Arch Coal, Inc. Reports Third Quarter Results

EPS increases 169% to $0.35 from $0.13 in prior-year period

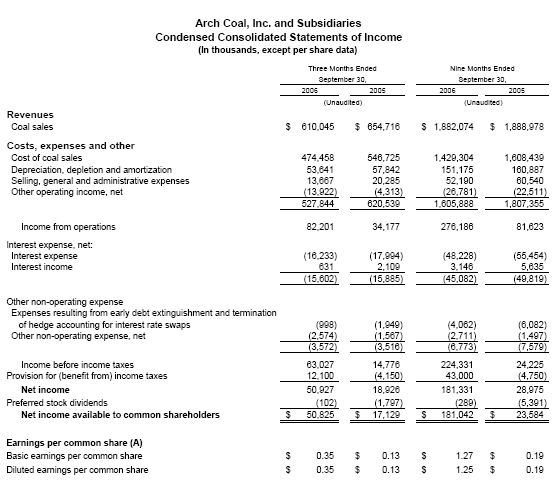

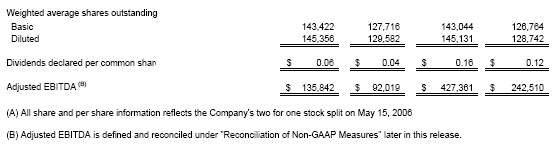

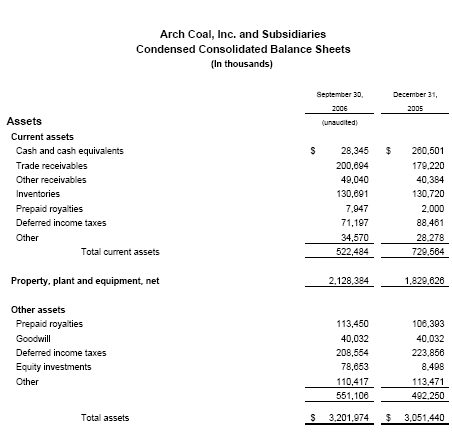

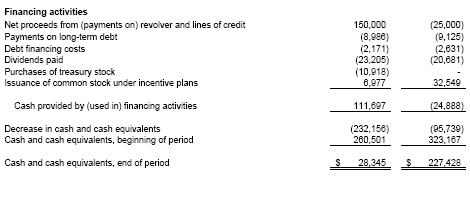

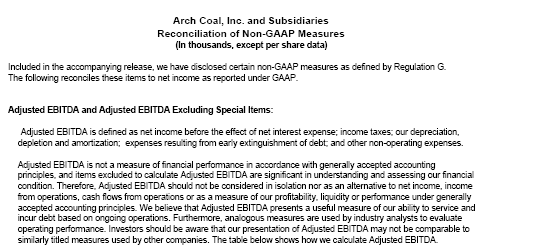

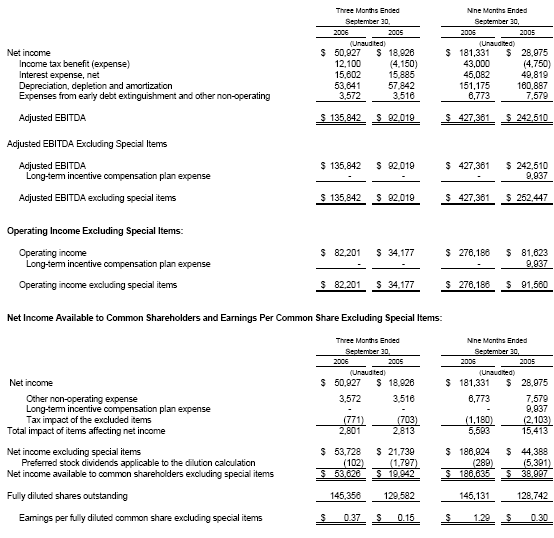

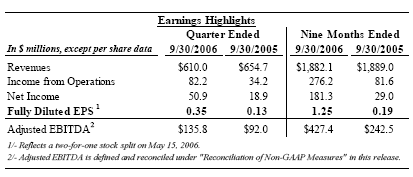

ST. LOUIS (October 20, 2006) – Arch Coal, Inc. (NYSE: ACI) today reported third quarter 2006 consolidated net income of $50.9 million, or $0.35 per fully diluted share, compared with $18.9 million, or $0.13 per fully diluted share, in the prior-year period. Arch more than doubled its income from operations during the third quarter of 2006, reaching $82.2 million compared with $34.2 million in the prior-year period. Adjusted EBITDA increased nearly 50 percent over the year-ago period, to $135.8 million from $92.0 million, while revenues declined on a year-over-year basis due to the disposition of select Central Appalachian operations at the end of 2005.

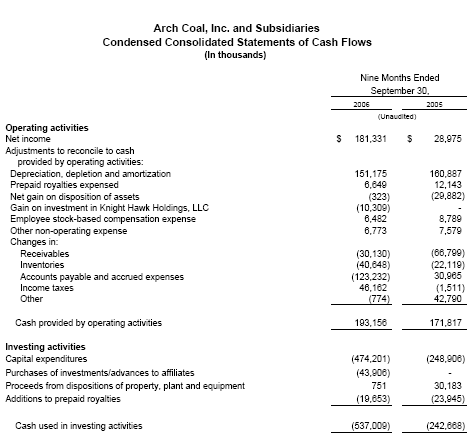

For the first nine months of 2006, Arch reported consolidated net income of $181.3 million, or $1.25 per fully diluted share, compared with $29.0 million, or $0.19 per fully diluted share, during the first nine months of 2005. Income from operations increased more than three-fold to $276.2 million, and adjusted EBITDA rose more than 75 percent to $427.4 million over the same time period.

