Arch Coal, Inc. Reports First Quarter Results

Arch Coal, Inc. Reports First Quarter Results

April 25, 2005 at 12:00 AM EDT

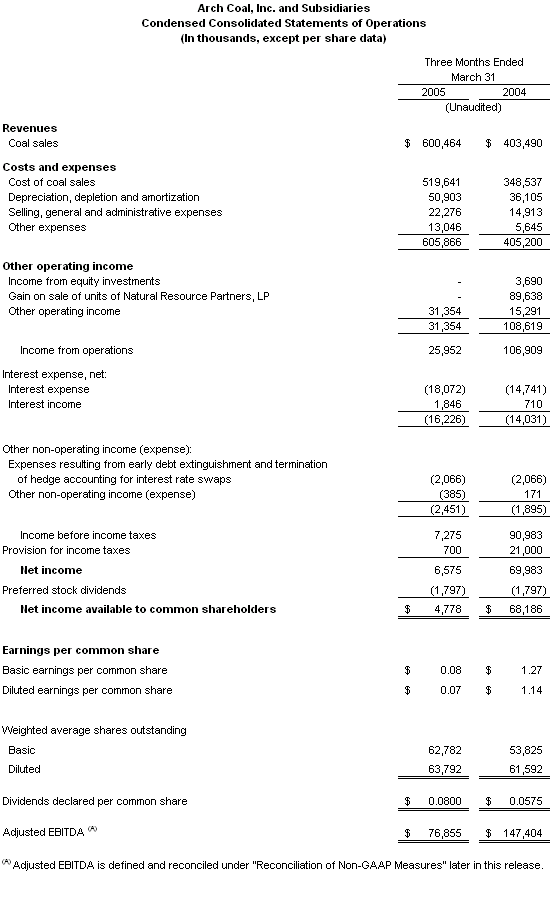

- Revenue increases to a record $600.5 million, up 49% vs. same period last year

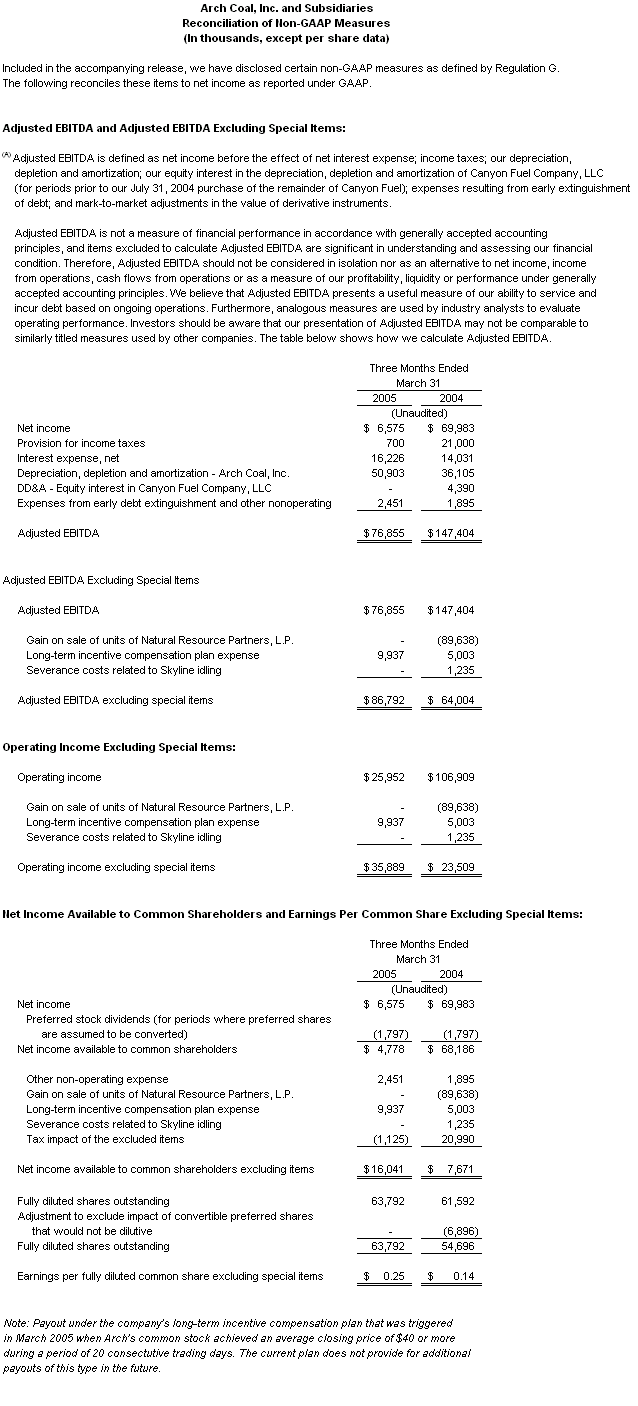

- Earnings per fully diluted share total $0.07 ($0.25 excluding special items, compared to $0.14 in 1Q04 excluding special items)

