Arch Coal, Inc. Reports Fourth Quarter Results

Arch Coal, Inc. Reports Fourth Quarter Results

February 10, 2006 at 12:00 AM EST

February 10, 2006

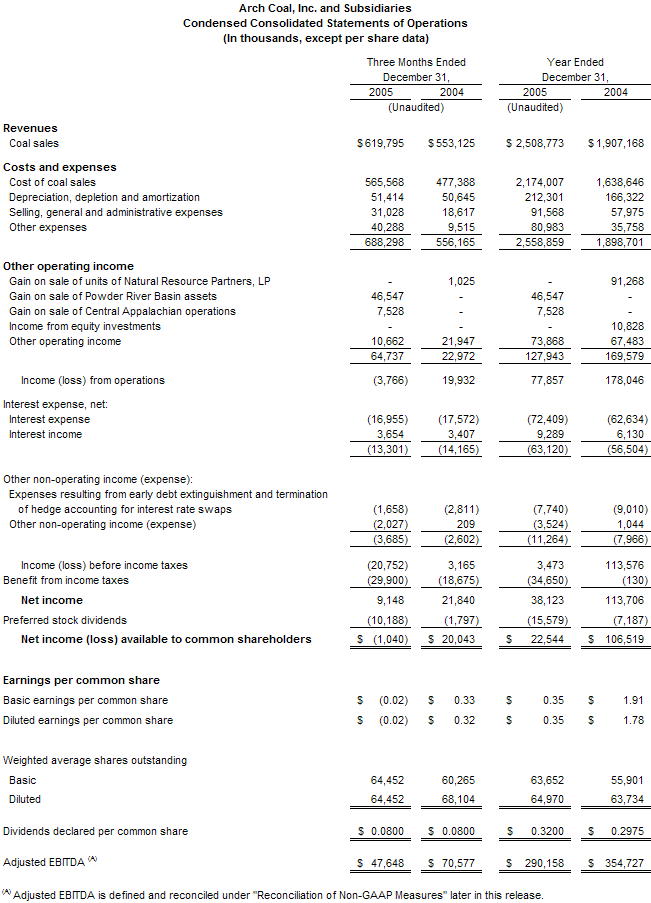

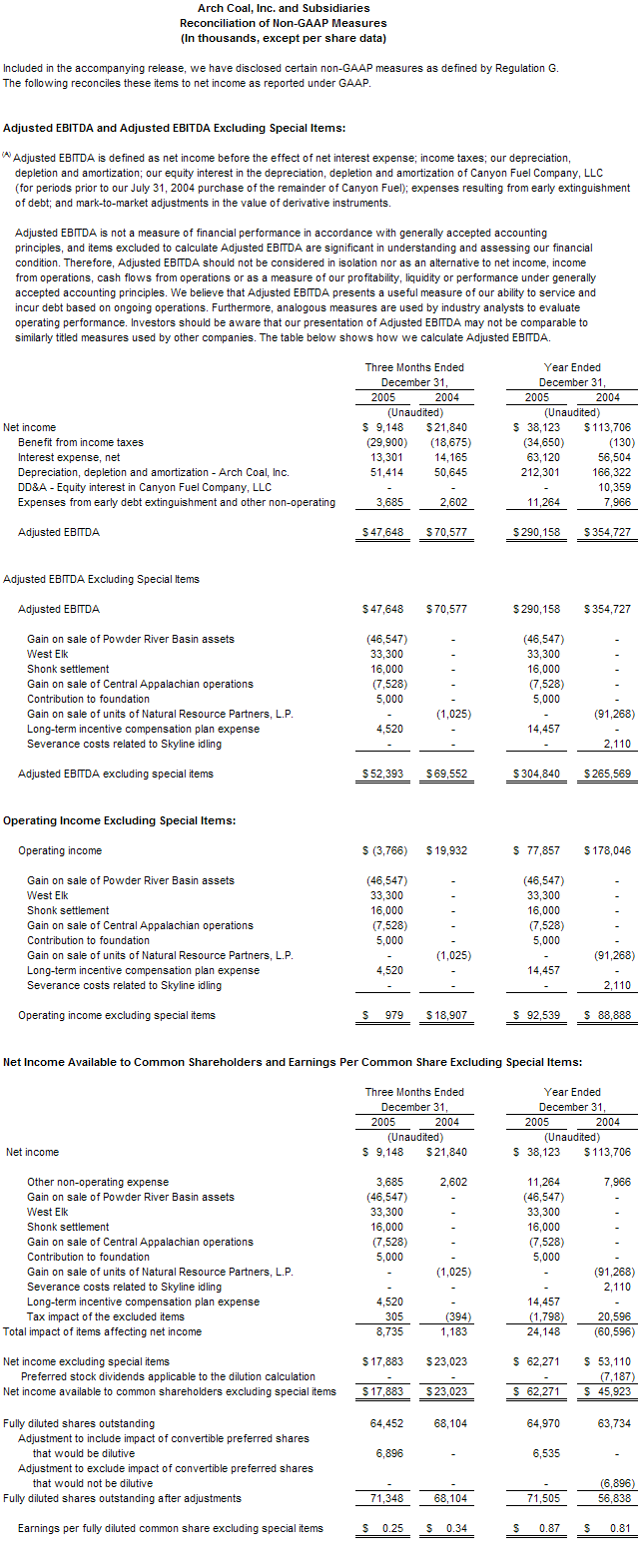

St. Louis – Arch Coal, Inc. (NYSE:ACI) today reported that it had a loss of $1.0 million, or $0.02 per fully diluted share, for its fourth quarter ended December 31, 2005. Excluding special items, which are listed below, Arch had income available to common shareholders of $17.9 million, or $0.25 per fully diluted share. Special items were comprised of:

- a gain of $46.5 million associated with the sale of a loadout, rail spur and idle office facility in the Powder River Basin of Wyoming;

- the adverse impact of the combustion-related event at the West Elk mine in Colorado, estimated at $33.3 million;

- a charge of $16.0 million associated with a legal settlement in West Virginia;

- a special dividend of $9.5 million related to the premium paid by the company to induce conversion of its preferred convertible stock;

- a gain of $7.5 million related to the sale of select assets in Central Appalachia;

- a charge of $5.0 million associated with the establishment of a new charitable foundation;

- a charge of $4.5 million related to stock-based incentive compensation; and

- other non-operating expenses of $3.7 million principally associated with the termination of hedge accounting for interest rate swaps.

In the fourth quarter of 2004, Arch had income available to common shareholders of $23.0 million, or $0.34 per fully diluted share, excluding special items. (See the table that follows this release for a reconciliation to GAAP numbers.)

