Arch Coal, Inc. Reports First Quarter Results

EPS increases to $0.84 compared to $0.07 in prior-year period

April 21, 2006

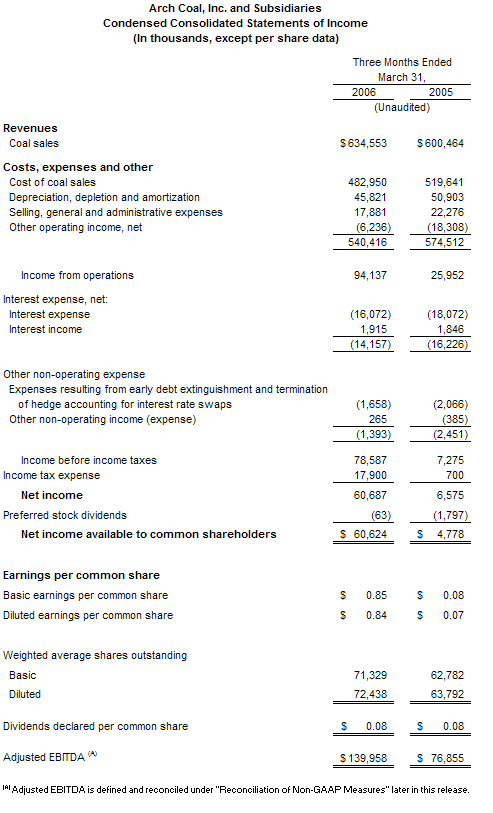

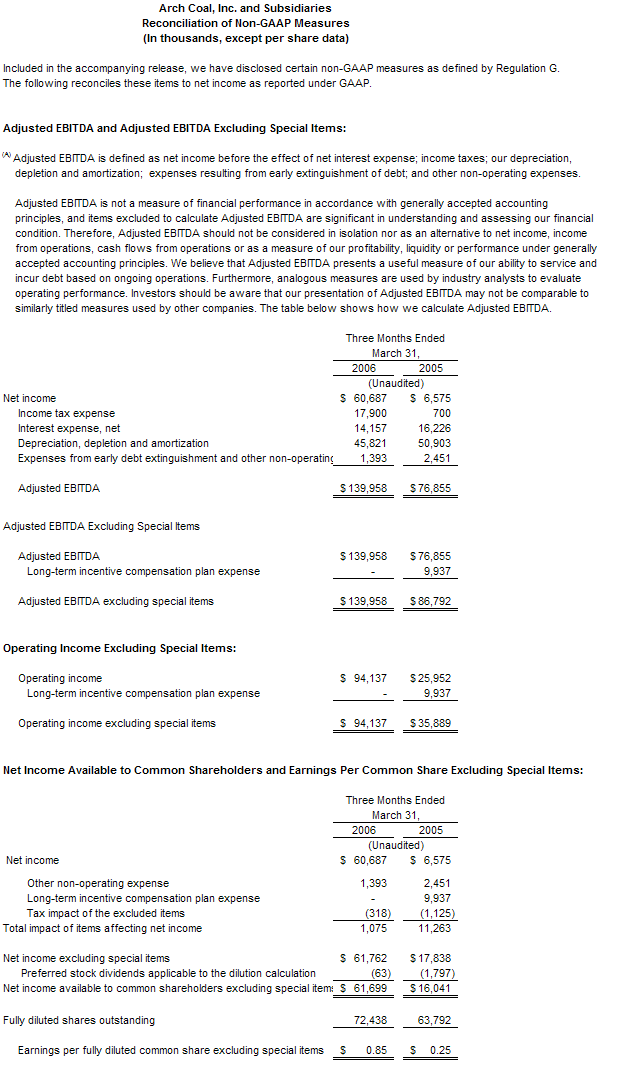

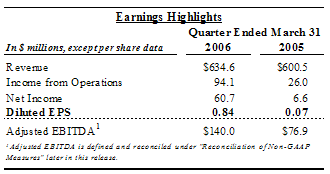

St. Louis – Arch Coal, Inc. (NYSE:ACI) today reported first quarter 2006 net income of $60.7 million, or $0.84 per fully diluted share, compared to $6.6 million, or $0.07 per fully diluted share, in the prior-year period. Income from operations more than tripled to $94.1 million, and adjusted EBITDA increased 82% vs. the prior-year period to $140.0 million.

