Arch Coal, Inc. Reports Second Quarter 2007 Results

Arch Coal achieves a solid performance in soft U.S. coal market

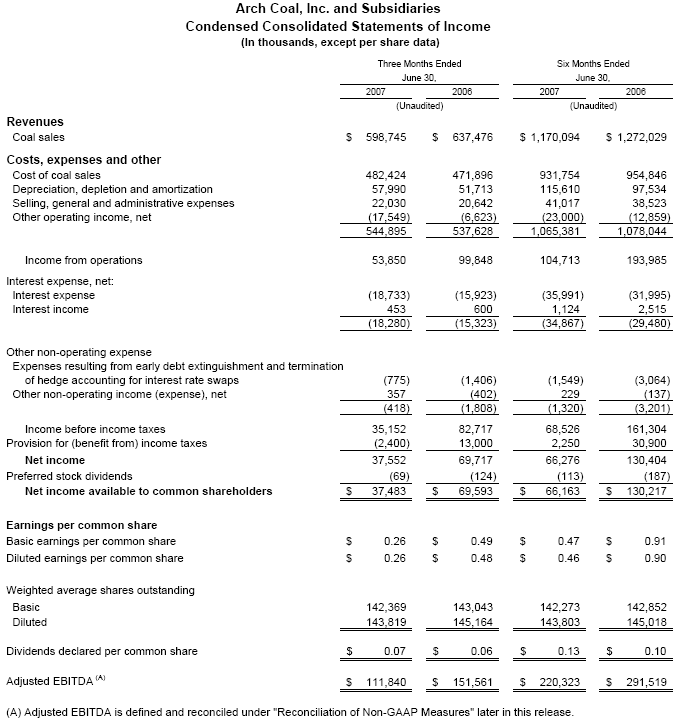

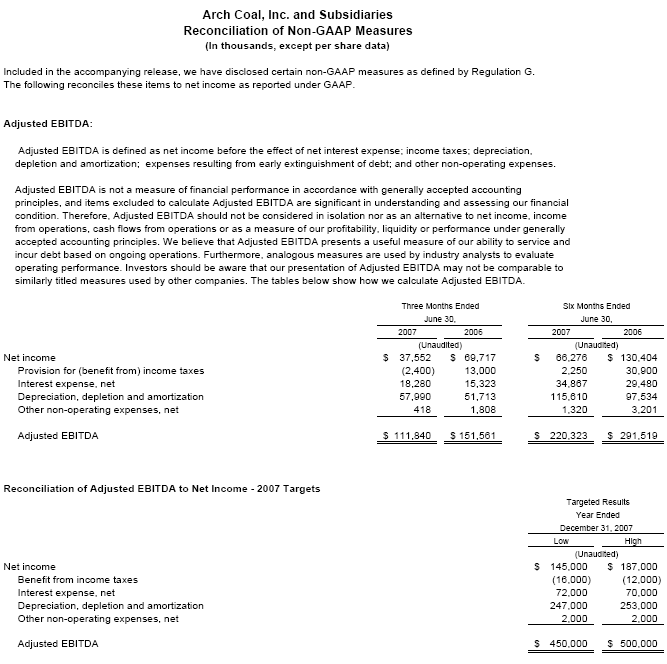

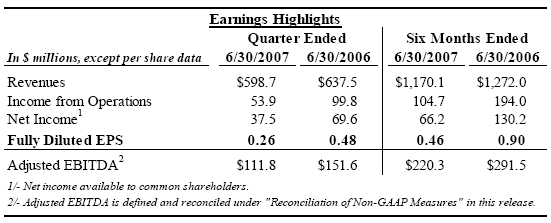

St. Louis (July 23, 2007) -- Arch Coal, Inc. (NYSE:ACI) today reported second quarter 2007 net income available to common shareholders of $37.5 million, or $0.26 per fully diluted share, compared with $69.6 million, or $0.48 per fully diluted share, in the prior-year period. Arch earned operating income of $53.9 million on revenues of $598.7 million in the second quarter of 2007, compared with operating income of $99.8 million on revenues of $637.5 million in the prior-year period.

During the first half of 2007, Arch earned net income available to common shareholders of $66.2 million and adjusted EBITDA of $220.3 million. In the first half of 2006, when market conditions were considerably stronger, the company reported net income available to common shareholders of $130.2 million and adjusted EBITDA of $291.5 million.

