Arch Coal, Inc. Reports Second Quarter Results

Arch Coal, Inc. Reports Second Quarter Results

July 25, 2005 at 12:00 AM EDT

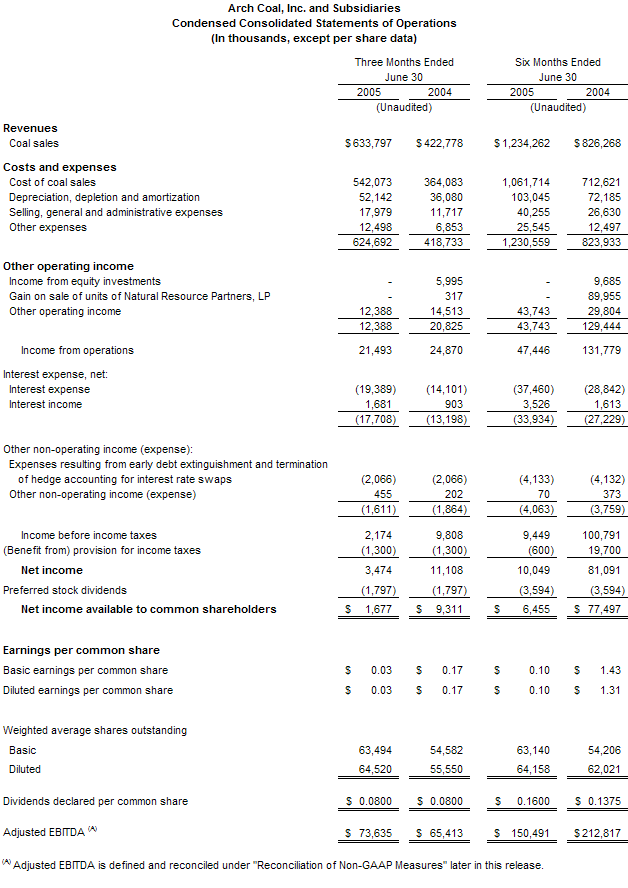

- Revenue increases by 50% to a record $633.8 million vs. 2Q04

- Sales volumes increase 31% on a reported basis to 34.6 million tons

- Earnings per fully diluted share total $0.03 (or $0.05 excluding special items)

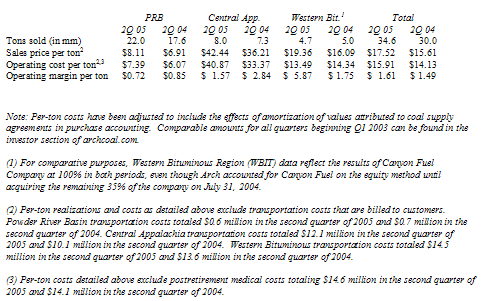

- Average realization per ton increases 17% at Powder River Basin operations, 20% at Western Bituminous operations, and 17% at Central Appalachian operations compared to the same period last year