"Arch Coal achieved record operating results during the first quarter, with significant improvements in most key financial metrics," said Steven F. Leer, Arch's president and chief executive officer. "We achieved substantially higher sales prices in each of our operating basins, a nearly 300% increase in our average per-ton operating margin, and a solid performance from our mines. We expect to build on those results as the year progresses, with further strengthening in margins, earnings and cash flow, particularly during the year's second half."

First quarter revenues increased 6% to $634.6 million compared to the prior-year period, despite the sale of select operations in Central Appalachia at the end of 2005. Sales volumes declined to 31.7 million tons from 37.0 million tons in the prior-year period, due largely to the previously mentioned sale.

Arch achieved these improved results despite mixed rail service in the Western United States and the outage of the West Elk longwall mining system in January and February. The outage cost the company an estimated $30.0 million during the first quarter, partially offset by an initial insurance recovery of $10.0 million.

Strong Increases in Regional Operating Results

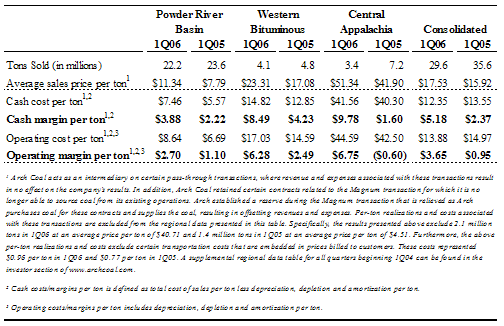

In the Powder River Basin, Arch's average realized price increased 46% compared to the prior-year period, while the average cash margin per ton rose 75% and the average operating margin per ton increased by nearly 150%. Mixed rail service reduced shipped volumes by 6% compared to the prior-year period. Arch expects its PRB operations to deliver even stronger results in future periods, as anticipated improvements in rail service lead to more optimal production levels and reduced average unit costs.

In the Western Bituminous Region, the average realized price increased 36% compared to the prior-year period, while the average cash margin per ton more than doubled and the average operating margin per ton increased by more than 150%. The outage of the West Elk longwall mine increased operating costs by an estimated $2 per ton net of the initial insurance recovery. West Elk longwall production resumed in early March.

In Central Appalachia, the average realized price increased 23% compared to the prior-year period, while the average cash margin per ton (fully loaded to include post-retirement medical costs) increased six-fold, and the average operating margin per ton increased to $6.75, from a negative $0.60 in the prior-year period.

"The strategic restructuring of our Central Appalachian operations at the end of 2005 contributed substantially to our financial performance during the quarter," said John W. Eaves, Arch's executive vice president and chief operating officer. "With our more focused operational approach and the substantial reduction in our legacy liabilities, we believe we have laid a strong foundation for continued success in the region."

Internal Growth Projects on Track

Arch is making good progress on select internal growth projects. "Supply constraints in the Eastern United States and increasing demand nationwide are creating opportunities for profitable growth," Leer said. "We believe that Arch has some of the industry's most promising organic growth prospects, offering superior geology, relatively modest capital costs, a strategic location, or a combination of the three."