"Despite the recent weakening in market conditions, Arch Coal achieved a solid operating performance in the third quarter of 2006 compared with the third quarter of 2005, with substantial improvement in EPS, operating income and EBITDA," said Steven F. Leer, Arch's chairman and chief executive officer. "At the same time, we made a strategic investment in a growing Illinois basin coal producer to expand Arch's footprint in that increasingly attractive region and acquired an interest in DKRW Advanced Fuels, LLC, to participate in the emerging coal-to-liquids industry. Additionally, we announced and commenced a share repurchase program of Arch's common stock to enhance value for our shareholders."

Arch Delivers a Solid Operating Performance Despite Challenges

"By effectively managing our controllable costs, Arch has succeeded in expanding its operating margins and earnings on a year-over-year basis," said John W. Eaves, Arch's president and chief operating officer. "However, as expected, Arch's operations during the third quarter of 2006 were affected by three scheduled longwall moves, as well as continuing rail challenges and generally weaker pricing conditions in the marketplace."

Consolidated volumes and price realization mix were impacted by the disposition of select Central Appalachian operations at the end of 2005, which affected the comparability of results on a year-over-year basis.

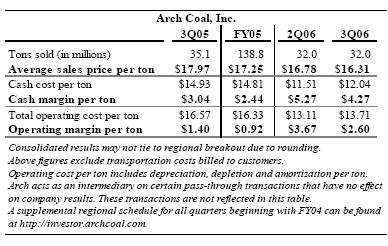

Compared with the second quarter of 2006, Arch's consolidated average price realization declined $0.47 per ton principally due to lower price realization in the Powder River Basin, while operating costs increased $0.60 per ton primarily due to scheduled longwall moves.