- Adjusted EBITDA increases 13% to $73.6 million excluding special items

July 25, 2005

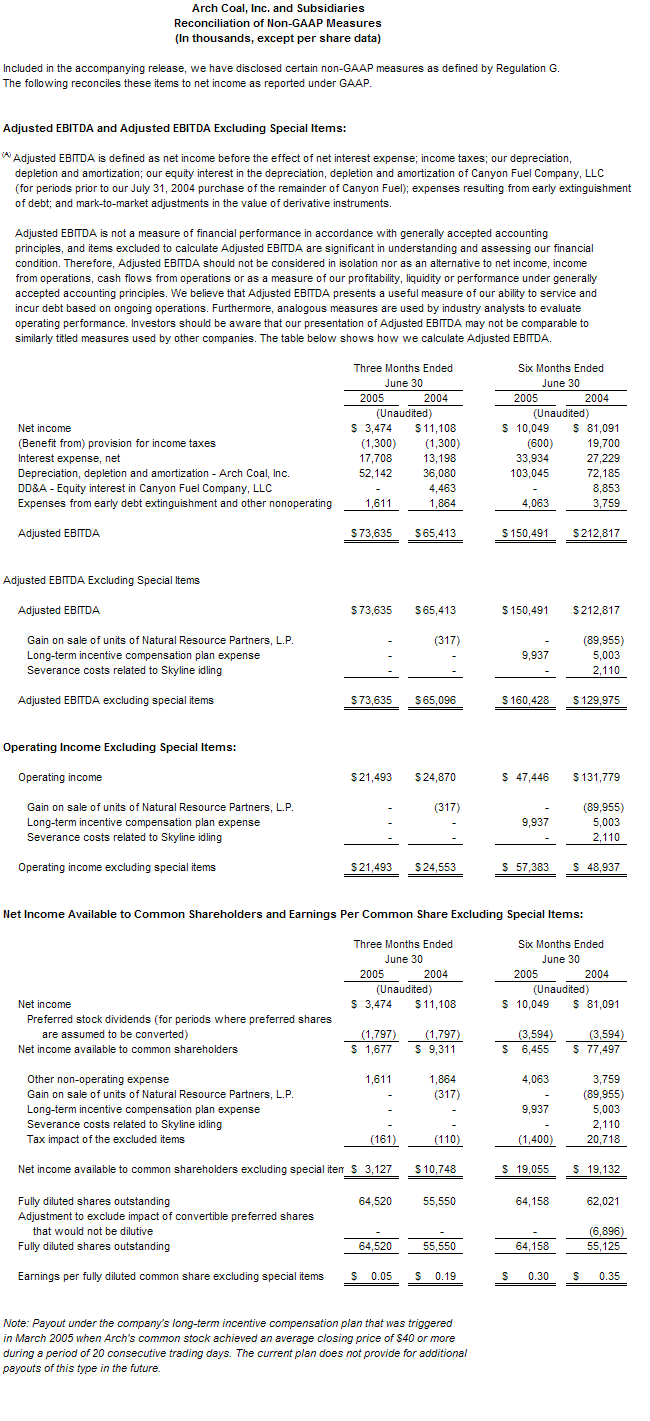

Saint Louis - Arch Coal, Inc. (NYSE:ACI) today announced that it had income available to common shareholders of $1.7 million, or $0.03 per fully diluted share, for its second quarter ended June 30, 2005. Excluding special items, Arch had income available to common shareholders of $3.1 million, or $.05 per fully diluted share. In the second quarter of 2004, Arch had income available to common shareholders of $10.7 million, or $0.19 per fully diluted share, excluding special items. (See the table that follows this release for a reconciliation to GAAP numbers.)

"As previously announced, Arch's performance during the second quarter was hampered by highly publicized rail disruptions in both the east and the west," said Steven F. Leer, Arch Coal's president and chief executive officer. "Those disruptions were most pronounced in the Powder River Basin of Wyoming, where shipments from our Black Thunder mine were reduced by a total of 3.8 million tons and production was curtailed by approximately two million tons." In total, poor rail performance reduced Arch's financial results by an estimated $0.35 for the quarter, according to Leer.

"Our mining operations achieved a solid overall performance," said John W. Eaves, Arch's executive vice president and chief operating officer. As expected, the principal exception was the Mingo Logan longwall mine in southern West Virginia, which struggled in April and May as the mine continued to address water-related challenges first encountered following a major longwall move early in 2005. "After an improved performance in June and a good start to July, we are confident that Mingo Logan has overcome these operational challenges," Eaves said.