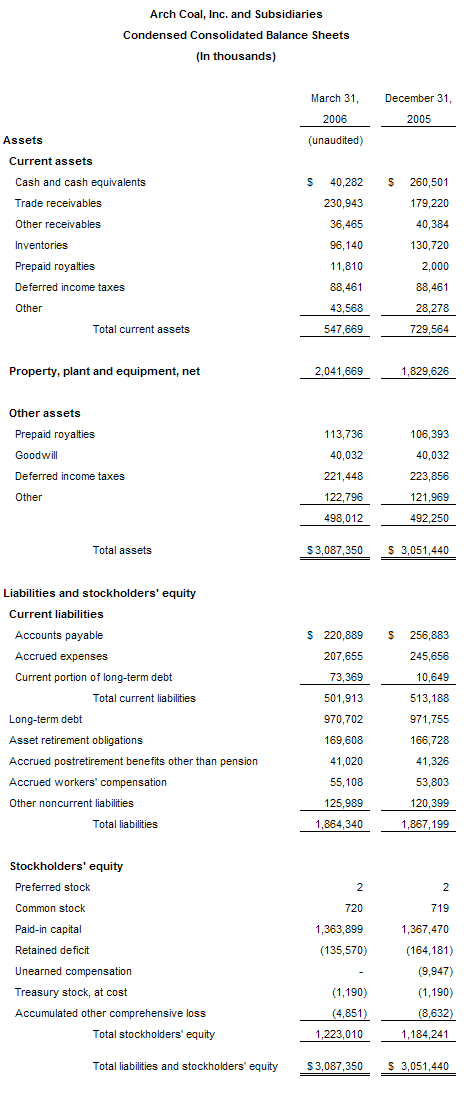

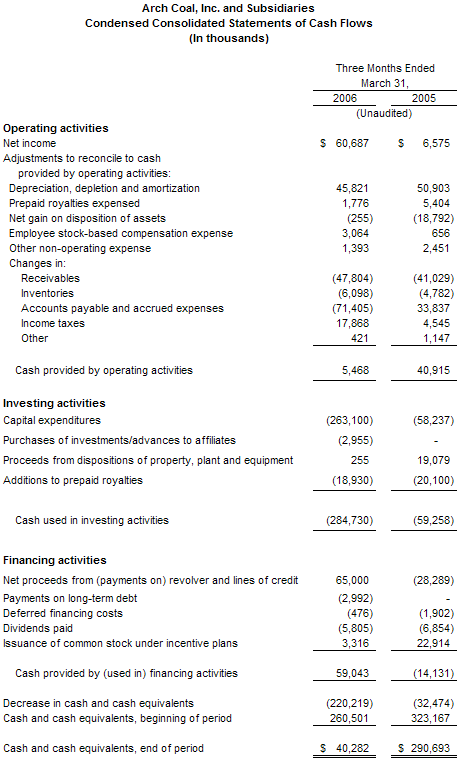

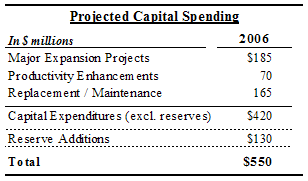

During the first quarter of 2006, Arch recorded capital expenditures of approximately $263 million, which included the second of five annual payments of $122 million on the Little Thunder federal reserve lease. During the prior-year period, capital spending totaled $58 million. Arch did not make a payment on Little Thunder in 2005. In 2006, Arch continues to target total capital spending within the previous guidance range, inclusive of reserve additions. Additionally, estimates for major expansion projects, such as Coal Creek, Skyline and Mountain Laurel, remain at similar levels as disclosed in the fourth quarter 2005 earnings release.

In the Powder River Basin, Arch expects to begin shipments from the previously idle Coal Creek mine by mid-year. The majority of the infrastructure and operating equipment is already in place, and a dragline that was formerly located at Arch's southern Wyoming operations is being upgraded and re-erected on the site. Arch is targeting production of 3 to 5 million tons during the second half of 2006, and expects to produce approximately 15 million tons at Coal Creek during 2007.

In the Western Bituminous Region, the installation of the longwall at the Skyline mining complex is slated for start-up in May. With the longwall operational, Skyline is expected to produce approximately 3 million tons of coal on an annualized basis, bringing Arch's forecasted annual production level in that region to more than 23 million tons.

In Central Appalachia, Arch is moving ahead with the development of a new longwall mine at the Mountain Laurel complex and continues to pursue the necessary permits for a surface operation as well. The longwall mine is expected to produce approximately 5 million tons when it ramps up to full production in the second half of 2007.

Western Rail Service Expected to Improve as Year Progresses

After a mixed performance during the first two months of the quarter, Western rail service improved markedly in March and has remained strong during the first three weeks of April. The construction of a third track on the section of the joint line adjacent to Black Thunder – scheduled for completion in mid-2006 – should further increase rail system fluidity.

"With improving rail service, we expect to operate Black Thunder at more optimal levels and to realize the full potential of this world-class asset," Eaves said. "We expect increased volumes to translate into higher revenues, a lower average unit cost and stronger margins."

Arch Selectively Adds to Sales Contract Portfolio

Arch continues to sell a significant percentage of its coal under sales contracts signed in earlier periods, when market conditions were substantially weaker than today. Over the next three years, the vast majority of these commitments will expire, and the volumes are expected to be re-priced based on market conditions at the time. Based on the current market environment, Arch anticipates that these contract roll-offs will have a favorable impact on the company's financial results.

While current spot prices are well above Arch's average realized pricing, the company is nevertheless taking a selective and patient approach to the current market environment. "We expect robust coal demand and continuing supply pressures in the Appalachian coalfields to exert further upward pressure on coal prices for the foreseeable future," Eaves said. "While we continue to evaluate new contract opportunities, we believe our unpriced position is highly advantageous."