- Average realization per ton increases 14% at Powder River Basin operations; 10% at Western Bituminous operations; and 27% at Central Appalachian operations

- Adjusted EBITDA increases 36% to $86.8 million, compared to $64.0 million in 1Q04, excluding special items in both periods

April 25, 2005

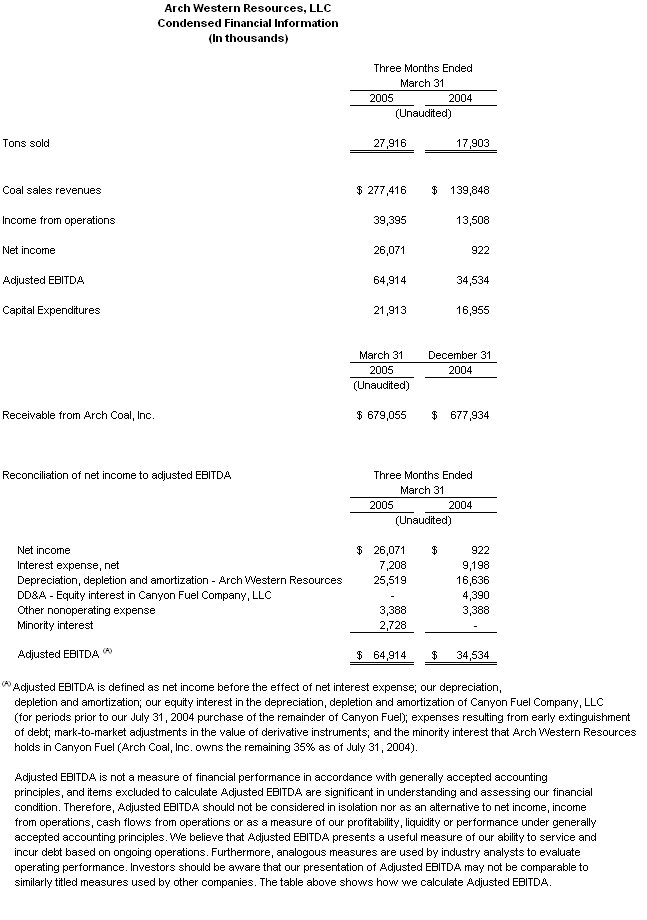

Saint Louis - Arch Coal, Inc. (NYSE:ACI) today announced that it had income available to common shareholders of $4.8 million, or $0.07 per fully diluted share, for its first quarter ended March 31, 2005. Excluding special items, Arch had income available to common shareholders of $16.0 million, or $0.25 per fully diluted share, in the quarter just ended. In the first quarter of 2004, excluding special items, Arch had income available to common shareholders of $7.7 million, or $0.14 per fully diluted share. (See table that follows release for reconciliation to GAAP net income.)

"Arch made excellent progress on many fronts during the quarter," said Steven F. Leer, Arch Coal's president and chief executive officer. "Per-ton realizations increased significantly in each of our operating basins and our average per-ton operating margin increased by 13%. In addition, we achieved very strong performances at our Powder River Basin and Western Bituminous operations as we continued to build on the highly strategic acquisitions completed in those basins during 2004."

Leer reiterated earnings guidance of $1.50 to $2.00 per fully diluted share and EBITDA guidance of $400 million to $450 million for the full year. "We remain on track for substantially improved operating results in 2005, and additional progress in 2006 and 2007," Leer said.

As expected, Arch's principal challenge during the quarter was in the Central Appalachia region, where the performance of the Mingo Logan mine was adversely affected by difficult geologic conditions in the previous longwall panel, a major longwall move and a slow startup of the longwall following the move due principally to equipment problems. "We are making progress in returning our historically strong Mingo Logan operation to more normal rates of productivity," said Leer. "We expect improved results in future periods."