"Arch Coal delivered solid operating results in the second quarter of 2007, especially considering the softness experienced in U.S. coal markets," said Steven F. Leer, Arch's chairman and chief executive officer. "While conditions were less favorable than during the year-ago period, U.S. coal markets began to strengthen in the second quarter. We believe coal markets are likely to continue to improve as the year progresses, as evidenced by many positive catalysts that suggest a better supply and demand balance in domestic coal markets by year-end."

"Arch is particularly well-positioned to capitalize on improving market fundamentals during the second half of this year and beyond," continued Leer. "Arch will continue to execute a market-driven strategy in an effort to match our production and capital spending programs with market demand. We believe this focused strategy will result in superior shareholder returns over the long-term."

Arch Achieves a Solid Operating Performance in Weak U.S. Coal Market

"Our operational performance during the second quarter of 2007 reflects higher unit costs associated with planned volume reductions, as well as the impact of three longwall moves at our Western Bituminous mines," said John W. Eaves, Arch's president and chief operating officer. "Despite these challenges, our operations performed well as we continued to focus on maintaining production flexibility at our mines. Going forward, we expect an even stronger operational performance during the second half of 2007 coupled with improving market conditions."

During the quarter just ended, Arch divested its Mingo Logan Ben Creek complex for approximately $43 million inclusive of working capital. Arch recorded an $8.1 million pre-tax gain on the transaction in the second quarter of 2007, which includes the recognition of losses on several below-market sales contracts retained in the transaction that Arch will continue to service and which the company is no longer able to source from existing operations.

"The Mingo Logan transaction was specifically timed to coincide with the depletion of the longwall reserves at this operation," said Eaves. "The divestiture of this once core asset also effectively offset higher mine operating costs associated with challenging conditions faced in the final longwall panel and the wind-down costs of the longwall operation during the quarter."

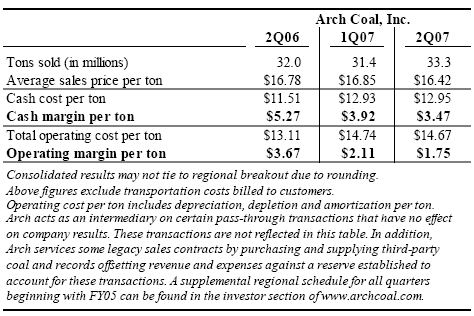

Consolidated average sales price per ton declined $0.43 in the second quarter of 2007 when compared with the first quarter, reflecting lower average price realization in Arch's Western Bituminous and Central Appalachian operating regions. Additionally, tons sold in the second quarter of 2007 reflect a higher percentage of Powder River Basin volume compared with the prior-quarter period. Consolidated operating cost per ton declined slightly in the second quarter of 2007 compared with the first quarter of 2007. As a result, Arch earned $1.75 per ton in operating margin in the second quarter of 2007 compared with $2.11 per ton in the prior-quarter period.

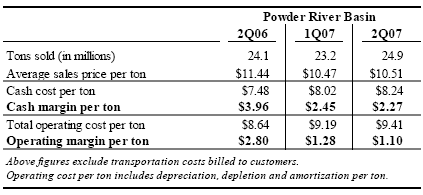

In the Powder River Basin, average sales price per ton increased modestly in the second quarter of 2007 when compared with the first quarter, while operating cost per ton increased $0.22, primarily due to planned dragline maintenance and repair activity, as well as higher costs associated with diesel fuel and large tires. As a result, Arch's Powder River Basin operations contributed $1.10 per ton in operating margin in the second quarter of 2007 compared with $1.28 per ton in the prior-quarter period.

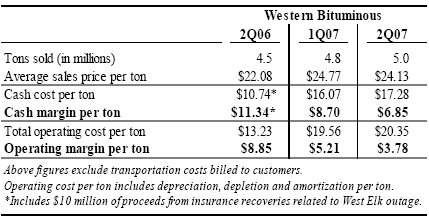

In the Western Bituminous region, average sales price per ton declined $0.64 in the second quarter of 2007 when compared with the first quarter, reflecting a less favorable mix of customer shipments. Operating costs per ton increased $0.79 over the same time period, mainly reflecting higher costs associated with reduced production volumes stemming from three longwall moves. During the second quarter of 2007, Arch reduced Western Bituminous coal inventory to meet customer obligations given the lost production from the longwall moves. During the second half of 2007, Arch currently anticipates one longwall move in the Western Bituminous region compared with four longwall moves that occurred in the region during the first half of the year.

