Arch Coal, Inc. Reports First Quarter 2007 Results

Arch Coal records solid performance despite weak market conditions

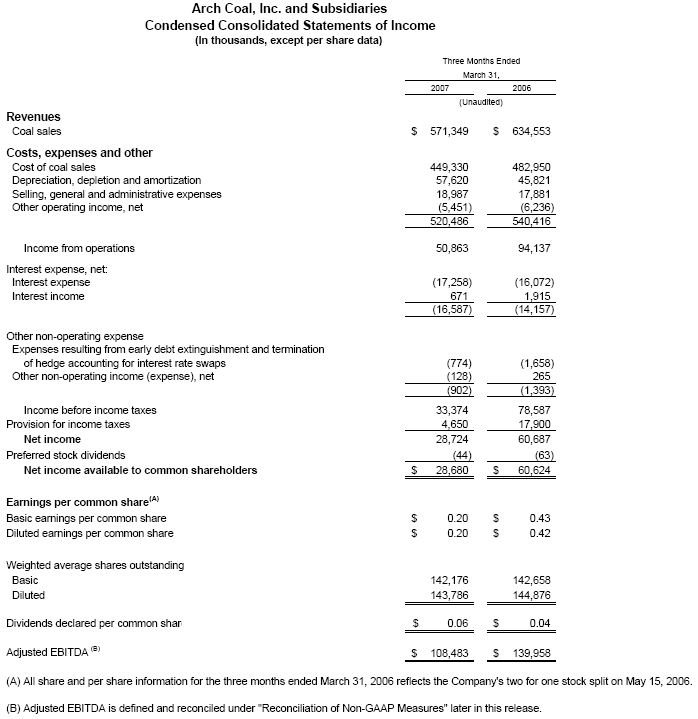

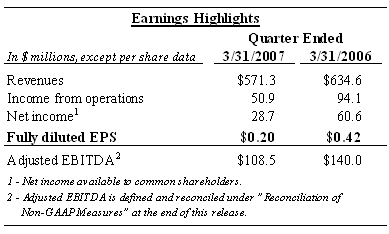

St. Louis - Arch Coal, In c. (NYSE:ACI) today reported first quarter 2007 net income available to common shareholders of $28.7 million, or $0.20 per fully diluted share, compared with $60.6 million, or $0.42 per fully diluted share, in the prior-year period. The company earned income from operations of $50.9 million on revenues of $571.3 million in the first quarter of 2007. In the first quarter of 2006, Arch recorded income from operations of $94.1 million on revenues of $634.6 million.

"Arch Coal achieved solid operating results during the first quarter of 2007 despite current soft conditions in U.S. coal markets," said Steven F. Leer, Arch's chairman and chief executive officer. "We benefited from good performances by our mines and higher average price realizations in our Western operating regions compared with the fourth quarter of 2006, and we expect to build on these results as the year progresses, particularly during the year's second half."

"Market conditions were considerably less favorable in the first quarter of 2007 than in the year-ago period, prompting Arch to reduce production volume targets at the end of last year," added Leer. "Despite these conditions, we are pleased with our operating results. Moreover, we believe Arch is particularly well-positioned to capitalize on improving market fundamentals."

Arch Achieves a Solid Performance in all Operating Regions

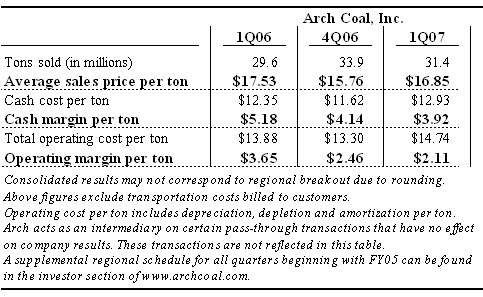

Consolidated average price realization per ton improved $1.09 in the first quarter of 2007 compared with the fourth quarter of 2006, while operating cost per ton increased $1.44 over the same time period. Higher operating cost per ton resulted from Arch's strategic decision to reduce production volume targets, weather-related shipment challenges during the quarter just ended, and higher depreciation, depletion and amortization expense. In the first quarter of 2007, Arch earned operating margin per ton of $2.11 compared with $2.46 in the prior-quarter period.

When compared with the first quarter of 2006, average price realization per ton declined $0.68 reflecting weaker conditions in U.S. coal markets from the year-ago period. Operating cost per ton increased $0.86, resulting in margin contraction from the year-ago period.

"During the quarter, we were able to overcome weak market conditions and weather-related challenges, while still continuing to create value for our shareholders," said John W. Eaves, Arch's president and chief operating officer. "Going forward, we will remain focused on controlling costs and improving profitability under any market condition."