Revenues increased to $600.5 million in the first quarter of 2005, compared to $403.5 million during the same period last year, due principally to higher realizations as well as consolidating acquisitions in the second half of 2004. Sales volume as reported increased to 37.0 million tons, compared to 25.8 million tons during the same period of 2004. Operating income for the first quarter totaled $35.9 million, compared to $23.5 million in the same period of 2004, excluding special items in both periods. Excluding special items, Adjusted EBITDA totaled $86.8 million vs. $64.0 million in last year's first quarter, which benefited from a large gain associated with the partial sale of the company's interest in Natural Resource Partners.

Regional Analysis and Other Data

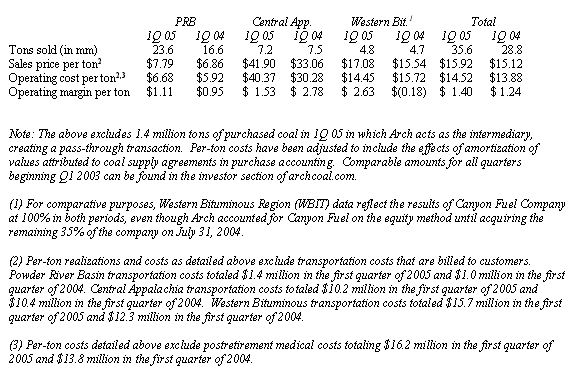

Powder River Basin

Arch's Powder River Basin mine, Black Thunder, achieved a 14% increase in its average per-ton realization compared to the same quarter last year and boosted shipments by more than 40% to a record 23.6 million tons. The mine shipped a record 8.3 million tons in March.

"The acquisition of the North Rochelle mine and its integration into Black Thunder is proving to be a tremendous success," said John W. Eaves, Arch's executive vice president and chief operating officer. "It is increasingly clear that the combination of these two mines has created a truly world-class asset with operating synergies well in excess of our initial estimates. With recent improvements in rail service, the expanded Black Thunder is currently producing at a rate of nearly 100 million tons annually, which is approximately 15% greater than the combined capacity of the two mines operating separately."

Eaves indicated that Western rail service has improved significantly since the beginning of March. "We are confident that the Western rail carriers are committed to meeting what is expected to be extremely robust growth in the demand for PRB coal," he said.

Western Bituminous Region

In the Western Bituminous Region, a 10% increase in average realization and an 8% reduction in per-ton operating costs contributed to substantially stronger results during the quarter. Arch's average operating margin in the region climbed to $2.63 per ton vs. a loss of $0.18 per ton during the same period of 2004.

"We see great things ahead for our Western Bituminous operations," Eaves said. "Demand for Colorado and Utah coal has shifted to a new and higher level as power generators have looked to the region for replacement tonnage for high-Btu, low-sulfur Eastern coal, which is in short supply and likely to remain so."

During the first quarter, Arch initiated development work on one of the best undeveloped reserves in the region - the North Lease at the Skyline mine complex. Development production has now begun, and the longwall is scheduled to start up in mid- to late 2006. Production at the new mine is expected to climb to 3 million tons annually.

Central Appalachia

Extremely robust market conditions in the East boosted Arch's average realization in the region by 27% during the quarter. Unfortunately, that strong revenue growth was offset by higher costs and lower volumes associated with the previously discussed challenges at Mingo Logan.

"After moving the longwall to the new panel in mid-February, the start-up process proved to be more challenging than anticipated due principally to a greater-than-expected influx of water, which in turn resulted in a series of equipment-related difficulties," Eaves said. "We have taken steps to resolve these issues, which reduced operating income by approximately $18 million from expected levels during the quarter, and we have seen progress in recent weeks. Given the advantageous geologic conditions in this new reserve area, we remain confident that Mingo Logan's performance will improve in future periods."

Contract Activity

Arch ended the quarter with very little coal left to sell for the remainder of 2005. In 2006, the company has 45 to 55 million tons of its expected production yet to be priced, and in 2007, it has 90 to 100 million tons yet to be priced.

"We continue to take a patient approach to the current market environment," Leer said. "We have reached agreements on approximately 10 million tons of PRB coal per year for delivery in 2006, 2007 and 2008, at an average netback to the mine that is 40% to 60% higher than our current average realization in the PRB, factoring in the premium we earn for Black Thunder coal based on today's sulfur dioxide emissions allowance prices. Our strategy is to continue to layer in new commitments in the current rising market environment, while still maintaining significant leverage to dynamic U.S. coal markets."