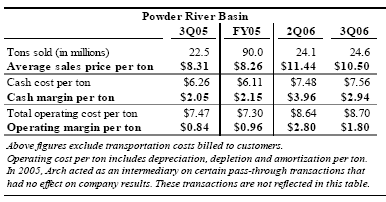

In the Powder River Basin, sales volume increased 2.1 million tons in the third quarter of 2006 compared with the third quarter of 2005, driven by somewhat improved rail service and the restart of Coal Creek. In 2005, Arch experienced significant disruptions in its rail service resulting from major maintenance and repair work. Similar repair and construction work continued in this most recent quarter and caused shipment disruptions; however, the impact was not as severe as in 2005. Average price realization rose by $2.19 per ton over the same time period, benefiting from the roll-off of lower-priced sales contracts. Operating margin per ton more than doubled compared with the prior-year period.

Compared with the second quarter of 2006, sales volume increased 0.5 million tons due to increased volume at Coal Creek. Sales volume at Black Thunder declined modestly during the quarter just ended as a result of mixed rail performance. Arch reported average price realization of $10.50 per ton compared with $11.44 per ton in the quarter-ago period. This decline was driven by lower realizations on market index-priced tons and lower average pricing related to an increasing percentage of Coal Creek coal. Operating costs for the quarter just ended increased less than 1.0 percent, reflecting reduced volumes at Black Thunder due to rail performance and higher unit start-up costs at Coal Creek.

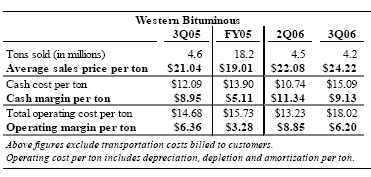

In the Western Bituminous Region, sales volume declined 0.4 million tons in the third quarter of 2006 compared with the third quarter of 2005, principally due to two scheduled longwall moves – including an extended move at the Dugout Canyon mine in Utah. Average price realization rose by $3.18 per ton over the same time period, benefiting from the roll-off of lower-priced sales contracts. Operating costs increased $3.34 per ton over the year-ago period, driven by the lost productivity associated with the longwall moves, as well as higher operating costs and sales-sensitive costs. These events were partially offset by a $10.0 million insurance recovery related to the West Elk mine outage in late 2005 and early 2006.

When compared with the second quarter of 2006, sales volume declined 0.3 million tons, while average price realization rose by $2.14 per ton, benefiting from a more favorable contract mix. Operating margin declined from the prior-quarter period principally due to the longwall move at Dugout, which was extended while development of the next longwall panel was completed.

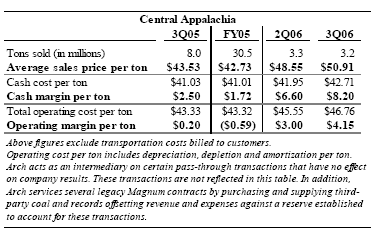

In Central Appalachia, volume comparisons between the third quarter of 2006 and the third quarter of 2005 were impacted by the divestiture of select operations in December 2005. Average price realization rose by $7.38 per ton over the same time period, benefiting from the roll-off of lower-priced sales contracts. Operating margin per ton improved substantially over the same time period resulting from the restructuring of Arch's Central Appalachian operations.

Compared with the second quarter of 2006, sales volume declined modestly, while average price realization increased $2.36 per ton, benefiting from the roll-off of lower-priced sales contracts and a more favorable contract mix. Operating costs for the quarter just ended increased slightly, reflecting higher sales-sensitive costs and higher operating costs at Mingo Logan as the mine's longwall nears the end of its operational life. In the second half of 2007, the production from the start-up of the longwall at Mountain Laurel's underground complex is expected to replace the production from the depleted longwall at Mingo Logan. Arch anticipates that Mountain Laurel's costs will be substantially lower than Mingo Logan's, and that this transition will lower overall operating costs at its Central Appalachian operations.

Operating margin increased to $4.15 per ton during the third quarter of 2006. "These results are well within Arch's stated range of $3 to $5 operating margin per ton in the region for 2006," said Eaves. "In the face of weaker market conditions, our margin expansion further validates the rationale for the strategic restructuring of our Central Appalachian operations in 2005."