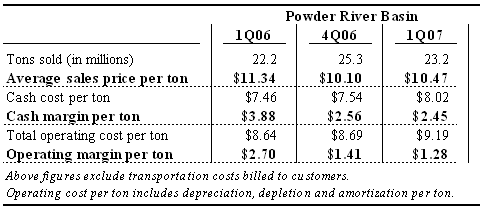

In the Powder River Basin, average price realization per ton increased $0.37 in the first quarter of 2007 compared with the fourth quarter of 2006, benefiting from stronger contract pricing. This per-ton price realization increase includes the effect of a larger mix of lower-priced Coal Creek tonnage compared with the prior-quarter period. Operating cost per ton increased $0.50 over this same time period due to planned lower volume targets, higher sales-sensitive costs, weather-related shipment challenges and an unplanned belt outage at Arch's Black Thunder operations in January 2007. As a result, this region's operating margin per ton declined to $1.28 in the first quarter of 2007 compared with $1.41 in the prior-quarter period.

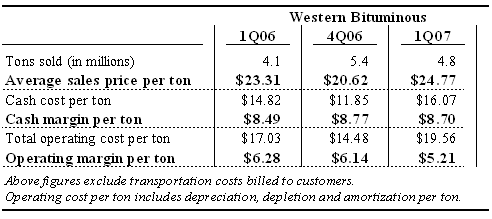

In the Western Bituminous region, average realized price per ton increased 20 percent in the first quarter of 2007 compared with the fourth quarter of 2006, benefiting from the roll-off of lower-priced legacy sales contracts. Operating costs per ton increased over the same time period, principally due to planned lower volume targets, higher sales-sensitive costs as well as startup costs and higher depreciation expense associated with the installation of a new, state-of-the-art replacement longwall at Arch's Sufco mine in Utah. Additionally, in the fourth quarter of 2006, operating costs benefited from a $2.20 per ton insurance recovery related to the West Elk combustion event that occurred during the fourth quarter of 2005.

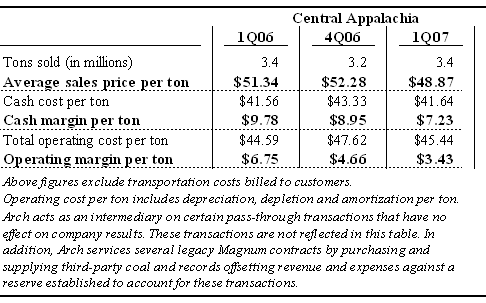

In the Central Appalachian region, average realized price per ton declined $3.41 in the first quarter of 2007 compared with the fourth quarter of 2006, principally due to lower market-based pricing on uncommitted and indexed tons as well as lower volumes of metallurgical coal sales compared with the fourth quarter of 2006. Operating costs per ton declined $2.18 over the same time period, benefiting from strong operating performances by Arch's mines as well as optimization strategies on brokered tons in the current weak market environment.

Arch Believes U.S. Coal Market Fundamentals Are Improving

Arch believes market fundamentals are improving in 2007 as the peak summer demand period approaches.

- Electric generation demand was up 4.6 percent year-to-date through the second week in April, according to the Edison Electric Institute. Additionally, electric output has been more robust in geographic regions that traditionally rely more heavily on coal-fueled generation.

- Coal production has declined 1.8 percent year-to-date through April 14, according to government estimates. Eastern coal production - specifically Central Appalachia - has declined 10.8 percent, while Western coal production has increased 2.2 percent. On a true energy-equivalent basis - specifically, production based on Btus rather than tons - total U.S. coal production would be down 2.4 percent.

- A recent court decision in Central Appalachia threatens to further slow the issuance of mining permits, which could accelerate production rationalization in the region. Even before the recent court decision, production in the region was down an estimated 10.8 percent year-to-date, according to the Energy Information Administration, due to reserve depletion, increasing cost pressures and the pull-back in coal prices.

- Global coal prices continue to strengthen due to robust growth in worldwide coal demand, particularly in China, which could become a net importer of coal for the first time ever this year. International coal supply also is expected to tighten in response to infrastructure and transportation challenges at some international ports. As a result, Arch estimates that growth in imported coal into the U.S. may slow meaningfully in 2007, further tightening U.S. coal supply.

Over the longer-term, Arch maintains a bullish outlook on coal markets. The company estimates that nearly 11 gigawatts of new coal-fueled electric generating capacity are currently under construction in the U.S., representing more than 40 million tons of incremental annual coal demand to be phased in over the next five years. Another 10 gigawatts are believed to be in advanced stages of development, translating into approximately 34 million tons of incremental annual coal demand over the same time frame. Between 1997 and 2006, power generators constructed only 4 gigawatts of new coal-fueled capacity.

"The construction of a new generation of coal-fueled power plants represents a transformation of our marketplace," said Leer. "We expect generators to continue to enter into contract discussions for their current and future fuel needs, with such activity increasing steadily as these new plants progress towards their start-up dates."