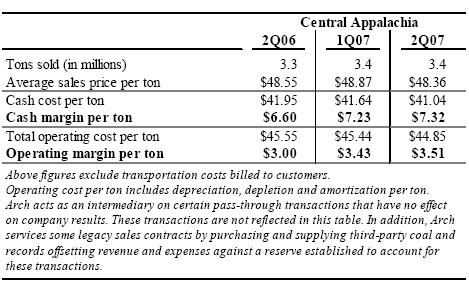

In the Central Appalachian region, average sales price per ton declined $0.51 in the second quarter of 2007 when compared with the first quarter as a result of lower metallurgical coal sales in the quarter just ended. Operating costs per ton declined $0.59 over the same time period, benefiting from strong performances at several of Arch's operations in the region, as well as increased brokerage activity, and would have declined more significantly if not for the higher costs associated with the final quarter of longwall production at Mingo Logan.

Arch Celebrates Key Awards, Safety Performance and Milestone

Arch's focus on three key pillars of performance - safety, environmental stewardship and productivity - was recognized with several awards earned to date in 2007. Notably, Arch's Skyline and Sufco mines both earned Utah Earth Day awards for outstanding efforts in environmental stewardship. Arch's Mountain Laurel operation earned two West Virginia State Council awards for mine safety, as well as the American Coal Council's Excellence Award for corporate citizenship.

Additionally, the company's total incident rate was more than 20 percent better in the first half of 2007 compared with its 2006 performance, which was one of Arch's best years on record for safety. "While there is always room for improvement," said Eaves, "we're pleased that Arch's lost-time safety rate is 62 percent better than the national average according to available 2007 MSHA data."

On July 1, Arch celebrated its 10-year anniversary as a public company. During the past 10 years, the company has strategically expanded its position in clean-burning, low-sulfur coal regions and today contributes roughly 11 percent of annual U.S. coal supply. "Arch Coal has become a leader in the U.S. coal industry over the past 10 years," said Leer. "We set a high standard from the beginning and we remain committed to demonstrating responsible and progressive leadership in the coal industry."

Arch Believes U.S. Coal Markets Are Poised to Strengthen in 2007

Arch believes market fundamentals in 2007 continue to improve. Electric generation demand increased 2.7 percent year-to-date through the second week of July, according to the Edison Electric Institute, while coal production declined 2.6 percent year-to-date, according to government estimates. Coal production was down in both the eastern and western U.S., with Central Appalachia declining by more than 5.0 percent and the Powder River Basin declining by close to 1.0 percent, based on the latest available Energy Information Administration statistics. Additionally, continued regulatory challenges in Central Appalachia threaten to further reduce production in that region.

Global coal prices continue to strengthen due to robust growth in worldwide coal demand, particularly in developing Asian nations. International coal supply also has tightened in response to infrastructure and transportation challenges at some international ports. As a result, Arch estimates that growth in U.S. coal imports will slow while U.S. coal exports may increase meaningfully in 2007. These trends are likely to further tighten the U.S. coal supply and demand balance during the second half of 2007.

Conversely, generator coal stockpiles were estimated to be approximately 155 million tons at the end of June 2007, representing a 52-day supply, which is above the historical five-year average according to company estimates. However, this level may be representative of higher generator stockpile targets going forward given recent transportation and supply challenges.

Over the longer-term, Arch maintains a bullish outlook on U.S. coal market fundamentals. More than 9 gigawatts of new coal-fueled electric generating capacity are currently under construction in the U.S., representing approximately 35 million tons of incremental annual coal demand to be phased in over the next four years and with a significant percentage of this demand likely to be supplied by Powder River Basin coal according to company estimates. At least one plant, representing close to 800 megawatts of generating capacity, has already come online in 2007. Additionally, another 10 gigawatts are believed to be in advanced stages of development, translating into approximately 34 million tons of incremental annual coal demand over the same time frame. Between 1997 and 2006, power generators constructed only 4 gigawatts of new coal-fueled capacity.

