease.

"I'm pleased to say that, except for the potential need for short-term borrowing related to timing differences, we expect our current cash balance and expected cash flows from operations to be sufficient to fund our currently identified capital requirements," Messey said.

As expected, fourth quarter results benefited from the release of a $9.7 million contingent income tax liability associated with the settlement of federal income tax audits/reviews for prior periods.

Market environment

Spot prices in many major coal basins remained near historic highs throughout the period. Pricing has been particularly strong in Central Appalachia, where coal producers have struggled to maintain production levels in the face of reserve degradation, an increasingly challenging permitting and regulatory environment, rail disruptions, and a continuing labor shortage. Despite very strong pricing, coal production in Central Appalachia only increased by an estimated 1% during 2004.

Meanwhile, overall coal demand remains strong, even with relatively mild winter temperatures so far across much of the nation. The current high natural gas price environment continues to provide power generators with a powerful inducement to maximize output at coal-fired plants. Arch estimates that total U.S. consumption outstripped production again in 2004, with demand exceeding output by as much as 15 million tons. Coal stockpiles at U.S. power plants declined to less than 110 million tons at year-end, according to Arch estimates, 16% lower than the year-end average for the previous five years. Furthermore, strong international demand for metallurgical coal shows no signs of abating, putting additional pressure on Eastern coal supply.

Arch expects Powder River Basin coal to be a principal beneficiary of the current market environment. "Despite constrained rail capacity in 2004, we estimate that more than 20 power plants burned PRB coal for the first time in 2004, and their consumption of PRB coal is likely to increase in 2005," Leer said. "Moreover, new customer interest remains high. With our strong positions in the Powder River Basin, Central Appalachia and the Western Bituminous Region, Arch is particularly well equipped to meet the changing needs of these customers by supplying them with tailored blends of eastern and western coal."

While demand for coal has strengthened across all regions, the positive outlook for low-sulfur coal is even more pronounced, Leer noted. At present, sulfur dioxide emissions allowances are trading at levels in the range of $650 to $700 per ton, which translates into a significant premium for the lowest sulfur coal products. "Our focus on the cleanest burning coals is proving to be highly advantageous in the current market environment," Leer said.

Looking ahead

After careful consideration, Arch is revising the manner in which it provides guidance about expected future financial performance. The company has elected to discontinue its past practice of furnishing quarterly EPS guidance and will instead provide financial projections for the full year, along with supplemental information concerning the company's plans and contract portfolio for the three-year period. This change in practice reflects management's view that Arch's financial guidance should better reflect the company's focus on creating long-term value for its shareholders.

For the full year 2005, Arch expects to achieve EBITDA in the range of $400 million to $450 million, and earnings per share of between $1.50 and $2.00. (Investors should be aware that results are likely to vary significantly by quarter.) Average realizations on already committed and priced tons across all basins are expected to increase by approximately 10%. Depreciation, depletion and amortization is expected to be in the range of $230 million to $250 million in 2005 and capital expenditures are expected to total in the range of $340 million to $360 million, of which an estimated $90 million is related to Mountain Laurel, $23 million is related to the new North Lease mine at the Skyline complex, and the remainder is maintenance capital and productivity enhancements. (Arch will not make its second of five payments on the recent Little Thunder reserve addition until the first quarter of 2006.) The company estimates that its effective tax rate will be approximately 10% in 2005.

The guidance provided assumes that rail performance will be constrained during the first half of 2005 and that it will improve gradually thereafter. Because of the aforementioned geologic challenges at the Mingo Logan mine during the month of January as well as rail disruptions, Arch expects first quarter results to be weaker than subsequent quarters. Total sales volume across all regions for the full year 2005 is expected to be in the range of 140 million to 150 million tons. Total production in the first quarter of 2005 is expected to be in the range of 35 million to 37 million tons.

"We are very pleased about our future prospects," Leer said. "We believe that we are exceptionally well positioned to benefit from the robust and growing coal market in the United States and abroad. We expect our recent upward momentum in profitability to continue in 2005 and beyond, and we are confident this trend will create tremendous value for our shareholders."

A conference call concerning fourth quarter earnings will be webcast live today at 11 a.m. Eastern. The conference call can be accessed via the "investor" section of the Arch Coal Web site (www.archcoal.com).

St. Louis-based Arch Coal is the nation's second largest coal producer, with subsidiary operations in West Virginia, Kentucky, Virginia, Wyoming, Colorado and Utah. Through these operations, Arch Coal provides the fuel for approximately 7% of the electricity generated in the United States.

Forward-Looking Statements: Statements in this press release which are not statements of historical fact are forward-looking statements within the "safe harbor" provision of the Private Securities Litigation Reform Act of 1995. These forward-looking statements are based on information currently available to, and expectations and assumptions deemed reasonable by, the company. Because these forward-looking statements are subject to various risks and uncertainties, actual results may differ materially from those projected in the statements. These expectations, assumptions and uncertainties include: the company's expectation of continued growth in the demand for electricity; belief that legislation and regulations relating to the Clean Air Act and the relatively higher costs of competing fuels will increase demand for its compliance and low-sulfur coal; expectation of continued improved market conditions for the price of coal; expectation that the company will continue to have adequate liquidity from its cash flow from operations, together with available borrowings under its credit facilities, to finance the company's working capital needs; a variety of operational, geologic, permitting, labor and weather related factors; and the other risks and uncertainties which are described from time to time in the company's reports filed with the Securities and Exchange Commission.