Railroad Triple Track Construction Nears Completion

The addition of the third track to the section of the joint rail line adjacent to Arch's Black Thunder mine is expected to be completed by the end of October 2006. "The additional rail capacity should translate into a higher level of operational efficiency at this world class mine," said Eaves.

Arch believes that additional investment is still needed by the railroads to overcome constraints on the system. "We are encouraged by the planned rail expansions announced by the major carriers," said Eaves. "We believe these expansions will help over time to increase rail fluidity, reduce bottlenecks and, ultimately, expand the breadth of the PRB marketplace."

Arch Recognized for Leadership in Safety, Corporate Citizenship and Innovation

During the quarter, Arch's Skyline mine in Utah was recognized by the Mine Safety and Health Administration (MSHA) as the nation's safest underground mine for its performance in 2005. Additionally, Dugout Canyon mine earned MSHA's Sentinels of Safety Certificate for its outstanding 2005 safety record.

Arch's Black Thunder mine in Wyoming earned the National Good Neighbor award from the U.S. Department of the Interior for its strong community involvement and disaster relief efforts. Furthermore, the company achieved the ranks of the InformationWeek 500 for its strategic use of advanced technologies. Additionally, Arch has been named among the finalists for the Platts' 2006 Global Energy Industry Leadership Award.

"We believe our long-term success depends on our ability to lead the industry in all areas of performance," said Eaves. "Achieving national recognition reinforces our high standards in safety, corporate citizenship and innovation."

Arch Makes Strategic Investments During the Third Quarter

As previously announced, Arch acquired a 33 percent equity interest in Knight Hawk Coal, a growing coal producer in the Illinois Basin, in exchange for $15 million in cash and approximately 30 million tons of coal reserves. As a result of the exchange of reserves for a portion of its ownership interest, Arch recognized a $10.3 million gain in income from operations for the quarter just ended. Arch currently holds around 230 million tons of coal reserves in Illinois in addition to the investment in Knight Hawk.

"Given the outlook for strong coal demand growth, we expect Illinois Basin coal to play an increasingly vital role in U.S. energy markets," said Leer. "As such, we view this transaction as a first step for Arch in re-entering this important region."

During the quarter, Arch also announced an acquisition of a 25 percent equity interest in DKRW Advanced Fuels, LLC, which is engaged in developing coal-to-liquids (CTL) facilities. In exchange for this interest, Arch agreed to extend its existing option agreement with DKRW Advanced Fuels on Arch's Carbon Basin reserves in southern Wyoming, to contribute $25 million in cash, and to cooperate with DKRW Advanced Fuels to identify coal reserves for two additional CTL projects outside the Carbon Basin.

"We believe our strategic partnership with DKRW Advanced Fuels will allow Arch to play a formative role in the emerging CTL industry by effectively leveraging our position as a leading coal producer," said Leer.

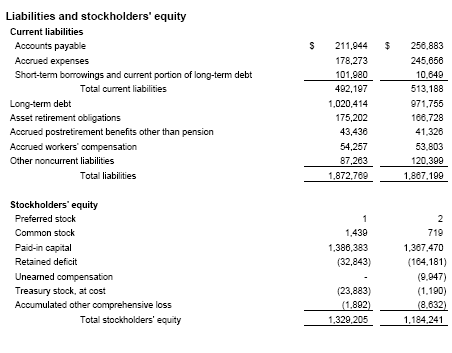

Arch Commences its Announced Share Repurchase Program

In September, Arch's Board of Directors authorized the company to repurchase up to 14 million shares of its common stock as market conditions warrant. Through the end of the quarter, Arch had repurchased 850,000 shares at an average price of $28.10. Arch funded these repurchases through a combination of operating cash flows and revolver borrowings. "We view share repurchases as a very effective way to return value to our shareholders," said Robert J. Messey, Arch's senior vice president and chief financial officer.