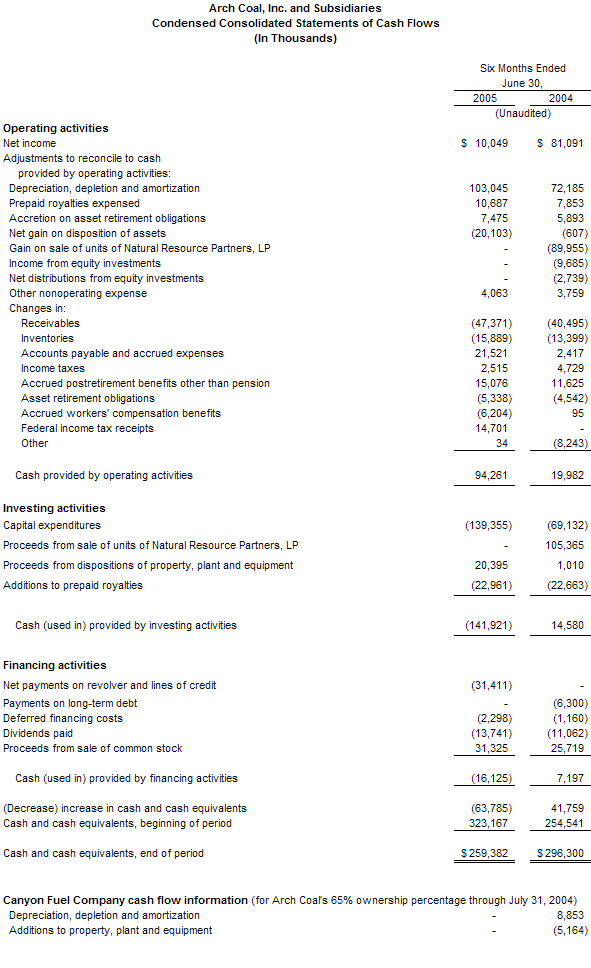

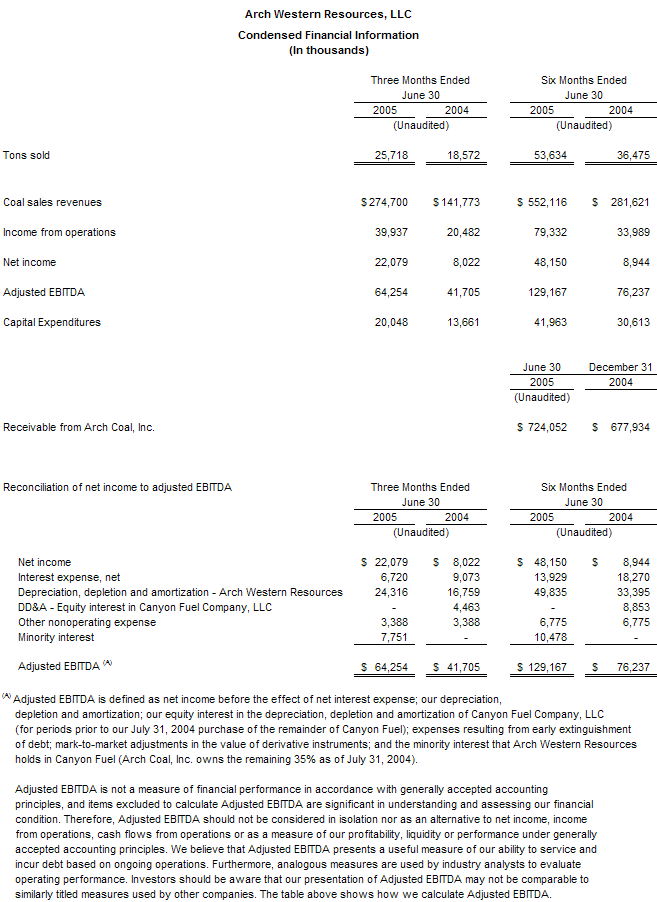

During the second quarter, revenues totaled $633.8 million, compared to $422.8 million during the same period last year. Sales volumes totaled 34.6 million tons, compared to 26.4 million tons during the same period last year as originally reported, or 30.0 million tons reflecting Canyon Fuel on a 100% basis. (Arch accounted for Canyon Fuel on the equity method prior to acquiring the remaining 35% interest in the company in July 2004.) Operating income for the second quarter totaled $21.5 million, compared to $24.9 million in the second quarter of 2004. Adjusted EBITDA totaled $73.6 million, compared to $65.4 million in last year's second quarter.