"The quarter just ended was one of the most eventful in Arch's history," said Steven F. Leer, Arch Coal's president and chief executive officer. "We restructured our Central Appalachian operations, completed a strategic transaction in the Powder River Basin, induced conversion of nearly all of our preferred stock into common shares, addressed a combustion-related event at the West Elk mine in a safe and efficient manner, and began work on the re-start of the Coal Creek mine, which we are officially announcing today. We believe these accomplishments – as well as the countless smaller steps we took during the quarter – significantly strengthen Arch's strategic, operating and financial standing, and set the stage for a multi-year period of robust growth in margins, earnings and cash flow."

Core Values

Arch defines success in the U.S. coal industry based on three critical metrics: safety performance, environmental stewardship and shareholder returns. "I'm pleased to report that we ranked among the industry leaders on all three fronts during 2005," Leer said.

Arch had a record safety performance for the second straight year in 2005. Arch's lost-time incident rate declined by 37% compared to the previous year, to 0.88 incidents per 200,000 hours worked. The national coal industry average was approximately four times higher. "While I consider our safety performance to be Arch's single most significant accomplishment in 2005 – ranking among the best of all of America's heavy industries – we remain firmly committed to continuous improvement in this area," Leer said. "The only performance we should be willing to accept is zero lost-time incidents at every one of our mines, every single year."

Arch also excelled in the environmental arena. For the second year in a row, an Arch subsidiary won the Department of the Interior's Director's Award – the nation's most prestigious award for land reclamation. In addition, an Arch subsidiary won the top reclamation honor in the state of West Virginia for the fourth straight year.