Long-Term Fundamentals in Coal Markets Remain Intact Despite Near-Term Concerns

Coal markets have been impacted in 2006 by several factors affecting the overall supply and demand balance. According to the Edison Electric Institute, electric power demand was essentially flat through September, driven principally by milder winter and cooler summer weather patterns in major coal consuming regions compared with last year. Arch estimates that coal consumption for power generation was down 1.0 percent through September, driven by milder weather, increased nuclear utilization, and increased precipitation in hydroelectric power regions. High natural gas storage levels have reduced natural gas prices despite a North American natural gas production decline of 1.2 percent through July. Arch estimates that the natural gas overhang led to some coal stockpile conservation efforts at power generators earlier this year.

Through the end of September, Arch estimates that power generators had, on average, a 42-day supply of coal inventory on hand, which is generally in line with the five-year average. Coal production was up an estimated 2.7 percent through September based on revised MSHA and EIA estimates, after three consecutive years in which consumption outpaced supply.

Despite these near-term pressures, Arch believes that a reversal of one or more of these factors could promptly change the supply and demand outlook for coal over the next few quarters. A return to more normal weather patterns could boost U.S. electric generation demand, benefiting both coal and natural gas consumption in particular. Furthermore, a growing U.S. economy, measured by the 2.6 percent annual rate increase in gross domestic product through the second quarter of 2006, and growth in domestic manufacturing activity, measured by the 5.6 percent annualized increase in the industrial production index through September 2006, should benefit electric generation demand given historical trends. Additionally, it appears unlikely that nuclear and hydroelectric facilities will improve further on their strong 2006 performances. Moreover, pressures on Central Appalachian supply, as demonstrated by recent announcements of production cutbacks, have not yet been fully factored into the overall coal supply and demand balance equation.

Arch strongly believes in the long-term fundamental outlook for the U.S. coal industry. According to government and industry sources, planned new domestic coal-fueled capacity announcements have reached more than 90 gigawatts, representing close to 30 percent of coal's current installed base and equating to more than 300 million tons of annual coal demand. Approximately 15 gigawatts of generating capacity is currently under construction or in advanced stages of development with completion expected by 2010, translating into nearly 60 million tons of incremental coal demand. Another 15 gigawatts of capacity is in earlier stages of development, but is currently slated to come on line by 2010 as well. Demand growth from new facilities represents a major driver for the favorable long-term outlook for coal.

Additionally, sustained elevated crude oil pricing and the geopolitical risk associated with the location of major world oil and natural gas reserves continues to bring the public policy debate of domestic energy security to the forefront. As a result, the strengthening outlook for the advancement of Btu-conversion technologies, such as coal-to-gas and coal-to-liquids, remains a favorable long-term development for the coal industry.

Arch Selectively Adds to its Sales Contract Portfolio

Arch continues to take a patient approach to its marketing efforts, layering in near-term sales while maintaining a significant unpriced position in future periods. Despite weaker pricing conditions, current spot prices for the coal basins in which Arch operates are above the company's year-ago price realization levels. "Arch expects that a return to normal demand growth for coal and continuing supply pressures in Appalachia will exert upward pressure on coal pricing in the future," said Leer.

During the third quarter, Arch signed commitments for 4.7 million tons of Powder River Basin coal for delivery principally in 2007 at prices averaging more than 25 percent above the company's average price realization in this region for quarter just ended. Additionally, the company signed commitments for 4.9 million tons of Central Appalachian coal for delivery over the next two years at an average realized price that is nearly 10 percent above this region's average realized price for the third quarter of 2006. In the Western Bituminous region, Arch signed commitments for approximately 1.6 million tons of coal for delivery through 2010 at an average price that is more than 50 percent above this region's average price realization in the just-ended quarter.

Other sales contracting activity during the third quarter consisted of short-term deals associated with remaining uncommitted 2006 production volumes. Based on current expected production over the next two years, Arch has unpriced volumes of 35 to 45 million tons in 2007 and 80 to 90 million tons in 2008.