U.S. Coal Markets

The first quarter saw continued market strength in Central Appalachia and the Western Bituminous Region, as well as a rally in the Powder River Basin late in the period. With rail service improving, published spot prices for PRB coal have increased by 20% to 30% since the beginning of January, with much of that movement occurring in recent weeks. The spot price for Arch's ultra-low sulfur PRB production has increased even more, buoyed by the climbing price of sulfur dioxide emissions allowances.

Since the first quarter began, the price of sulfur dioxide emissions allowances has climbed an additional 20%, to approximately $850 per ton. Such allowances were trading at just $130 per ton in January 2003. The increased price of SO2 allowances boosts the value of compliance and low-sulfur coals - the only types of coal that Arch produces.

Generally speaking, coal offers a compelling economic advantage over virtually every other competing fuel for electric generation. For the vast majority of coal-fired power generating stations in the United States, the economics of burning coal from the PRB are more compelling still.

"The PRB is already the fastest growing U.S. coal supply basin, and it appears poised for more accelerated growth in the years ahead," Leer said. "In recent weeks, power generators in Pennsylvania, North Carolina and other Eastern states have announced plans to increase the amount of PRB coal they use in the future. Furthermore, recent improvements in Western rail service are finally allowing this increased level of interest to translate into higher shipments out of the basin."

Despite continuing growth in PRB output, overall U.S. coal supply remains constrained. Through April 16, total U.S. coal production was flat compared to the same period of 2004, according to the Energy Information Administration. In fact, U.S. coal production has increased very little since 2000, despite significant increases in consumption for both electric generation and metallurgical purposes. That has led to continuing declines in power plant stockpiles, particularly in the Eastern United States. Arch estimates that such stockpiles currently stand at 109 million tons - approximately 17% lower than the five-year average. "Pressure on supply and restocking requirements should keep coal demand strong for the foreseeable future," Leer said.

Metallurgical markets remained strong as well, despite a pullback in world steel prices. Arch is targeting met sales of 5 million tons in 2005 and 7 million tons in 2006, assuming the met market remains robust through that period.