For the sixth year in a row, Arch's total return to shareholders exceeded the average of the S&P 500. In fact, Arch's total return to shareholders of over 120% ranked among the highest of all mid-cap stocks in 2005.

Arch also established a new charitable foundation during the fourth quarter with an initial contribution of $5 million. The mission of the Arch Coal Foundation is to support organizations and causes that are making a positive difference in the communities where Arch operates. "We are firm believers in the concept that good corporate citizenship is a central tenet of long-term success for any business," Leer said.

Strategic Restructuring

As previously announced, Arch completed the sale of three of its Central Appalachian operating subsidiaries to Magnum Coal Company on December 31, 2005. The sale resulted in a $7.5 million gain during the quarter, which included the recognition of a charge of approximately $66.0 million related to the retention of several below-market legacy sales contracts for which Arch no longer has the ability to source subsequent to the sale, and a charge of $59.1 million related to previously unrecognized actuarial liabilities associated with post-retiree healthcare.

"This strategic restructuring will enable us to focus on a select group of Central Appalachian operations – including the Mountain Laurel complex currently in development – that we believe can provide a real and sustainable competitive advantage over time," Leer said. "In addition, the sale of these assets has transformed our balance sheet and created a strong foundation for continued growth in the future."

The book liabilities and unrecognized actuarial losses associated with these operations included approximately $455.2 million of post-retiree healthcare, $17.1 million of workers' compensation, and $32.9 million of reclamation obligations. In 2005, Arch accrued costs of approximately $68.3 million associated with these various liabilities.

Arch also settled a longstanding legal dispute in Central Appalachia deemed necessary for the completion of the Magnum transaction, resulting in a charge of $16.0 million during the quarter.

Further Strengthening Black Thunder's Outlook

During the fourth quarter, Arch completed a reserve swap with Peabody Energy that is expected to enable a more efficient future mine plan for Black Thunder, the world's largest coal mine. In addition, Arch sold to Peabody a rail spur, rail loadout and idle office complex for a purchase price of $84.6 million, resulting in a $46.5 million pre-tax gain for the quarter.

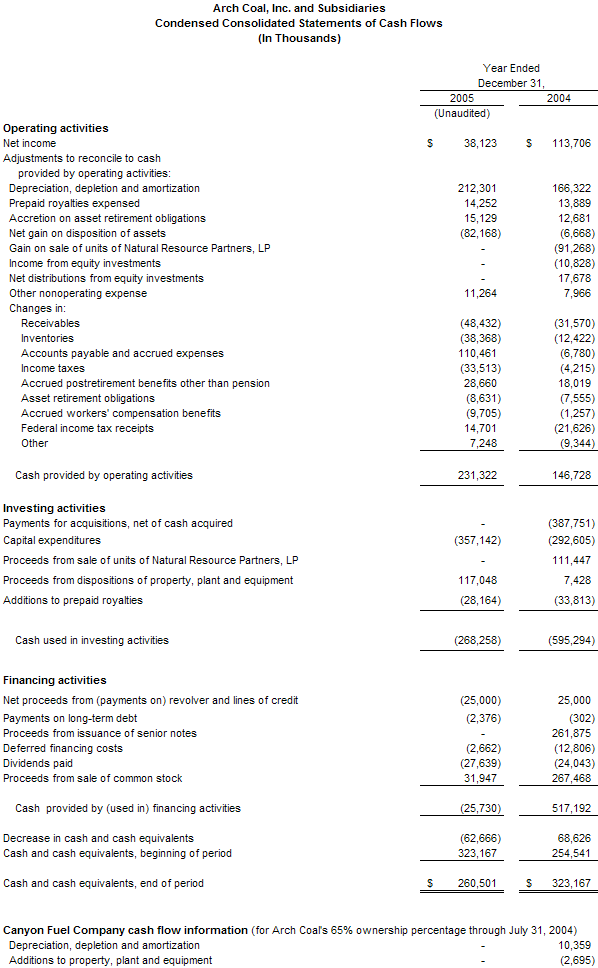

Arch plans to use a portion of the proceeds to build a new rail spur and state-of-the-art loadout facility in closer proximity to Black Thunder's principal reserve base. The construction of this new facility will enable Arch to forego approximately $35 million of other planned capital expenditures over the next three years. The revision to the Black Thunder mine plan resulting from the reserve swap also reduces Arch's reclamation liabilities.