During the quarter, Arch signed commitments for approximately 20 million tons of Powder River Basin coal for delivery over the next five years, at an average price approaching 150% higher than the company's average realized sales price in that region during 2005. Based on expected production over the next three years, Arch has unpriced volumes estimated at 13 million to 17 million tons in 2006; 55 million to 65 million tons in 2007; and 85 million to 95 million tons in 2008.

U.S. Coal Market Dynamics Remain Strong

Although the U.S. coal market weakened modestly late in the quarter following a very mild winter, Arch believes market dynamics remain strong as the peak summer demand period approaches.

- Crude oil is trading at record levels and the price of natural gas in the futures market for delivery this winter exceeds $12 per million BTUs, establishing a compelling reference price for coal-based energy.

- The amount of announced new coal-fueled electric generating capacity in the United States has risen to 85 gigawatts – an amount that would increase coal-fueled capacity by more than 25% and boost annual coal requirements by approximately 300 million tons.

- Despite an exceptionally mild winter, coal stockpiles at domestic power plants – measured in days supply – are an estimated 20% below the 10-year average, with some Midwestern plants still hovering near critical levels.

- Coal production has increased a modest 1.6% year to date, according to government estimates, in spite of a strong pricing environment by historical standards.

- World coal prices have strengthened markedly of late in response to rapid growth in global demand, particularly in China and India, and continuing pressures on international supply due to insufficient investment in the development of new reserves and inadequate transportation infrastructure.

- With the expected continuation of high crude oil and natural gas prices, the outlook for real investment in BTU-conversion processes such as coal-to-gas and coal-to-liquids continues to improve.

Arch Anticipates Continued Strength in 2006

"Arch Coal is off to a strong start, and we expect to maintain that momentum as the year progresses," Leer said. "As we look ahead, we expect to benefit from the return to form of the West Elk mine, the continuing expiration of below-market contracts and the start-up of the Coal Creek and Skyline mines, as well as strengthening volumes in the Powder River Basin in response to anticipated improvements in rail service."

While the second half of the year is expected to be particularly strong, Arch expects as many as four longwall moves during the second quarter. The timing of these moves, combined with anticipated spring maintenance activity on the joint rail line, is likely to reduce second quarter earnings when compared to the third and fourth quarters. (In contrast, Arch currently anticipates a combined total of two longwall moves in the year's second half.)

Arch is raising the bottom end of its previous guidance for EPS from $3.50 to $3.75 per fully diluted share, and the bottom end of its previous guidance for adjusted EBITDA from $550 million to $570 million. The company now projects EPS of between $3.75 and $4.25 per fully diluted share, and adjusted EBITDA of between $570 million and $610 million.

"We believe that U.S. coal markets are poised for a sustained period of robust growth," Leer said. "With the steps we have taken in recent quarters to strengthen and streamline the company, we believe that the stage is set for a multi-year period of upward momentum in margins, earnings and cash flow."

A conference call regarding Arch Coal's first quarter financial results will be webcast live today at 11 a.m. EDT. The conference call can be accessed via the "investor" section of the Arch Coal Web site (http://www.archcoal.com).

Arch Coal is the nation's second largest coal producer, with subsidiary operations in Wyoming, Colorado, Utah, West Virginia, Kentucky and Virginia. Through these operations, Arch provides the fuel for approximately 6% of the electricity generated in the United States.

Forward-Looking Statements: This press release contains "forward-looking statements" – that is, statements related to future, not past, events. In this context, forward-looking statements often address our expected future business and financial performance, and often contain words such as "expects," "anticipates," "intends," "plans," "believes," "seeks," or "will." Forward-looking statements by their nature address matters that are, to different degrees, uncertain. For us, particular uncertainties arise from changes in the demand for our coal by the domestic electric generation industry; from legislation and regulations relating to the Clean Air Act and other environmental initiatives; from operational, geological, permit, labor and weather-related factors; from fluctuations in the amount of cash we generate from operations; from future integration of acquired businesses; and from numerous other matters of national, regional and global scale, including those of a political, economic, business, competitive or regulatory nature. These uncertainties may cause our actual future results to be materially different than those expressed in our forward-looking statements. We do not undertake to update our forward-looking statements, whether as a result of new information, future events or otherwise, except as may be required by law.