For the six months ended June 30, 2005, income available to common shareholders totaled $19.1 million, or $0.30 per fully diluted share, excluding special items. (See the table that follows this release for a reconciliation to GAAP numbers.) That compares to $19.1 million, or $0.35 per fully diluted share, on a comparable basis for the same period of 2004. Revenues for the first six months totaled $1,234.3 million and coal sales volumes totaled 71.7 million tons, vs. $826.3 million and 52.3 million tons in the comparable period of 2004, or 58.7 million tons reflecting Canyon Fuel on a 100% basis. Operating income for the first six months of 2005 totaled $57.4 million excluding special items, compared to $48.9 million in the same period of 2004 on a comparable basis. Adjusted EBITDA totaled $160.4 million for the first six months excluding special items, compared to $130.0 million for the same period of 2004 on a comparable basis.

Strengthening U.S. Coal Markets

Coal markets have strengthened significantly since the beginning of the second quarter in response to a growing U.S. economy, hotter than normal summer temperatures and extremely high prices for competing fuels. Quoted spot prices for Powder River Basin coal have risen nearly 70% since 2005 began, and the robust prices in both the Western Bituminous and Central Appalachia regions have once again begun to edge higher as well.

The major maintenance and repair work currently under way on the joint line rail system in the Powder River Basin is likely to tighten the market still further, according to Leer. Utility stockpiles at the end of June were approximately 15% below the five-year average, according to Arch estimates. "Power generators are likely to see stockpile levels erode still further in coming weeks, with record lows likely by the end of summer," Leer said. "As a result, we expect unprecedented demand for coal as we enter 2006, with utilities competing aggressively for available tonnage."

The summer of 2005 has been approximately 9% warmer than normal, according to the Energy Information Administration. Electric generation is up 1.7% year to date, while coal production has increased 0.8% based on tonnage ? and less than that based on total Btus produced.

Coal consumption is rising most rapidly in the regions of the country most dependent on Powder River Basin coal, according to Arch analysis. The western rail carriers have reported that a number of the power plants on their systems are reaching critically low stockpile levels, and have suggested that those plants evaluate all fuel supply options. "Several Arch customers that generally burn PRB coal exclusively have approached us in recent weeks to inquire about the possible availability of tons in other regions," Leer said. "Such efforts to find replacement tons are causing the market to tighten further in all regions, and underscore the value of Arch's multi-regional portfolio of mines in serving the needs of our customer base."

Sales Contract Agreements

Arch continues to approach the current market environment in a patient but opportunistic manner, according to Leer. "Our strategy is to layer in attractive new contracts in this rising market environment, while maintaining significant exposure to dynamic U.S. coal markets," he said.

Since the beginning of 2005, Arch has reached agreements to ship approximately 20 million tons of PRB coal per year in 2006, 2007 and 2008, at average realized prices 40% to 60% higher than the company's average realized price for PRB coal during the first half of 2005, factoring in the premium earned for ultra-low-sulfur Black Thunder coal based on current sulfur dioxide emissions allowance prices.

In the Western Bituminous Region, 2006 spot prices quoted in Argus Coal Daily are between 70% and 90% higher than the average price Arch is currently receiving for its tonnage in Utah and Colorado. In Central Appalachia, 2006 spot prices are approximately 30% to 40% higher than Arch's current average realization on shipments from that region. With the vast majority of Arch's existing coal supply agreements scheduled to roll off over the next three years, such a favorable market environment creates significant opportunities for value creation.

At present, Arch has approximately 35 to 45 million tons of its budgeted production yet-to-be-priced for 2006, and 80 to 90 million tons yet-to-be-priced for 2007.

Regional Analysis and Other Data

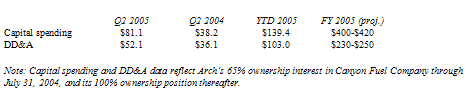

Capital Spending and DD&A (in millions):

During the quarter, Arch made steady progress on the previously announced development of the five-million-ton-per-year Mountain Laurel longwall mine in West Virginia and the three-million-ton-per-year Skyline longwall mine in Utah. Skyline is scheduled to ramp to full production in mid-2006, and Mountain Laurel in the second half of 2007. "With strong demand and limited expansion opportunities in both Central Appalachia and the Western Bituminous Region, we expect excellent rates of return on both of these projects," Eaves said.