Arch has signed a lease for the exclusive use of the rail and loadout facilities through September 30, 2008, by which time Arch expects to have completed construction on the new loadout.

Re-opening Coal Creek

Arch is announcing today that it plans to re-open its Coal Creek mine, which was idled in mid-2000 in response to market conditions at the time. Coal Creek represents the only idle mine located on the joint line rail system in the Powder River Basin.

The coal-handling infrastructure – including the rail spur and loadout – is already in place. Arch also is in the process of upgrading and re-erecting an idle dragline that it moved to the site from its former southern Wyoming operations. In total, Arch expects to invest approximately $50 million to re-open Coal Creek.

"We view Coal Creek as one of the most strategic expansion opportunities in the entire U.S. coal industry," said John W. Eaves, Arch's executive vice president and chief operating officer. "Demand for Powder River Basin coal is outstripping the industry's ability to produce it. Because the coal-handling infrastructure and some of the mobile equipment are already in place, we will be able to ramp up Coal Creek quickly with a relatively modest level of capital investment."

Arch is targeting annualized production of approximately 15 million tons at Coal Creek, with the capability to add another three to five million tons of production at low cost if and when market conditions warrant. The company plans to begin shipping from Coal Creek in the third quarter of 2006, and to ramp up to targeted production levels by the beginning of 2007.

Because the Coal Creek mine has operated only sparingly since its initial development in 1982, mining conditions at the site are expected to be very favorable. Arch recently secured the necessary permit to boost the mine's output to 25 million tons annually, if and when market conditions warrant.

Included in Arch's existing portfolio of PRB sales contracts are certain agreements with flexible sourcing provisions. Arch may opt to satisfy some or all of those contracts with Coal Creek coal, thus freeing up Black Thunder coal for future sales.

Continuing Progress at West Elk

Arch continues to make good progress in its efforts to return the West Elk mine to normal operations. West Elk was idled in late October following the detection of combustion-related gases there. The mined-out area where the elevated readings were detected has been permanently sealed. One continuous miner system resumed production at the end of January, and the second is scheduled to restart in the next few days. The longwall mining system is expected to resume production around March 1. Arch estimates that the idling and suppression-related efforts had an adverse impact of $33.3 million on the company's fourth quarter results.

Arch has property and business interruption insurance and has filed its initial claim under those policies for the costs incurred during 2005 as a result of the combustion-related event.

Regional Analysis and Other Data

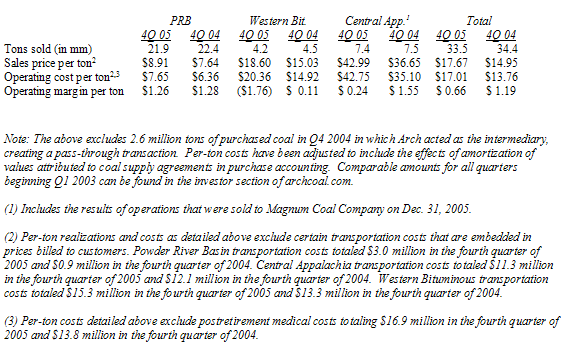

Average per-ton realizations increased by 17% in the Powder River Basin, 24% in the Western Bituminous Region, and 17% in Central Appalachia when compared to the fourth quarter of 2004, as a percentage of Arch's existing sales contracts expired and were repriced in an improved market environment.

Production and sales volumes were adversely affected by rail disruptions in the Powder River Basin and the extended outage at the West Elk mine. Coupled with higher sales-sensitive costs in both regions, these reduced volumes led to higher per-ton operating costs in both Western regions. The estimated impact of the events at West Elk raised average costs in the Western Bituminous Region by approximately $5.00 per ton during the quarter. Poor rail service reduced shipments at Black Thunder by an estimated two million to three million tons.