In fact, coal was the fastest growing fuel source in the world over the past six years according to BP's 2007 Statistical Review of World Energy. More importantly, the International Energy Agency (IEA) projects that coal will be the fastest growing fuel source on an oil-equivalent basis over the next 25 years. According to the IEA, fossil fuels are expected to remain the dominant world energy sources through 2030 and beyond. "We believe that strong demand pull and ongoing supply constraints will continue to exert upward pressure on coal prices over the long-term," said Leer.

Arch Selectively Adds to Sales Contract Portfolio

Arch continues to take a patient approach to sales contracting in the current market. "While we evaluate all new sales contract opportunities, Arch is taking a very selective approach to committing its available tonnage," said Eaves. "We continue to believe that maintaining an appropriate unpriced position is advantageous for our shareholders."

Since the last update, Arch priced selective coal commitments of close to 9 million tons annually for 2008 and 2009 delivery in the Western Bituminous region, at realizations ranging between $30 per ton and $35 per ton. Additionally, the company signed approximately 5 million tons of Powder River Basin coal for 2008 delivery at prices that significantly exceeded this region's average realized pricing - and prevailing spot pricing - for the second quarter of 2007.

At present, Arch has unpriced volumes of approximately 5 million tons for 2007 delivery; between 50 million and 60 million tons for 2008 delivery; and between 105 million and 115 million tons for 2009 delivery.

Arch Reduces Outstanding Debt in Second Quarter

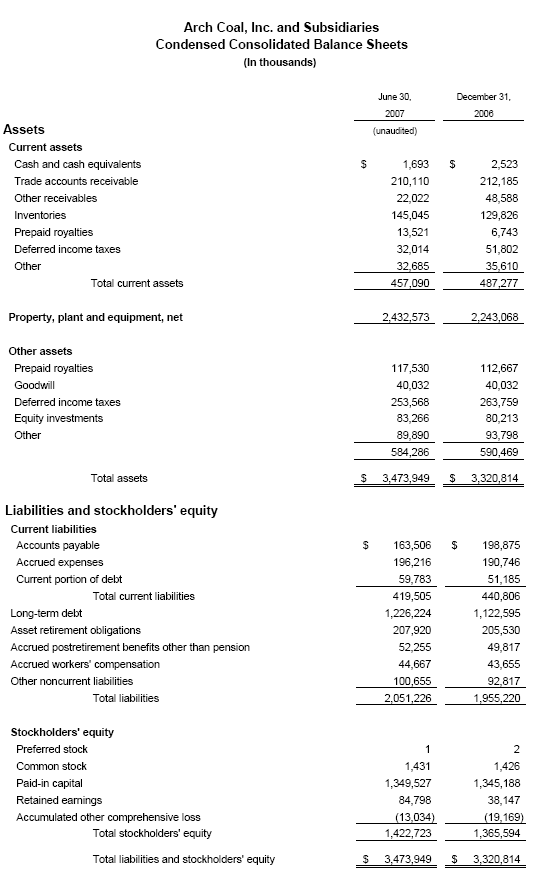

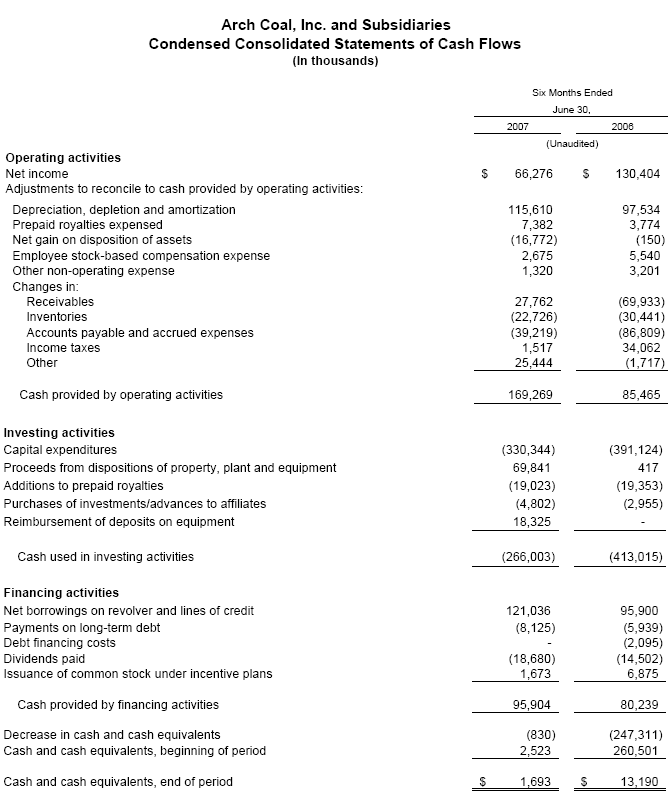

During the second quarter of 2007, Arch reduced its outstanding debt balance by $83 million. Total debt outstanding represented $1.3 billion as of June 30, 2007, while the company's debt-to-total-capital ratio declined from approximately 50 percent at the end of the first quarter to approximately 47 percent at the end of the second quarter of 2007.