Additionally, prevailing prices of alternative fuels such as crude oil and natural gas establish a compelling reference price for coal-based energy. Moreover, Congressional support for enhancing domestic energy security is growing, spurring interest in coal-to-liquids and coal-to-gas technologies. The advancement of coal-conversion technologies represents a meaningful positive long-term development for the coal industry.

Arch's Sales Contract Portfolio Remains Relatively Unchanged

Arch continues to take a selective and patient approach to sales contracting in the current market environment. "We expect growth in coal demand and continuing supply pressures in the Appalachian coalfields to exert upward pressure on coal prices in the foreseeable future," Eaves said. "While we continue to evaluate new contract opportunities, we believe our unpriced position is highly advantageous."

Since the last update, Arch has signed selective coal commitments of approximately 5 million tons for 2008 delivery at average prices that significantly exceeded the company's average realized pricing for the first quarter of 2007 in the respective basins in which the coal was committed. At present, Arch has approximately 10 million to 15 million tons of 2007 expected production that has yet to be priced. Additionally, Arch has unpriced volumes of between 70 million and 80 million tons in 2008 and between 110 million and 120 million tons in 2009.

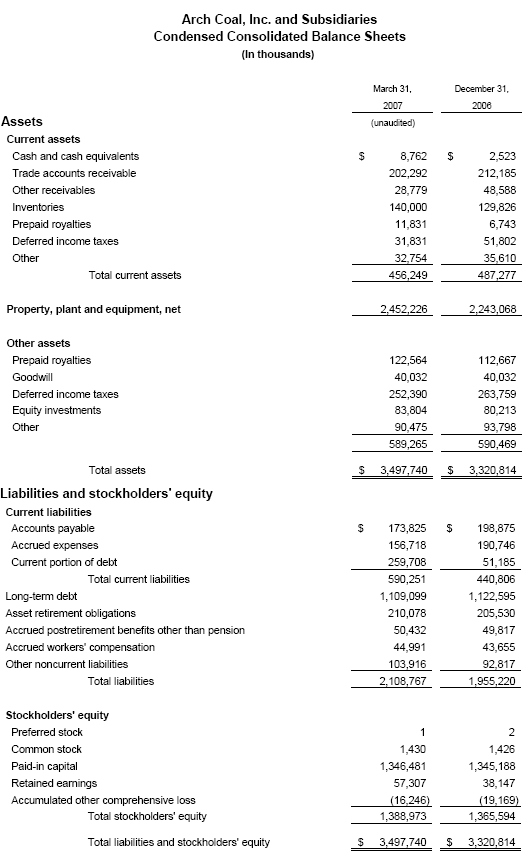

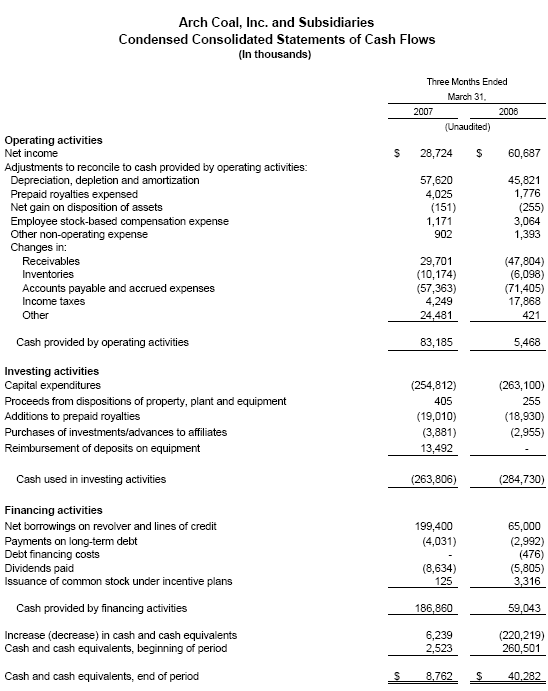

Capital Spending Remains at Reduced Levels

Arch typically invests a relatively high percentage of its total capital budget during the first quarter, and that was again the case in 2007. During the first quarter of 2007, Arch recorded spending on equipment, infrastructure and development of approximately $80 million. Of the $80 million, approximately $32 million relates to the continued development of the Mountain Laurel complex in Central Appalachia and approximately $20 million represents payments for the new longwall at Arch's Sufco mine in Utah. In addition, Arch recorded spending on reserve additions of approximately $175 million in the quarter just ended.

For full year 2007, Arch continues to target total capital spending within the previous guidance range of $240 million to $280 million, which is exclusive of reserve additions. "Despite a robust long-term outlook for U.S. coal markets, Arch continues to target lower capital spending levels that match our reduced planned production levels in this current soft market environment," said Eaves.