In Central Appalachia, per-ton operating costs were adversely affected by higher commodity prices, increased contract labor costs and reduced production volumes, as well as higher sales-sensitive costs. Arch expects operating margins to improve significantly in this region in 2006, due in part to the sale of select subsidiaries in the region. During the fourth quarter, the divested subsidiaries had a negative margin – including post-retiree medical costs – of between $2 and $3 per ton. Arch expects its remaining Central Appalachian operations to have a positive average operating margin of between $3 and $5 per ton for full year 2006.

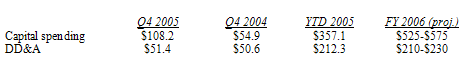

Capital Spending and DD&A (in millions):

Arch expects capital expenditures to total between $525 million and $575 million in 2006. That range includes the second of five equal payments of $122.2 million on the Little Thunder federal reserve lease; an estimated $120 million associated with the development of the Mountain Laurel mining complex in southern West Virginia; an estimated $50 million related to the re-opening of the Coal Creek mine; and approximately $15 million to complete development of the North Lease longwall mine at the Skyline complex in Utah, which is scheduled to ramp up to full production in mid-2006. Maintenance capital and productivity enhancement initiatives are expected to total between $225 million and $275 million.

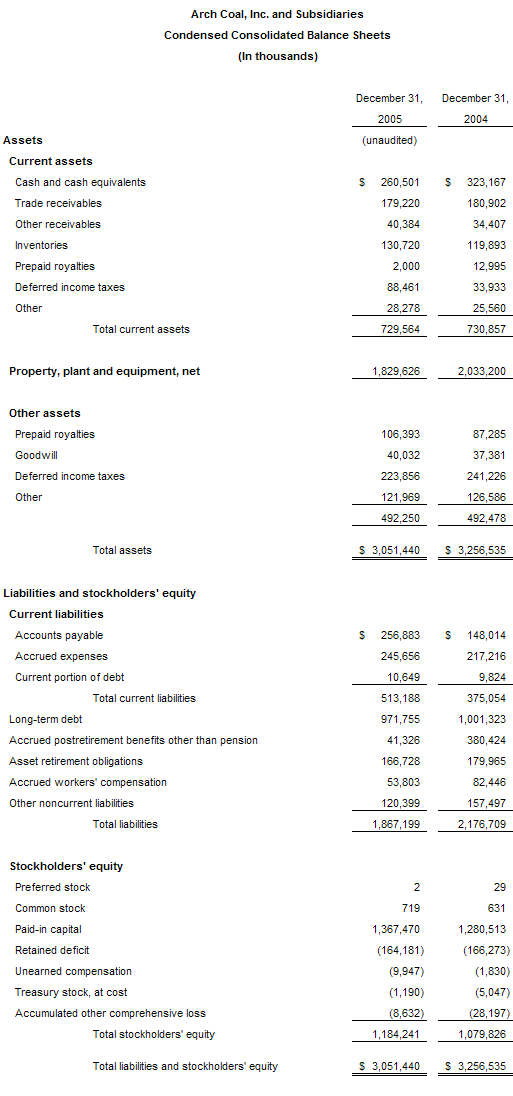

Transforming Our Balance Sheet

Arch ended the year in arguably the strongest financial condition in its history. At December 31, 2005, Arch's legacy liabilities – which the company defines as postretirement medical, workers' compensation and reclamation – stood at $285.5 million, compared to $704.9 million at December 31, 2004. Of the total remaining, approximately $177.4 million is related to reclamation.

"We believe that Arch's strong balance sheet differentiates us from nearly every other coal company and provides us with a powerful competitive advantage," said Robert J. Messey, Arch's senior vice president and chief financial officer.

Arch ended the year with a total debt to total capitalization ratio of approximately 45% – nearly 40 points lower than at the same time five years ago – and a net debt to total capitalization ratio of approximately 38%. "We view our current balance between debt and equity as very healthy," Messey said. "We are making good use of low-cost debt, while maintaining the financial flexibility we need to act opportunistically."

Streamlining Our Capital Structure

On December 31, 2005, Arch completed an offer that resulted in the conversion of approximately 95% of the company's preferred stock into common shares. In connection with the conversion, the company paid a special dividend of $9.5 million to preferred stockholders in order to induce conversion. (Arch estimates that the premium was less than the net present value of the remaining preferred share dividends to be paid through the no-call date.) Following the completion of the offer, Arch had 71.5 million common shares outstanding.