Arch Adjusts Guidance for 2006

Arch has revised its guidance for full year 2006 as follows:

- Earnings per share is projected to be in the $1.60 to $1.70 range, on a post-split, fully diluted share basis.

- Adjusted EBITDA is expected to be in the $540 million to $560 million range.

- Total sales volume is expected to be between 125 million and 130 million tons, excluding approximately 8 million pass-through tons associated with legacy Magnum contracts that Arch is currently servicing.

- Capital expenditures – including reserve additions but excluding the Knight Hawk and DKRW Advanced Fuels transactions – are projected to be $550 million.

- Depreciation, depletion and amortization is expected to be roughly $210 million.

- Arch's tax rate for full year 2006 is projected to be approximately 15 percent.

"Despite weaker near-term market conditions, Arch continues to concentrate on achieving margin expansion through the roll-off of lower-priced sales contracts and further progress in optimizing operational execution," said Leer. "Arch is sharply focused on managing the principal business drivers that should translate into significant value for its shareholders. As such, Arch is committed to making the right business decisions in the near-term in response to current market conditions in order to retain upside potential for the long-term."

With the recent weakness in U.S. coal markets, Arch is now targeting lower fourth quarter 2006 and full year 2007 production levels. "While the long-term outlook for U.S. coal markets remains extremely bright, near-term factors have served to dampen market demand and depress pricing," said Leer. "Our goal is always to match our ongoing production levels with market demand, while leaving the remainder of our valuable, low-cost reserves in place for future development. As a result, we have reduced our targeted production for the fourth quarter of 2006 by 3 million tons and for full year 2007 by approximately 10 million tons. Arch is now targeting production of approximately 140 million tons in 2007."

Arch has invested a significant amount of time and energy in recent years in an effort to increase the flexibility of its mining operations, according to Leer. "Despite the fact that coal mines have relatively high fixed costs, we believe we can operate our mines productively and profitably at reduced production levels," said Leer.

"We strongly believe in the long-term fundamentals of U.S. coal markets," continued Leer. "Coal's economic advantage over other fuels in electric generation markets has led to a significant level of new coal-fueled capacity announcements, which is expected to translate into meaningful incremental coal demand beginning by 2008. This development represents a sea change for the industry. Additionally, public interest in domestic energy independence and the price of oil is swinging momentum in favor of real investment in Btu-conversion technologies. Arch expects to benefit from these new demand drivers given its size, diverse asset portfolio, skilled workforce, and low-cost operations."

A conference call regarding Arch Coal's third quarter financial results will be webcast live today at 11 a.m. EDT. The conference call can be accessed via the "investor" section of the Arch Coal Web site (http://investor.archcoal.com).

St. Louis-based Arch Coal is the nation's second largest coal producer. The company's core business is providing U.S. power generators with clean-burning, low-sulfur coal for electric generation. Through its national network of mines, Arch supplies the fuel for approximately 6 percent of the electricity generated in the United States.

Forward-Looking Statements: This press release contains "forward-looking statements" – that is, statements related to future, not past, events. In this context, forward-looking statements often address our expected future business and financial performance, and often contain words such as "expects," "anticipates," "intends," "plans," "believes," "seeks," or "will." Forward-looking statements by their nature address matters that are, to different degrees, uncertain. For us, particular uncertainties arise from changes in the demand for our coal by the domestic electric generation industry; from legislation and regulations relating to the Clean Air Act and other environmental initiatives; from operational, geological, permit, labor and weather-related factors; from fluctuations in the amount of cash we generate from operations; from future integration of acquired businesses; and from numerous other matters of national, regional and global scale, including those of a political, economic, business, competitive or regulatory nature. These uncertainties may cause our actual future results to be materially different than those expressed in our forward-looking statements. We do not undertake to update our forward-looking statements, whether as a result of new information, future events or otherwise, except as may be required by law. For a description of some of the risks and uncertainties that may affect our future results, you should see the risk factors described from time to time in the reports we file with the Securities and Exchange Commission.