Arch Anticipates Continued Progress in 2007

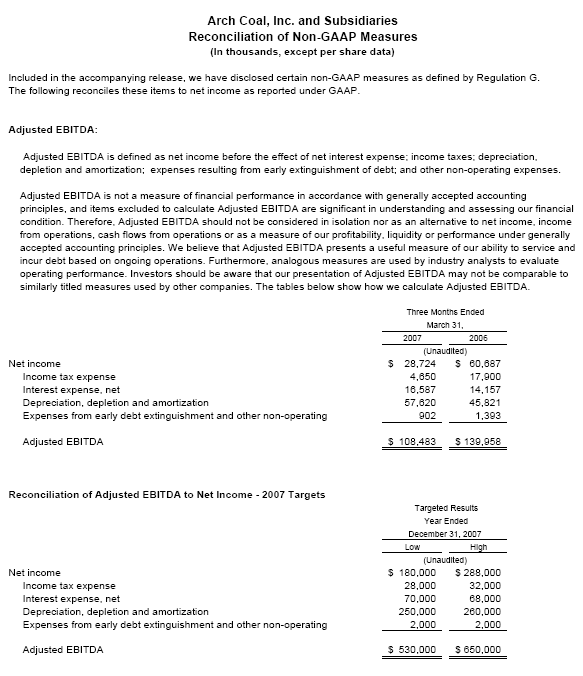

Arch affirms its guidance for 2007, with fully diluted earnings per share projected to be within the range of $1.25 to $2.00, while adjusted EBITDA is expected to be in the $530 million to $650 million range. Total sales volume is expected to be between 130 million to 135 million tons, excluding 2 million pass-through tons that Arch currently services from the 2005 sale of select Central Appalachian operations. Arch's actual results will be significantly influenced by market developments over the course of the year, the company's final production levels in 2007, and the pricing Arch achieves on its remaining unpriced tons. As previously indicated, Arch expects the second half of the year to be substantially stronger than the first half.

"We believe that an inflection point may have been reached recently in U.S. coal markets," said Leer. "The return of more normal weather spurred increased coal consumption during the first three months of the year. Additionally, coal production declines in the East, especially Central Appalachia, along with greater permitting uncertainty in that region should lead to further reductions in power generator stockpiles and a more balanced supply and demand position for 2007 and thereafter."

"As such, Arch is sharply focused on managing the business to create long-term value for shareholders," said Leer. "We are committed to making the right decisions in 2007 in order to retain upside potential in the years ahead. Arch's strategy is driven by our strong belief in the long-term fundamentals of U.S. coal markets. The significant level of investment in new coal-fueled generator capacity represents a key avenue for demand growth going forward. Additionally, policies that favor the adoption of coal-conversion technologies to promote America's energy security are gaining traction."

"Going forward, we expect Arch's size, diversified asset portfolio, talented workforce and low-cost operations to enable us to capitalize in a meaningful way on these future growth opportunities," added Leer.

"In fact, coal has been the fastest growing fuel in the world over the past four years, having increased by an estimated 23 percent," continued Leer. "Coal is the most affordable and abundant resource available to meet increased global energy needs. Moreover, we are seeing continuing advances in technologies that promise to make coal a near-zero-emission fuel source in the years ahead. While such technologies won't emerge overnight, we believe these new technologies can help America meet its goal of a secure and clean energy future."

A conference call regarding Arch Coal's first quarter 2007 financial results will be webcast live today at 11 a.m. E.D.T. The conference call can be accessed via the "investor" section of the Arch Coal Web site (www.archcoal.com).

St. Louis-based Arch Coal is one of the nation's largest coal producers. The company's core business is providing U.S. power generators with clean-burning, low-sulfur coal for electric generation. Through its national network of mines, Arch supplies the fuel for approximately 6 percent of the electricity generated in the United States.

Forward-Looking Statements: This press release contains "forward-looking statements" - that is, statements related to future, not past, events. In this context, forward-looking statements often address our expected future business and financial performance, and often contain words such as "expects," "anticipates," "intends," "plans," "believes," "seeks," or "will." Forward-looking statements by their nature address matters that are, to different degrees, uncertain. For us, particular uncertainties arise from changes in the demand for our coal by the domestic electric generation industry; from legislation and regulations relating to the Clean Air Act and other environmental initiatives; from operational, geological, permit, labor and weather-related factors; from fluctuations in the amount of cash we generate from operations; from future integration of acquired businesses; and from numerous other matters of national, regional and global scale, including those of a political, economic, business, competitive or regulatory nature. These uncertainties may cause our actual future results to be materially different than those expressed in our forward-looking statements. We do not undertake to update our forward-looking statements, whether as a result of new information, future events or otherwise, except as may be required by law. For a description of some of the risks and uncertainties that may affect our future results, you should see the risk factors described from time to time in the reports we file with the Securities and Exchange Commission.