"By inducing the conversion of nearly all of our preferred stock, we have reduced our fixed dividend obligations, strengthened our credit standing, and paved the way for greater clarity in our financial statements," Messey said.

Continuing Strength in U.S. Coal Market

Economic expansion and the high cost of competing fuels translated into strong coal demand throughout 2005. Arch estimates that coal-fueled electric generation increased 2.5% for the year. Meanwhile, coal production struggled to keep pace, with consumption outstripping supply for the third consecutive year, according to Arch estimates.

Arch estimates that utility coal stockpiles ended 2005 at their lowest year-end levels in decades at approximately 33 days of supply, or 37% below the 15-year average. Arch believes that stockpile levels are particularly low in the Midwest, where advantageous coal fuel costs have boosted wholesale power sales and rail disruptions have constrained coal deliveries.

"We believe that robust coal demand and continuing supply constraints will result in a multi-year effort to restore utility stockpiles to targeted levels, particularly in those Midwestern markets traditionally served by Powder River Basin coal producers," Eaves said.

In addition to increasing utilization at existing coal-fired power plants, U.S. power generators are moving forward with plans to build new coal plants. Already announced projects would boost the installed coal-fired base by approximately 80 gigawatts, or 25%, over the course of the next two decades, and could increase coal demand by as much as 300 million tons annually. In addition, investment is beginning to flow into projects seeking to convert coal into transportation fuels and synthetic natural gas.

Recent Contracting Activity

Over the next three years, most of Arch's sales contracts are scheduled to expire. Based on current market conditions, the company believes that the expiration of these contracts – coupled with the company's internal growth initiatives – will drive significant increases in revenues, operating margins, earnings and cash flow.

Arch continues to take a balanced approach to its marketing efforts, layering in new sales contract agreements while maintaining a significant unpriced position for future periods. Based on expected production over the next three years, Arch has unpriced volumes estimated at 20 million to 25 million tons in 2006; 60 million to 70 million tons in 2007; and 90 million to 100 million tons in 2008.

Looking Ahead

"Arch finished work on a long list of key objectives during the fourth quarter of 2005," Leer said. "In the span of just three months, we succeeded in sharpening our operating focus, transforming our balance sheet, enhancing our competitive position, streamlining our capital structure and reducing our future cash requirements. We expect these accomplishments to deliver significant new value for our shareholders in 2006 and beyond."

Arch currently expects to report earnings of between $3.50 and $4.25 per fully diluted share, and adjusted EBITDA of between $550 million and $610 million, for its full year ended December 31, 2006, excluding insurance recoveries associated with recent events at West Elk. Rail service and prevailing market conditions are expected to be key factors in determining Arch's actual performance within that range. The range above assumes a negative impact of $25 million at West Elk during the first quarter as the company prepares for the March 1 restart of the longwall.

A conference call concerning fourth quarter earnings will be webcast live today at 11 a.m. EST. The conference call can be accessed via the "investor" section of the Arch Coal Web site (www.archcoal.com).

Arch Coal is the nation's second largest coal producer, with subsidiary operations in Wyoming, Colorado, Utah, West Virginia, Kentucky and Virginia. Through these operations, Arch provides the fuel for approximately 6% of the electricity generated in the United States.

Forward-Looking Statements: This press release contains "forward-looking statements" – that is, statements related to future, not past, events. In this context, forward-looking statements often address our expected future business and financial performance, and often contain words such as "expects," "anticipates," "intends," "plans," "believes," "seeks," or "will." Forward-looking statements by their nature address matters that are, to different degrees, uncertain. For us, particular uncertainties arise from changes in the demand for our coal by the domestic electric generation industry; from legislation and regulations relating to the Clean Air Act and other environmental initiatives; from operational, geological, permit, labor and weather-related factors; from fluctuations in the amount of cash we generate from operations; from future integration of acquired businesses; and from numerous other matters of national, regional and global scale, including those of a political, economic, business, competitive or regulatory nature. These uncertainties may cause our actual future results to be materially different than those expressed in our forward-looking statements. We do not undertake to update our forward-looking statements, whether as a result of new information, future events or otherwise, except as may be required by law.