"We borrowed on our available revolver during the first quarter of 2007 due to the timing of our capital spending needs, which are typically weighted towards the first quarter of the year," said Senior Vice President and Chief Financial Officer Robert J. Messey. "With our positive cash flow in the quarter just ended, we reduced our debt-to-capital ratio, which is consistent with our previously stated strategy of reducing our short-term borrowings to maintain our debt balance at the levels at which we began 2007."

Arch Reduces Guidance Range for Full Year 2007

Arch's core focus continues to be a market-driven operating strategy. "More normal weather patterns, U.S. coal production declines, increased net exports, and a more stringent regulatory environment - particularly in Central Appalachia - are leading to a more balanced coal supply and demand position in 2007," said Leer. "However, power generator stockpile levels are still relatively high and pricing remains generally weak. As a result, Arch has elected to reduce production in 2007 below previously announced levels. While this reduction is expected to affect our results in 2007, we believe it is the right decision for our shareholders over the long-term."

Arch now expects total sales volume for 2007 to be between 125 million to 130 million tons, excluding 3 million pass-through tons that Arch services from the 2005 sale of select Central Appalachian operations and the retained contracts associated with the 2007 sale of its Mingo Logan operations. Accordingly, earnings per share for 2007 is projected to be within the range of $1.00 to $1.30, while adjusted EBITDA is expected to be in the $450 million to $500 million range.

Furthermore, capital spending levels are expected to range between $250 million to $270 million, exclusive of reserve additions. Depreciation, depletion and amortization expense is projected to be in the $247 million to $253 million range.

"Our company is keenly focused on managing our operations to create value for shareholders," said Leer. "We are committed to making the right decisions today in order to retain upside potential in coming years. We believe Arch's size, superior asset base, talented workforce and low-cost operations will enable us to deliver substantial shareholder value over the long-term."

"Additionally, crude oil is currently trading above $70 per barrel and the threat of increasing resource nationalism is emerging," added Leer. "These trends continue to bring the public policy debate of domestic energy security to the forefront. Coal is the most affordable and abundant resource available to meet increased global energy needs, and while near-zero coal emission technologies won't emerge overnight, we believe such technologies can help America meet its goal of a secure and clean energy future."

A conference call regarding Arch Coal's second quarter 2007 financial results will be webcast live today at 11 a.m. E.D.T. The conference call can be accessed via the "investor" section of the Arch Coal Web site (www.archcoal.com).

St. Louis-based Arch Coal is one of the nation's largest coal producers. The company's core business is providing U.S. power generators with clean-burning, low-sulfur coal for electric generation. Through its national network of mines, Arch supplies the fuel for approximately 6 percent of the electricity generated in the United States.

Forward-Looking Statements: This press release contains "forward-looking statements" - that is, statements related to future, not past, events. In this context, forward-looking statements often address our expected future business and financial performance, and often contain words such as "expects," "anticipates," "intends," "plans," "believes," "seeks," or "will." Forward-looking statements by their nature address matters that are, to different degrees, uncertain. For us, particular uncertainties arise from changes in the demand for our coal by the domestic electric generation industry; from legislation and regulations relating to the Clean Air Act and other environmental initiatives; from operational, geological, permit, labor and weather-related factors; from fluctuations in the amount of cash we generate from operations; from future integration of acquired businesses; and from numerous other matters of national, regional and global scale, including those of a political, economic, business, competitive or regulatory nature. These uncertainties may cause our actual future results to be materially different than those expressed in our forward-looking statements. We do not undertake to update our forward-looking statements, whether as a result of new information, future events or otherwise, except as may be required by law. For a description of some of the risks and uncertainties that may affect our future results, you should see the risk factors described from time to time in the reports we file with the Securities and Exchange Commission.