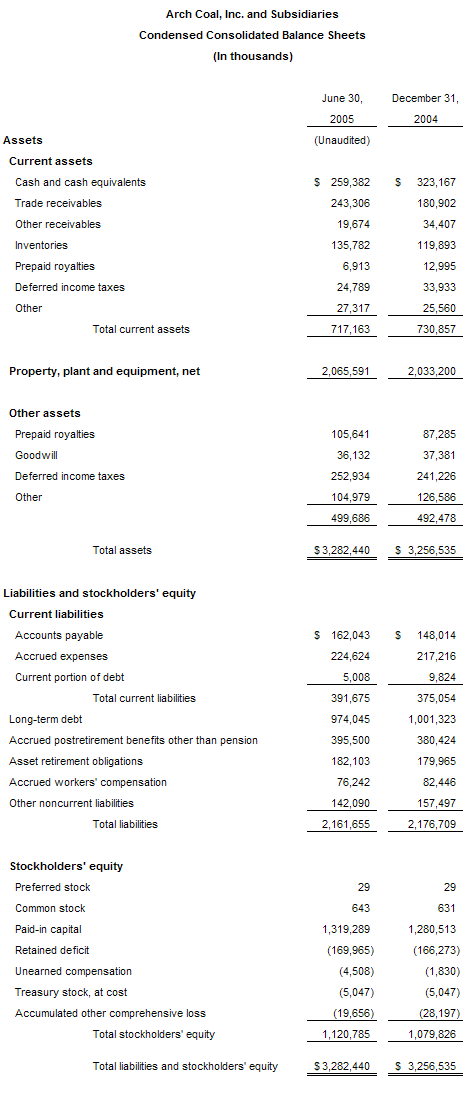

Arch expects to fund the continuing capital requirements of these expansion projects with available cash, having ended the quarter with a cash balance of approximately $259.4 million.

Looking Ahead

"Despite ongoing transportation challenges, we are increasingly confident about the long-term prospects for the U.S. coal industry in general, and Arch Coal in particular," Leer said. "Virtually every major indicator points to an attractive and sustainable U.S. coal market well into the future."

Even the railroads' decision to perform major maintenance on the entire joint line rail system in the Powder River Basin should prove beneficial in the long run, Leer said. "It is absolutely imperative U.S. rail carriers devote the appropriate level of resources and make the necessary investments in infrastructure to support America's growing demand for coal in the years ahead," Leer said. "We have been assured by the railroads that the work being done currently will translate into significant improvements in service levels next year ? and a more efficient and reliable rail system for many years to come."

Arch currently expects full year 2005 earnings to be in the range of $0.75 to $1.25 per share, based on current assumptions about rail performance.

"Between now and 2008, the vast majority of Arch's coal supply agreements will expire and reset to market-based pricing, and new low-cost production will come on line for Arch in both the east and west," Leer said. "We expect these developments to drive progressively stronger earnings and cash flow over that time period, and to create significant new value for our shareholders."

A conference call concerning second quarter earnings will be webcast live today at 11 a.m. Eastern. The conference call can be accessed via the "investor" section of the Arch Coal Web site (www.archcoal.com).

Arch Coal is the nation's second largest coal producer, with subsidiary operations in West Virginia, Kentucky, Virginia, Wyoming, Colorado and Utah. Through these operations, Arch provides the fuel for approximately 7% of the electricity generated in the United States.

Forward-Looking Statements: Statements in this press release which are not statements of historical fact are forward-looking statements within the "safe harbor" provision of the Private Securities Litigation Reform Act of 1995. These forward-looking statements are based on information currently available to, and expectations and assumptions deemed reasonable by, the company. Because these forward-looking statements are subject to various risks and uncertainties, actual results may differ materially from those projected in the statements. These expectations, assumptions and uncertainties include: the company's expectation of continued growth in the demand for electricity; belief that legislation and regulations relating to the Clean Air Act and the relatively higher costs of competing fuels will increase demand for its compliance and low-sulfur coal; expectation of continued improved market conditions for the price of coal; expectation that the company will continue to have adequate liquidity from its cash flow from operations, together with available borrowings under its credit facilities, to finance the company's working capital needs; a variety of operational, geologic, permitting, labor and weather related factors; and the other risks and uncertainties which are described from time to time in the company's reports filed with the Securities and Exchange Commission.