Financial Developments

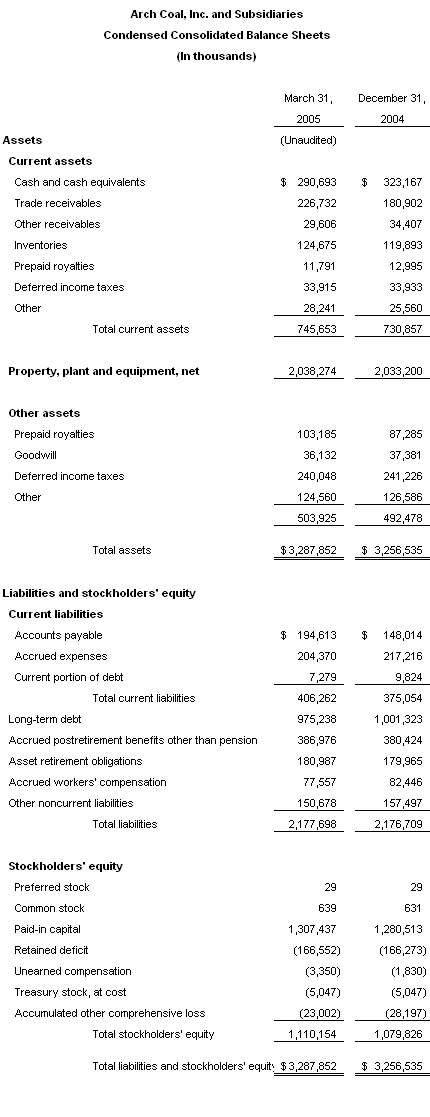

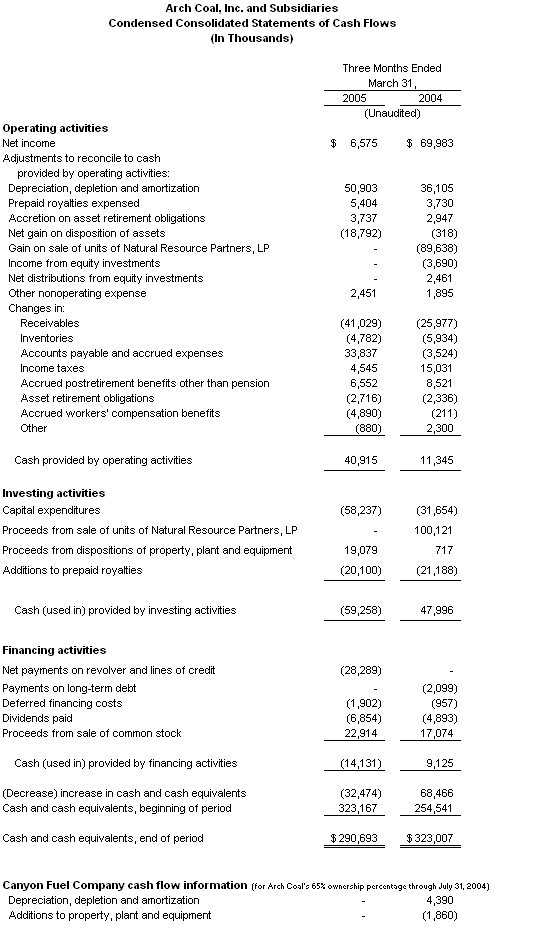

Arch ended the first quarter with cash and cash equivalents of $290.7 million and total available liquidity of $900 million. At March 31, total debt as a percentage of total capitalization had declined to approximately 47%, vs. 84% at the end of 2000.

"After a systematic and multi-year effort to strengthen our balance sheet and enhance our financial flexibility, Arch is in its strongest financial position in many years," said Robert J. Messey, senior vice president and chief financial officer.

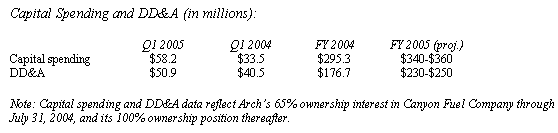

Arch has budgeted significant expansion-related capital requirements during 2005 and 2006 related to the development of the 5-million-ton-per-year Mountain Laurel longwall mine in southern West Virginia; the development of the 3-million-ton-per-year North Lease mine at the Skyline complex in Utah; and future payments on the recently acquired 719-million-ton Little Thunder Creek federal lease in the Powder River Basin. Despite those requirements, Arch expects its current cash balance and cash flows from operations to be sufficient to fund its capital needs through the period, absent the potential need for short-term borrowing due to timing issues.

Arch's resource management efforts during the quarter included the planned disposition of used equipment and excess land totaling approximately $18.8 million. "We remain focused on maximizing the value of our very substantial land holdings and used equipment fleet," Messey said.

Looking Ahead

"Arch is in an exceptionally strong position to benefit from the growing demand for the lowest sulfur coals," Leer said. "We expect continued growth in profitability throughout the remainder of this year and into 2006 and 2007, and we are confident this trend will create significant new value for our shareholders."

Arch expects stronger results in each successive quarter as the company progresses through the remainder of 2005.

A conference call concerning first quarter earnings will be webcast live today at 11 a.m. Eastern. The conference call can be accessed via the "investor" section of the Arch Coal Web site (www.archcoal.com).

St. Louis-based Arch Coal is the nation's second largest coal producer, with subsidiary operations in West Virginia, Kentucky, Virginia, Wyoming, Colorado and Utah. Through these operations, Arch Coal provides the fuel for approximately 7% of the electricity generated in the United States.

Forward-Looking Statements: Statements in this press release that are not statements of historical fact are forward-looking statements within the "safe harbor" provision of the Private Securities Litigation Reform Act of 1995. These forward-looking statements are based on information currently available to, and expectations and assumptions deemed reasonable by, the company. Because these forward-looking statements are subject to various risks and uncertainties, actual results may differ materially from those projected in the statements. These expectations, assumptions and uncertainties include: the company's expectation of continued growth in the demand for electricity; belief that legislation and regulations relating to the Clean Air Act and the relatively higher costs of competing fuels will increase demand for its compliance and low-sulfur coal; expectation of continued improved market conditions for the price of coal; expectation that the company will continue to have adequate liquidity from its cash flow from operations, together with available borrowings under its credit facilities, to finance the company's working capital needs; a variety of operational, geologic, permitting, labor and weather related factors; and the other risks and uncertainties which are described from time to time in the company's reports filed with the Securities and Exchange Commission.